Simplify ACA filing and reporting

ACA Essential® provides the tools and support you need to meet federal ACA reporting requirements with ease.

- Meet deadlines: on-time accurate 1095-C/1094-C filing with the IRS and state agencies

- Penalty risk assessment: identify coverage gaps and liabilities with proactive insights

- Designated ACA specialist: gain peace of mind with our expert support

Seamless secure data integration and clean data processing

ACA Essential has certified integrations with leading HRIS platforms like Workday and UKG ensuring fast secure data transfers. Our solution solves the people and process failures that drive penalties. It consolidates, cleans, and transforms your data into accurate, actionable insights, so you can focus on compliance instead of errors.

Schedule Demo

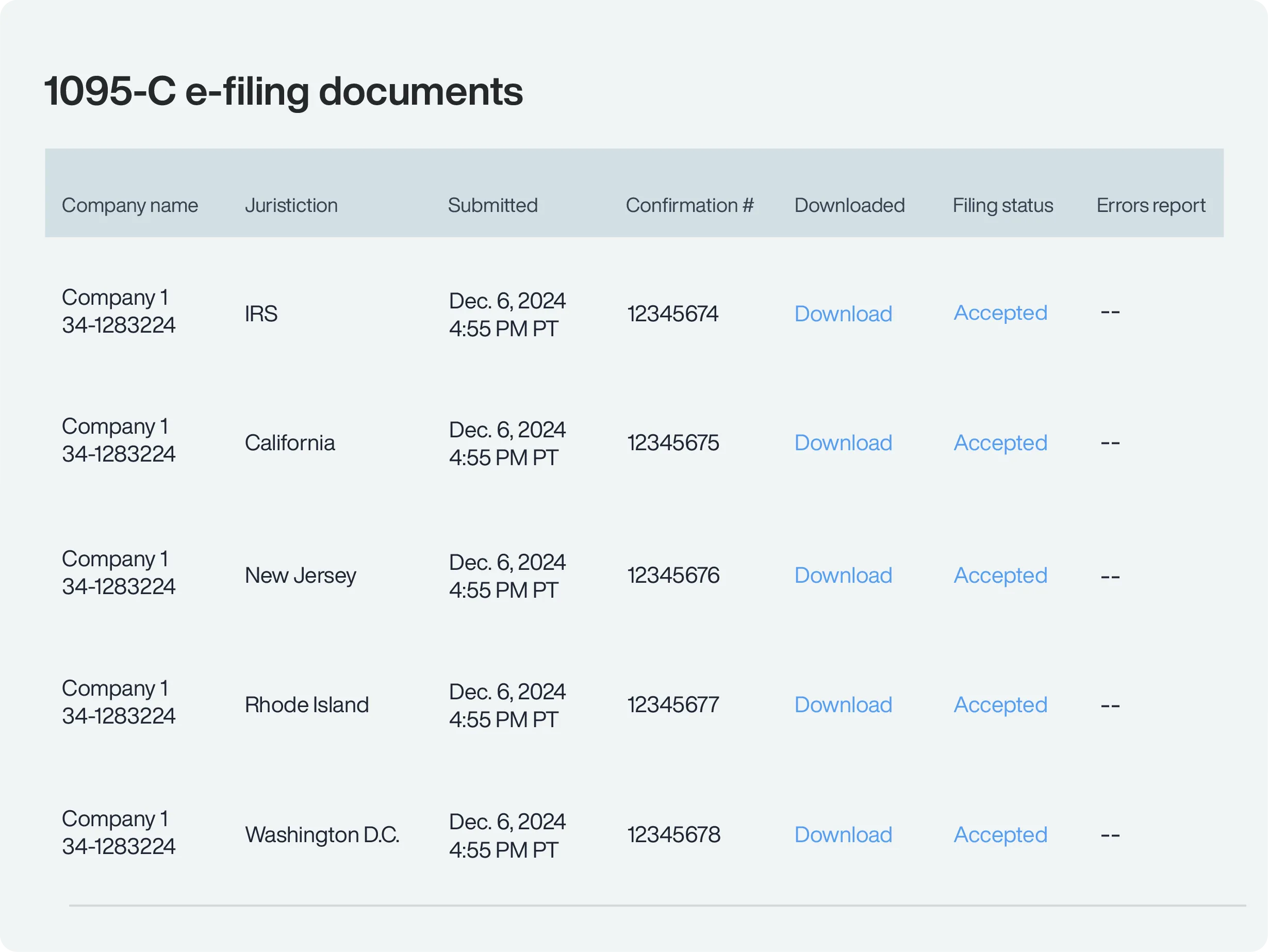

Federal and state 1095-C filing and furnishing compliance

ACA Essential ensures your 1095-C forms are prepared and distributed on-time to applicable employees by U.S. mail, electronically, or both. By utilizing e-distribution you can send 1095-C forms to employees directly from the platform to easily comply with IRS deadlines. State filing is available for California, New Jersey, Rhode Island, and Washington D.C.

Learn More

Proven expertise in penalty prevention

With over $1 billion in penalties prevented, Trusaic is your trusted partner for avoiding ACA compliance risks.

- Proactive penalty risk assessment: identify address compliance gaps

- Unlimited expert support: your designated ACA specialist provides ongoing assistance and peace of mind

Key Features

Accurate IRS reporting

Ensure accurate and timely Form

1095-C and Form 1094-C reporting

through error-free data processing.

Penalty risk mitigation

Gain actionable insights to reduce

your ACA compliance risks and

avoid costly IRS penalties.

Certified HRIS integrations

Workday, UKG, SAP, ADP, and other

leading HRIS platforms to ensure

seamless data transfer.

State filing add-on

Meet reporting requirements in

California, New Jersey, Rhode Island,

and Washington D.C.

Employee e-distribution

Furnish employee 1095-C forms

electronically directly from the platform

for secure delivery.

Designated expert support

Receive guidance at every

step of the compliance process

from a designated ACA expert.

