Introduction

For companies in the European Union (EU), the principle of pay transparency is no longer a recommendation – it’s a legal requirement. The EU Pay Transparency Directive has arrived and is already changing the landscape of compensation.

By June 2027, companies with more than 150 workers will be required to file their first report in line with these new regulations – with certain requirements applying to all organizations regardless of the number of workers. Even so, many EU organizations have still taken no action toward pay transparency and pay equity in their workplace. Research by think-tank The Conference Board, based on a survey of 78 of Europe’s largest employers, found that 41% have yet to begin preparing for the Directive.

Many unanswered questions remain regarding implementing the legal requirements for pay transparency in organizations across the EU. That’s why this guide has been created – to expand your pay transparency understanding and show you how to ensure compliance with emerging legislation.

Created by gradar and Trusaic, two leading software solutions in the pay transparency space, it dives deep into how job evaluation and pay equity analytics can be integrated to foster transparency, promote fairness, and put you at the forefront of bridging the gender pay gap.

An introduction to pay transparency and emerging EU legislation

- What is pay transparency?

- Understanding the EU Pay Transparency Directive

- Key elements of the Directive

Job evaluation as the foundation for fair, transparent rewards

- The role of job evaluation in the EU Pay Transparency Directive

- Analytical vs. non-analytical job evaluation systems

- Why point-factor analysis is recommended by regulators

- Important job evaluation takeaways

Pay equity analytics and rewards fairness

- Role of pay equity analysis in the EU Pay Transparency Directive

- What is pay equity?

- Measuring pay equity using multiple regression

- Applying pay equity to the Directive

Bringing it all together: Pay transparency recommendations

- Project roadmap for compliance with pay transparency legislation

- gradar and Trusaic as market-leading tools for pay transparency

Whether you’re starting from scratch or refining your existing practices, this guide will equip you with the knowledge and tools to better understand the critical concepts of pay transparency and how they can be leveraged to build a stronger organizational culture in the face of the Directive.

An introduction to pay transparency and emerging EU legislation

What is pay transparency?

In recent years, pay transparency has emerged as a vital tool in addressing wage discrimination, including the persistent gender pay gap. It refers to organizational practices that openly communicate compensation details to current and prospective employees. Despite growing awareness, the gender pay gap remains a significant challenge in the EU, with women (in 2023) earning an average of 13% less than men, per a statement from the EU Commission.

However, attitudes toward pay discussions are shifting. Employees, employers, and regulatory bodies increasingly recognize the need to confront pay inequalities and biases in the workplace.

Understanding the EU Pay Transparency Directive

For companies operating in the EU, pay transparency is no longer optional – it is a legal obligation. In April 2023, the European Commission’s proposal for binding pay transparency measures was formally adopted as the EU Pay Transparency Directive.

The Directive’s objective is to establish minimum standards for pay transparency across the EU, empowering workers to assert their right to equal pay and reducing the enduring gender pay gap.

It will apply to all employers regardless of their size and is set to be implemented into local law by 2026. That said, the obligation to deliver detailed reports on pay transparency will be tailored to the size of employers. This Directive is reshaping the landscape of compensation in the EU by placing a stronger emphasis on proven processes and tools such as equitable pay structures and transparency.

Many organizations, however, are not yet prepared to address the significant requirements of this legislation. The Directive challenges employers to adapt quickly, whether by identifying potential pay disparities, introducing job architectures, optimizing compensation frameworks, or fostering transparency through manager education and employee communication.

Key elements of the Directive

The new Directive is like nothing organizations have seen before. It’s set to tackle the pay gap head on, with a multi-pronged approach to the root causes of pay inequity. Crucially, it will mandate – not just recommend – pay transparency and pay gap reporting for all member states and, unlike previous pay equality legislation in the EU, the incoming Directive will be backed by robust enforcement mechanisms.

