Maximize your bottom line with tax credits for hiring and retaining employees

Get rewarded for doing the right thing

Tax credits provide incentives for employers that cultivate a more diverse workforce and retain employees during challenging times. Trusaic TaxAdvantage® helps you identify opportunities for the following types of tax credits:

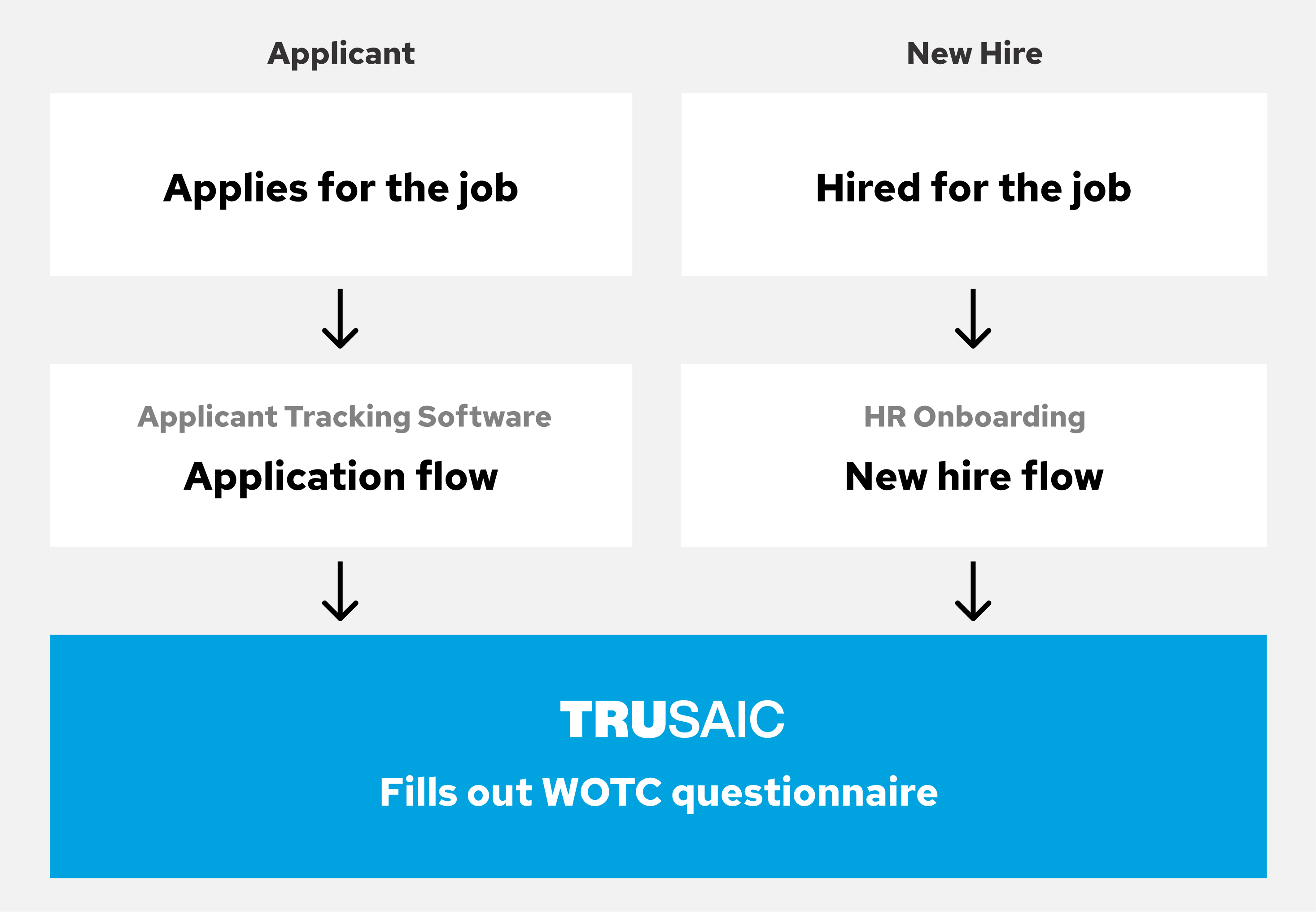

Work Opportunity Tax Credit

Federal Empowerment Zones

Federal Disaster Zones Retention Credit

Employee Retention Credit

Never miss a savings opportunity

We perform a comprehensive analysis of your HR data to determine which tax credits you qualify for and review it alongside other factors such as PPP loan forgiveness to maximize your opportunity while minimizing your risk for an IRS audit.

Keep up with changing legislation

Our experts in tax, regulatory compliance, and data analysis stay on top of the constant compliance changes as well as identify new tax credit opportunities so you don't have to.

Extending your team

We've helped clients discover over $350 million in tax credits by working side by side with them to:

- Determine qualification

- Estimate potential refunds

- Prepare all supporting documentation for qualification

- Prepare documentation to claim tax credit and amend tax returns if necessary

- Provide comprehensive assistance in the event of an audit