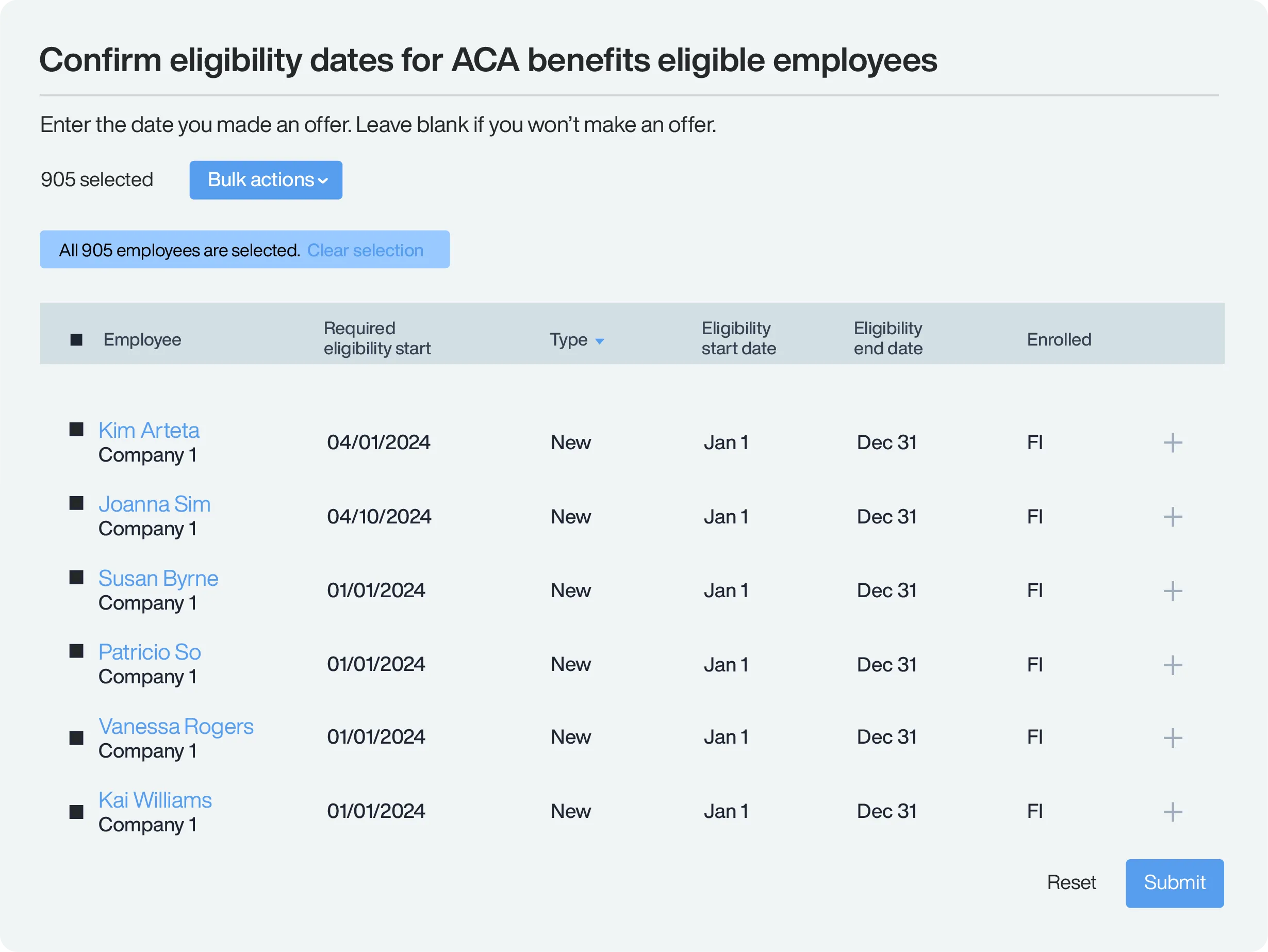

Capabilities

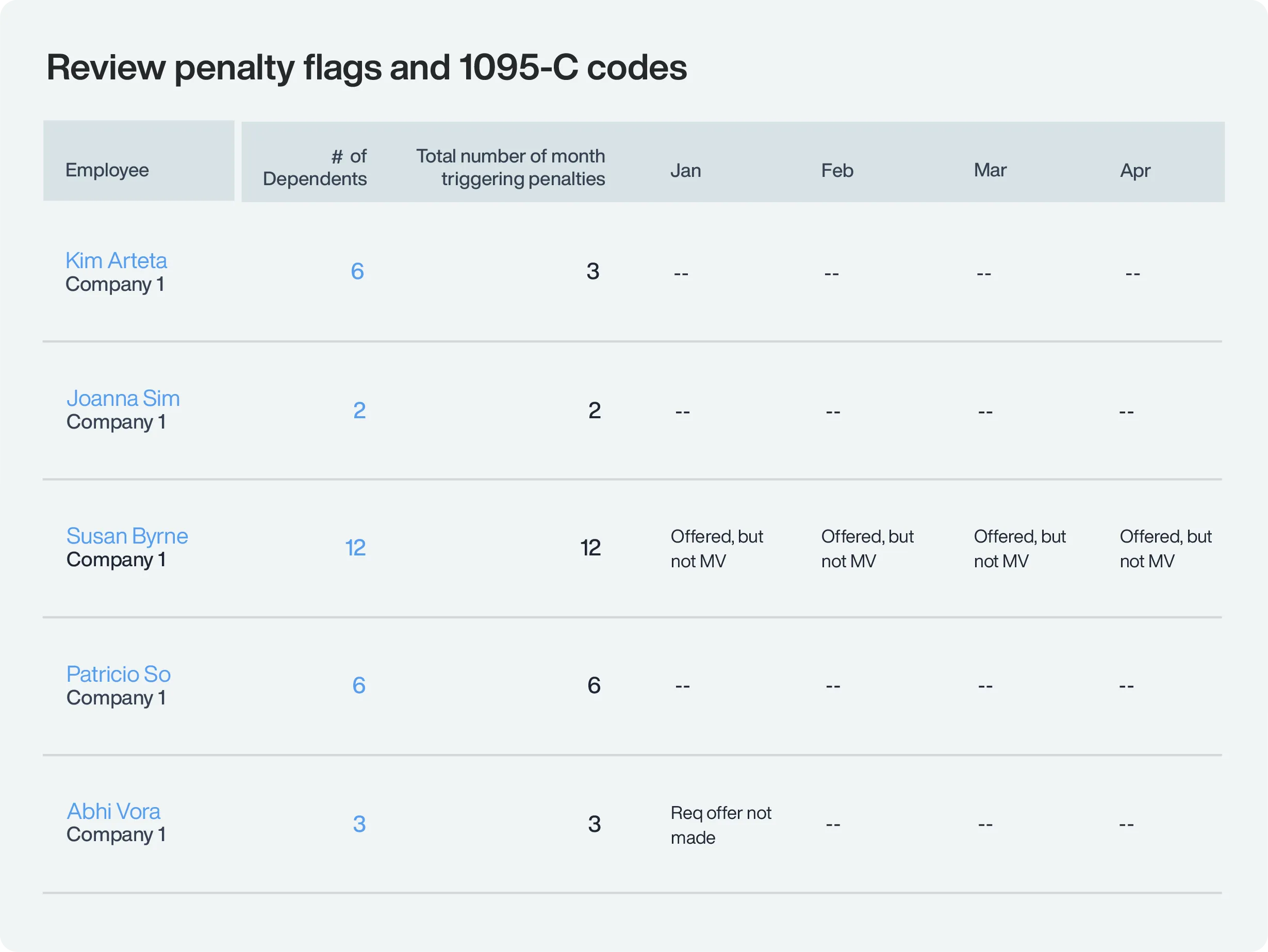

Penalty risk assessment

Analyze HRIS data to identify ACA coverage gaps and liabilities, enabling timely corrections.

ACA data quality assurance

Ensure accurate and timely Form

1095-C and Form 1094-C ACA reporting

through error-free data processing.

Data security

SOC 2 certified technology with role-based access, and annual penetration testing to ensure data security.

FAQs

-

What's the difference between ACA Essential® and ACA Complete® ?

ACA Essential is our entry-level compliance solution, offering everything you need to file 1094-C/1095-C forms and meet federal reporting requirements. ACA Complete goes further, providing ongoing monitoring, penalty risk assessments, and full audit defense — keeping you compliant every step of the way.

-

Can I add state filing to ACA Essential?

Yes, state filing is available as an add-on for an additional fee.

-

Does ACA Essential include expert support?

Yes, you’ll receive unlimited guidance from a designated ACA specialist.

-

Do you offer 1095-C e-Distribution?

Yes, customers can utilize our 1095-C furnishing option or electronically distribute forms to employees, who can then access them from our platform. This ensures all your forms are distributed on-time and can be easily tracked for compliance purposes.

-

What happens if I've already received an IRS penalty notice?

We’ll conduct a retroactive audit of your HR data, prepare a penalty response letter, and implement ongoing tracking to prevent future penalties.

-

What is the benefit of the Penalty Risk Assessment?

Our Penalty Risk Assessment identifies data discrepancies and compliance gaps, giving you the opportunity to address issues before penalties occur.

-

What is an Applicable Large Employer (ALE)?

If an employer has at least 50 full-time employees, including full-time equivalent employees, on average during the prior year, the employer is an Applicable Large Employer (ALE) for the current calendar year, and is therefore subject to the Employer Shared Responsibility Provisions (also referred to as the ACA Employer Mandate) and the Employer Information Reporting Provisions, which requires ALEs to report annually to the IRS information about the health care coverage, if any, they offered to full-time employees. The IRS will use this information to administer ACA penalties for non-compliance.