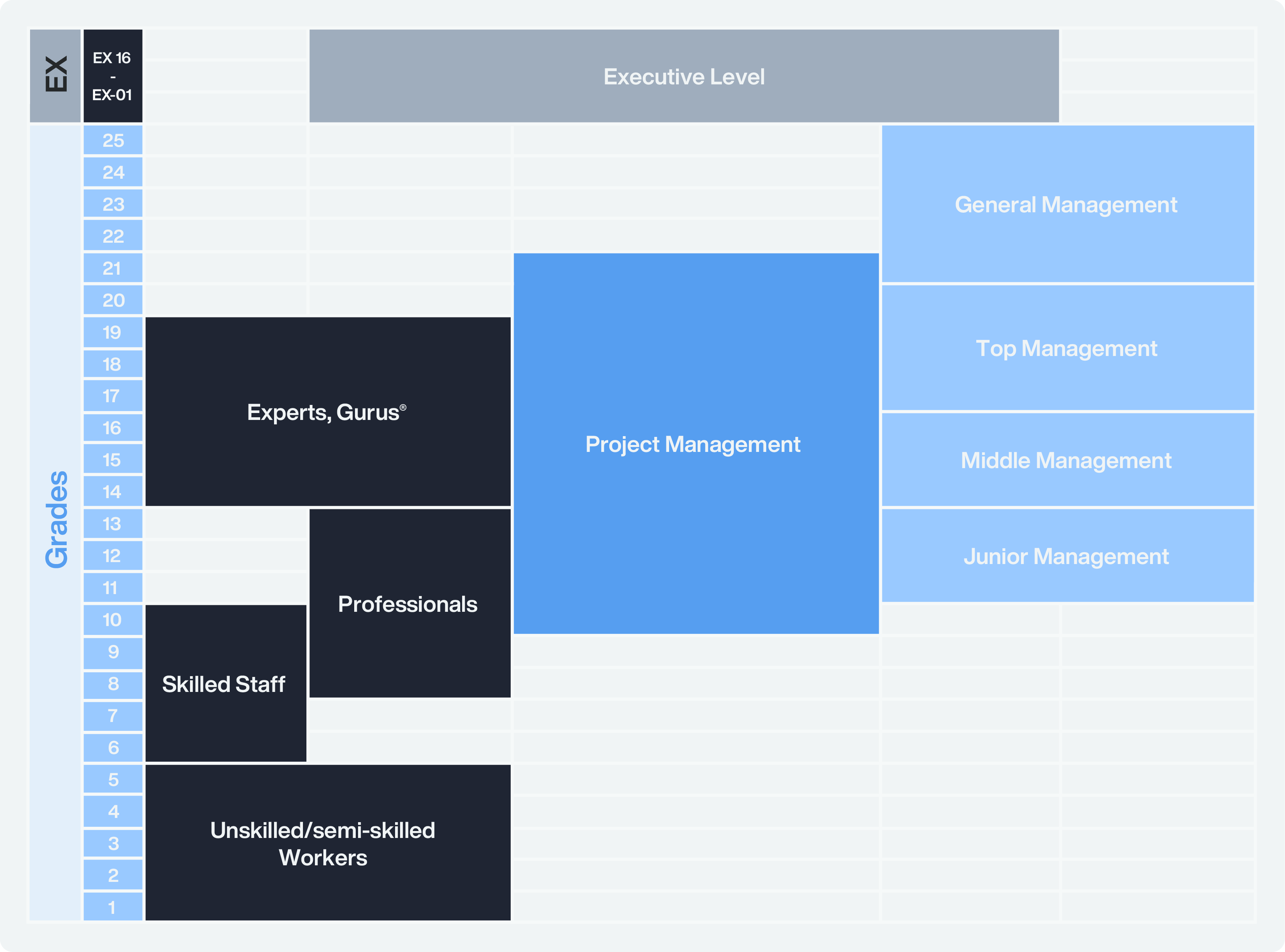

Obligatory job evaluation: Employers must establish gender-neutral, objective criteria – such as education, skills, and responsibility levels – for determining work of equal value. This ensures transparency and fairness in assessing jobs of equal value and is a strong contrast to market driven pricing of labor. The below illustration (Figure 1) shows how the value of a job is represented by gradar grades 1-25 and how company-specific career levels can be mapped across grades.

Figure 1: Job Evaluation (i.e. with gradar) determines the relative value of a job based on objective criteria

- Pay transparency for job-seekers: Employers must disclose the initial pay or pay range in job postings or during the recruitment process, fostering informed and fair pay negotiations.

- Gender pay gap accountability: Organizations with pay gaps at or above 5% must provide justifications using objective, gender-neutral criteria or face a joint pay assessment and possible fines. This mechanism creates accountability for narrowing unjustified pay disparities.

- Right to information: Employees can request information about their individual pay levels, average pay levels, broken down by gender, for employees performing the same or similar work (of equal value), and criteria for pay progression, enhancing transparency and trust.

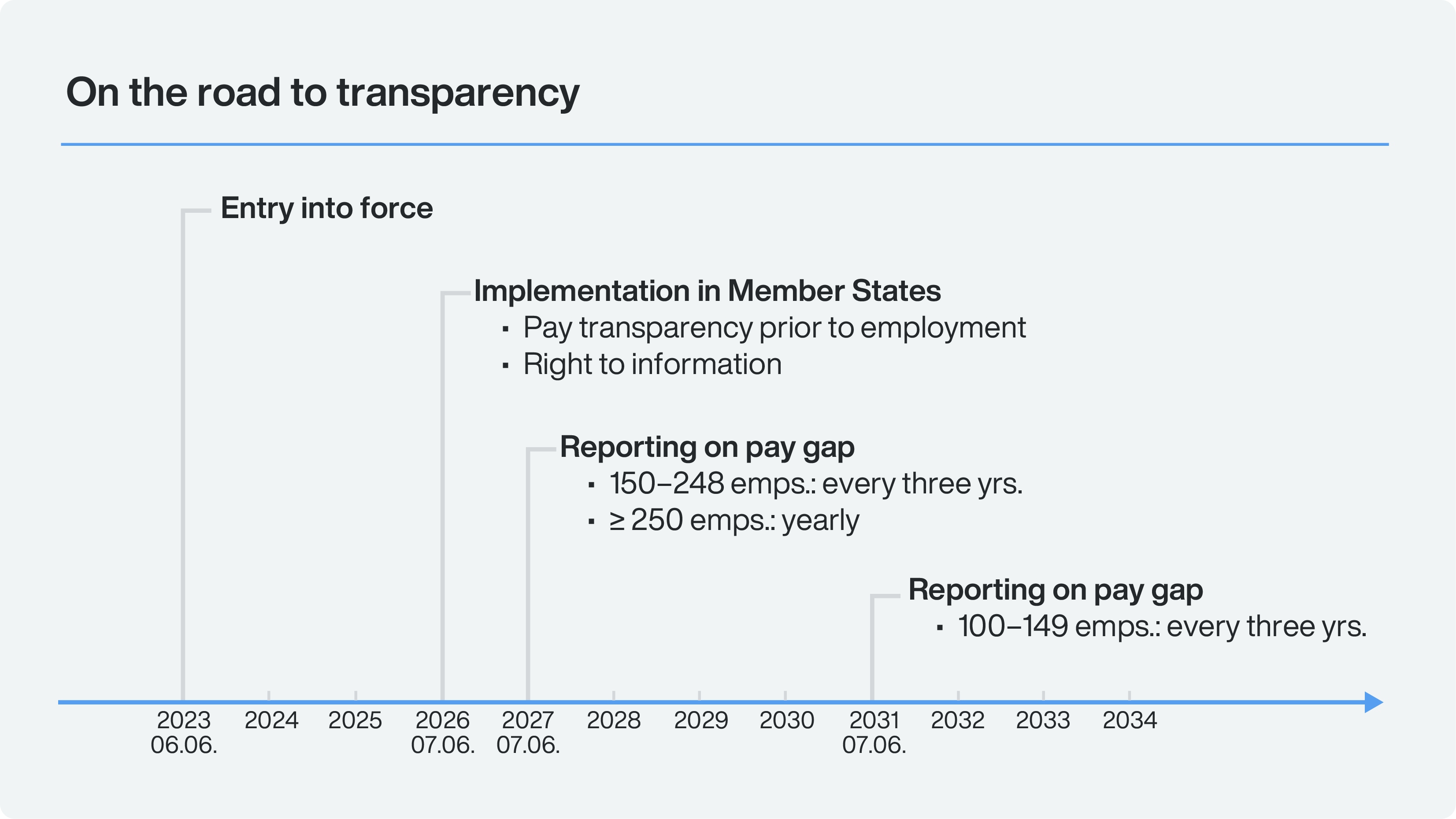

Public pay reporting: Employers with at least 100 employees are required to periodically report gender pay gaps. Reporting frequencies vary by company size, and these reports must include detailed information on pay structures and disparities. While the Directive emphasizes minimizing costs and administrative burdens for employers, achieving this objective may prove challenging for many organizations. Despite advancements in digitization and the availability of compensation data across European organizations, effectively integrating, analyzing, and reporting this data will require significant effort and coordination.

Figure 2: The roadmap to compliance as determined by the European Union and its Member States

- Strengthening employee representation through joint pay assessments: If a company’s gender pay gap in any category of workers is at or above 5% and cannot be justified through objective, gender-neutral criteria, a joint pay assessment is required. This assessment involves cooperation between employers and employee representatives to analyze and address pay disparities. Employers must act within a reasonable timeframe to address unjustified pay differences and may involve labor inspectorates or equality bodies in the process. The Directive emphasizes the role of employee representatives such as worker councils and union representatives in advocating for fair pay practices, ensuring they are integral to the remediation process.

- Justice for victims of pay discrimination: Victims can claim compensation for gender-based pay discrimination, including back pay. Employers must prove that any pay differences are justified and not discriminatory.

- Shift of the burden of proof: In cases of suspected pay discrimination, the burden of proof shifts to the employer. This means that employers must demonstrate that pay differences are not discriminatory, making it easier for employees to assert their rights.

- Penalties for non-compliance: Member States must establish effective, proportionate, and dissuasive penalties for employers that fail to comply with the Directive’s provisions. Penalties can include fines or other corrective measures.

- Monitoring & awareness-raising: Member States are required to collect and analyze data on pay gaps and other transparency measures, while equality bodies and monitoring institutions must run awareness campaigns to educate organizations and employees about their rights and obligations under the Directive.

Job evaluation as the foundation for fair, transparent rewards

The role of job evaluation in the EU Pay Transparency Directive

Job evaluation is a cornerstone of compliance with the Directive, ensuring pay structures are transparent, equitable, and based on objective criteria such as work of equal value. The Directive emphasizes the importance of evaluating “work of equal value” through gender-neutral methods, a task best addressed through robust job evaluation systems.

Analytical vs. non-analytical job evaluation systems

Organizations have a variety of methods at their disposal for job evaluation, broadly categorized into analytical and non-analytical systems.

Non-analytical job evaluation systems:

- Paired ranking:

- Method: Jobs are compared against each other in pairs to establish relative value.

- Challenges: Rarely used today due to its subjective nature and limited scalability in large organizations. Paired ranking does not provide detailed insights into the factors contributing to job value, making it less effective and less likely for ensuring compliance with the Directive.

- Job classification:

- Method: Jobs are grouped into predefined categories or levels (e.g., P1, P2, P3 for professional levels; M1, M2, M3 for management levels).

- Usage: Widely adopted due to its simplicity and efficiency. The levels are predetermined and provide a broad framework for categorizing roles.

- Limitations: Job classification systems can lack the granularity required to address the Directive’s demand for objective, gender-neutral evaluation criteria. They rely heavily on predefined structures, which may overlook nuanced differences in job responsibilities.

Analytical job evaluation systems:

- Job ranking:

- Method: Jobs are ranked in order of importance or value to the organization.

- Challenges: Outdated and rarely used in modern organizations, as it does not break down the value of work into measurable components, which is a key requirement of the Directive.

- Job grading (Point-factor analysis):

- Method: Roles are evaluated based on a set of predefined factors, such as skills, effort, responsibility, and (if relevant) working conditions. Each factor is assigned a weight, and jobs are graded based on their cumulative scores.

- Advantages: Aligns with the requirements of the Directive by supporting evidence-based pay assessments and promoting greater gender equality and pay equity across organizations through a structured, objective method for assessing job roles.

Why job grading (Point-factor analysis) is recommended by regulators

The Directive demands objective, detailed, and gender-neutral job evaluations, making analytical systems, particularly point-factor-based job grading, the optimal choice for a number of key reasons.

- Ensures fairness in compensation: Job grading helps create a clear and consistent method for evaluating the value of different roles within an organization. This ensures that employees performing similar tasks or requiring comparable skills and responsibilities are paid equally, reducing the potential for unfair wage disparities.

- Supports gender pay equity: One of the key objectives of the Directive is to close the gender pay gap. Job grading plays a vital role by ensuring that compensation is based on objective criteria, rather than subjective factors that may result in gender-based pay inequalities. By evaluating jobs based on standardized factors, organizations can identify and address any discrepancies in pay between male and female employees.

- Promotes transparency: The Directive requires organizations to be transparent about their pay structures. Job grading enables businesses to establish clear, structured pay scales that can be easily communicated to employees. This transparency helps build trust within the workforce, as employees can see how their pay is determined and understand how different roles are valued within the organization.

- Facilitates audits and accountability: Job grading creates an easily understandable framework for how roles are evaluated and compensated. This makes it simpler for companies to conduct internal audits or respond to external inquiries about pay practices. By having an objective system in place, employers can demonstrate compliance with pay transparency laws and be accountable for their compensation decisions. Detailed documentation and standardized criteria meet regulatory requirements and reduce the risk of pay-related legal challenges.

- Helps prevent discriminatory practices: By categorizing jobs according to clear, measurable factors (such as skills, responsibilities, and working conditions), job grading minimizes the likelihood of unconscious bias influencing pay decisions. This structured approach makes it easier to identify and correct any discriminatory practices or pay gaps that may exist within the organization, ensuring a more equitable workplace for all employees.

- Creates a comprehensive job architecture: Analytical systems provide the framework for managing roles, pay structures, and competencies cohesively. By breaking down roles into measurable factors, these systems offer a clear rationale for pay and career decisions, and foster trust and understanding among employees. Job grading systems may also align with market surveys, enabling organizations to remain competitive while addressing internal equity.

Important job evaluation takeaways

By adopting the right job evaluation system, organizations not only comply with the Directive but also establish a foundation for sustainable and fair pay practices that benefit employees and employers alike.

Organizations relying on job classification or on one of the other more dated methodologies should evaluate their current approach and assess whether their system meets the Directive’s requirements for objectivity and transparency. If they do not provide the granularity needed to comply with the Directive, a transition should be made to an analytical system.

Point-factor-based solutions like gradar provide a robust framework for meeting the Directive’s requirements – and can facilitate a seamless and pragmatic migration of existing job evaluation results to their methodology, minimizing disruption and preserving organizational continuity.

These systems also play a huge role in pay transparency – ensuring equitable pay practices and supporting workforce development and retention. By linking job evaluation with pay equity analytics, organizations can analyze their pay data more effectively, pinpointing any gender pay gaps or other disparities in compensation. This alignment enables businesses to address inequities and demonstrate compliance with the Directive, fostering a fairer, more transparent pay structure across the organization.

So, with job evaluation as the foundation, pay equity analytics becomes a powerful next step toward fair, transparent pay. When used together, they can help organizations more accurately assess whether compensation is equitable across all employee groups and, crucially, ensure compliance with emerging pay transparency legislation.

Pay equity analytics and rewards fairness

Role of pay equity analysis in the EU Pay Transparency Directive

The primary motivation behind the Directive is “to strengthen the application of the principle of equal pay for equal work or work of equal value between men and women through pay transparency and enforcement mechanisms.”

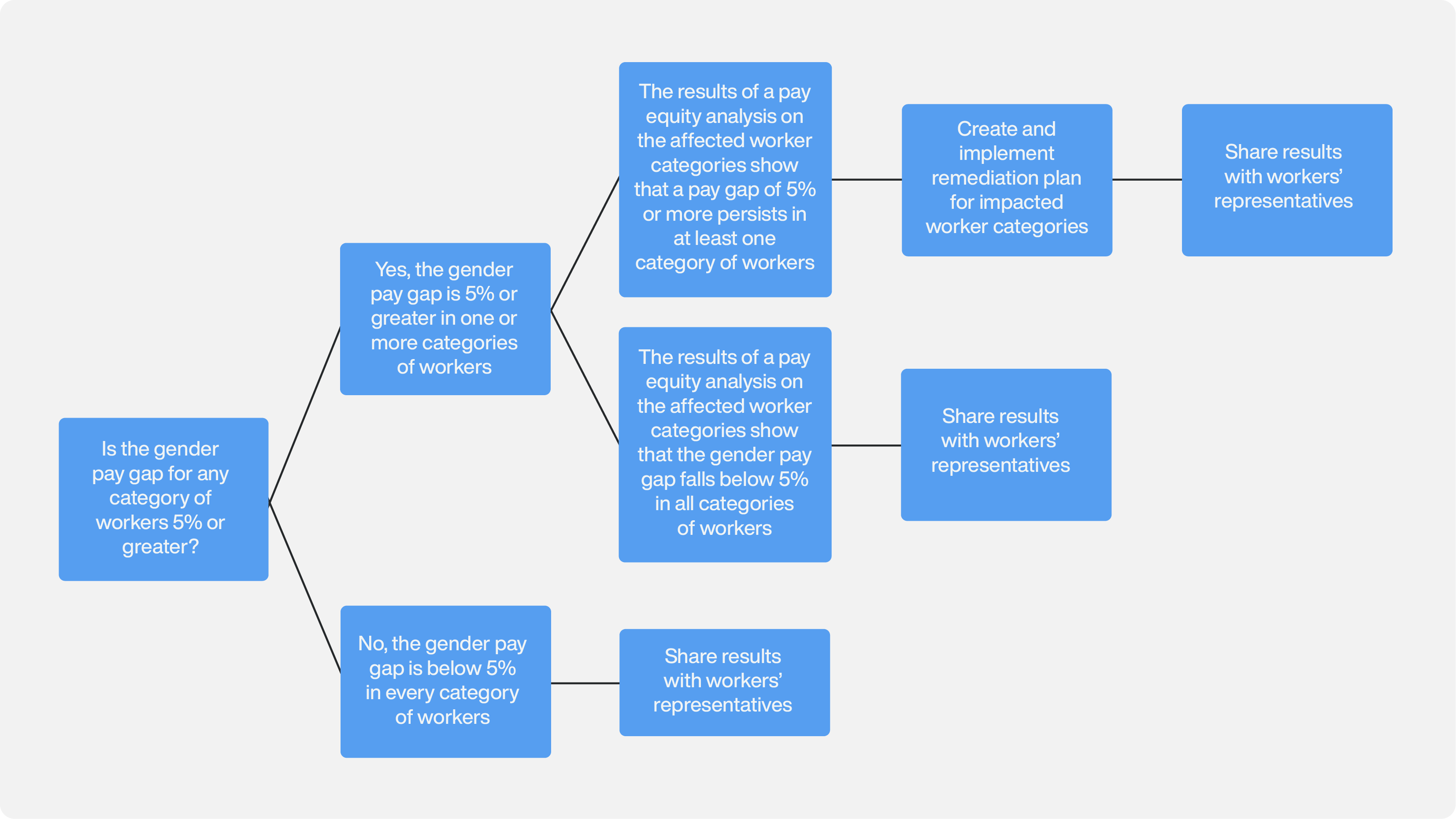

A key part of the Directive requires that covered employers report on the gender pay gap between female and male workers. More specifically, the gender pay gap must be reported by categories of workers, where categories reflect workers who perform the same work or work of equal value. We explained earlier how job evaluation can enable employers to create categories of workers. Once this job evaluation is complete, employers can compute gender pay gap statistics by categories of workers as required by the Directive. If the gender pay gap – measured by the difference in the average pay between female and male workers – is 5% or more in any category of workers, the employer has the opportunity to explain the difference on the basis of objective, gender-neutral factors.

In such a case, the employer will want to conduct a pay equity analysis on the affected categories of workers. If the analysis shows that a pay difference of 5% or more persists – even after accounting for objective, gender-neutral factors – then a remediation plan needs to be put in place and implemented for the impacted categories of workers.

Figure 3 provides a high-level illustration of the assessment process. The remainder of this section delves more deeply into each step of the assessment process. Note that, according to the Directive, if a covered employer fails to take action as outlined here when a pay gap of 5% or more is found in any category of workers, the employer must coordinate with workers’ representatives to conduct a joint pay assessment.

Figure 3: Process for assessing pay gaps by categories of workers.

What is pay equity?

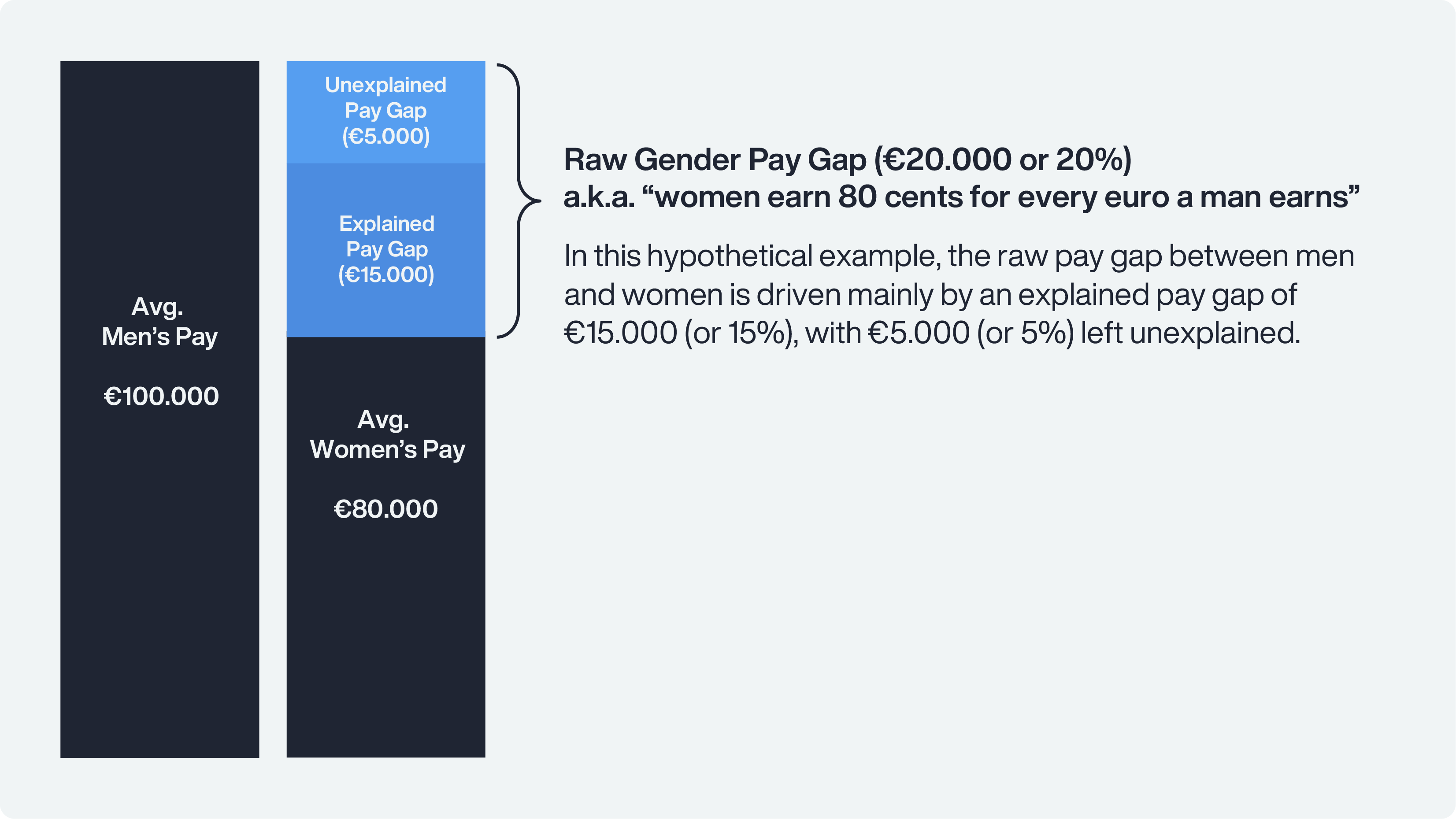

Understanding the concept of pay equity is crucial. Most people are familiar with the raw pay gap, which tells us how average (or median) pay differs by demographic group. For example, the Directive requires companies with 100+ workers to report the average pay of women compared to the average pay of men.

Conceptually, the raw pay gap consists of two components:

- “Explained” pay gap: This component of the raw pay gap reflects the extent to which pay differs by demographic group due to differences in “compensable factors.” These are factors like career level, education, and experience. For the typical organization, the largest part of the explained pay gap is due to representation differences across career levels (e.g., individual contributor, manager, director), with men disproportionately represented in higher career levels (that pay more) and women disproportionately represented in lower career levels (that pay less). Explained pay gaps are best addressed through career and opportunity equity policies to ensure that all workers are provided with equitable access to career advancement.

- “Unexplained” pay gap: This component is the remaining portion of the raw pay gap that cannot be explained by differences in compensable factors and may be due to pay inequities based on gender (or another demographic characteristic). You may also see this pay disparity referred to as the “adjusted” or “controlled” pay gap. The unexplained pay gap can be addressed directly by conducting a pay equity analysis and, as needed, adjusting the compensation of individuals who are part of an underpaid demographic class.

Figure 4 provides an illustrative example of these different pay gaps. In this hypothetical example, men are paid €100.000 on average and women are paid €80.000 on average. The raw gender pay gap is €20.000 or 20%. That is, women earn 80 cents for every euro a man earns. The explained gender pay gap – which we’ve measured at €15.000 (or 15%) – is the primary driver of the raw gender pay gap, with the remaining €5.000 (or 5%) left unexplained. The primary purpose of a pay equity analysis is to measure an organization’s unexplained gender pay gap and make pay adjustments as appropriate to close it.

Figure 4: Illustrative example of pay gaps

Measuring pay equity using multiple regression

In the illustrative example above, the unexplained gender pay gap was measured at €5.000 (or 5%). To measure this unexplained pay gap, we need to measure the part of the raw pay gap that can be explained by legitimate, compensable factors. We do this by using a multiple linear regression analysis.

Multiple regression estimates the relationship between an outcome, such as compensation, and multiple factors that are related to that outcome. Starting with compensation as our outcome of interest, we add relevant compensable factors to a regression model. Once these compensable factors are accounted for, we determine if gender is statistically related to compensation. If it is, it’s recommended to put in place a remediation strategy to address this unexplained gender pay gap.

Figure 5 is an illustrative example showing how to use multiple regression to measure unexplained gender pay gaps. In this hypothetical example, the “No Controls” gender pay gap is the raw pay gap, which is 20% (i.e., on average, women are paid 20% less than men). This pay gap falls as relevant compensable factors are added to the regression model. In particular, the gender pay gap drops to 18% when education and years of prior work experience are added to the model. Most notably, the pay gap falls to 7% when career level and geographic zone are added as compensable factors. Lastly, adding company tenure and tenure in position further reduces the pay gap to 5%. This final figure represents the unexplained gender pay gap based on the results of the multiple regression analysis.

Figure 5: Illustrative example measuring pay equity with multiple regression analysis.

Role of statistical significance in the EU Pay Transparency Directive

When conducting a pay equity analysis using multiple regression, an unexplained gender pay gap is generally thought to be worthy of attention if the gap is “statistically significant.” The statistical significance of a pay gap is typically measured using a 5% significance level. This is a commonly used significance threshold and indicates that there is a 5% chance or less that the pay gap we’re seeing is due to chance.

A 5% significance level does not refer to the size of the pay gap. This is a common misunderstanding. Instead, it tells us whether the pay gap we’ve identified, which could be of any magnitude, is statistically meaningful and unlikely to be due to chance. Unlike a traditional pay equity analysis, the EU Pay Transparency Directive does not focus on the statistical significance of an unexplained gender pay gap. Rather, the Directive focuses on the magnitude of the pay gap – specifically, whether it is 5% or higher – regardless of the statistical significance of the pay gap.

Applying pay equity to the Directive

As discussed earlier, under the Directive, if the raw gender pay gap is 5% or more in any category of workers, the employer can conduct a pay equity analysis on the affected categories of workers to determine if the gap can be explained by objective, gender-neutral factors. Let’s delve into the logistics of this more deeply.

Step 1. Compute raw pay gaps statistics for each category of workers

The first step is to compute raw pay gap statistics, measured by the difference in the average pay between female and male workers, for each category of workers. The Directive requires this metric to be calculated for (1) ordinary basic wage/salary and (2) complementary/variable components of pay. These metrics are based on compensation for the previous calendar year.

If the statistics show that the raw gender pay gaps, under both measures of pay, are below 5% for every category of workers, then no further analysis is needed, and you are in a position to share the results with workers’ representatives. On the other hand, if the statistics show that the raw gender pay gap, under either measure of pay, is 5% or greater for any category of workers, then it’s recommended to conduct a pay equity analysis on those categories of workers that exceed the 5% threshold.

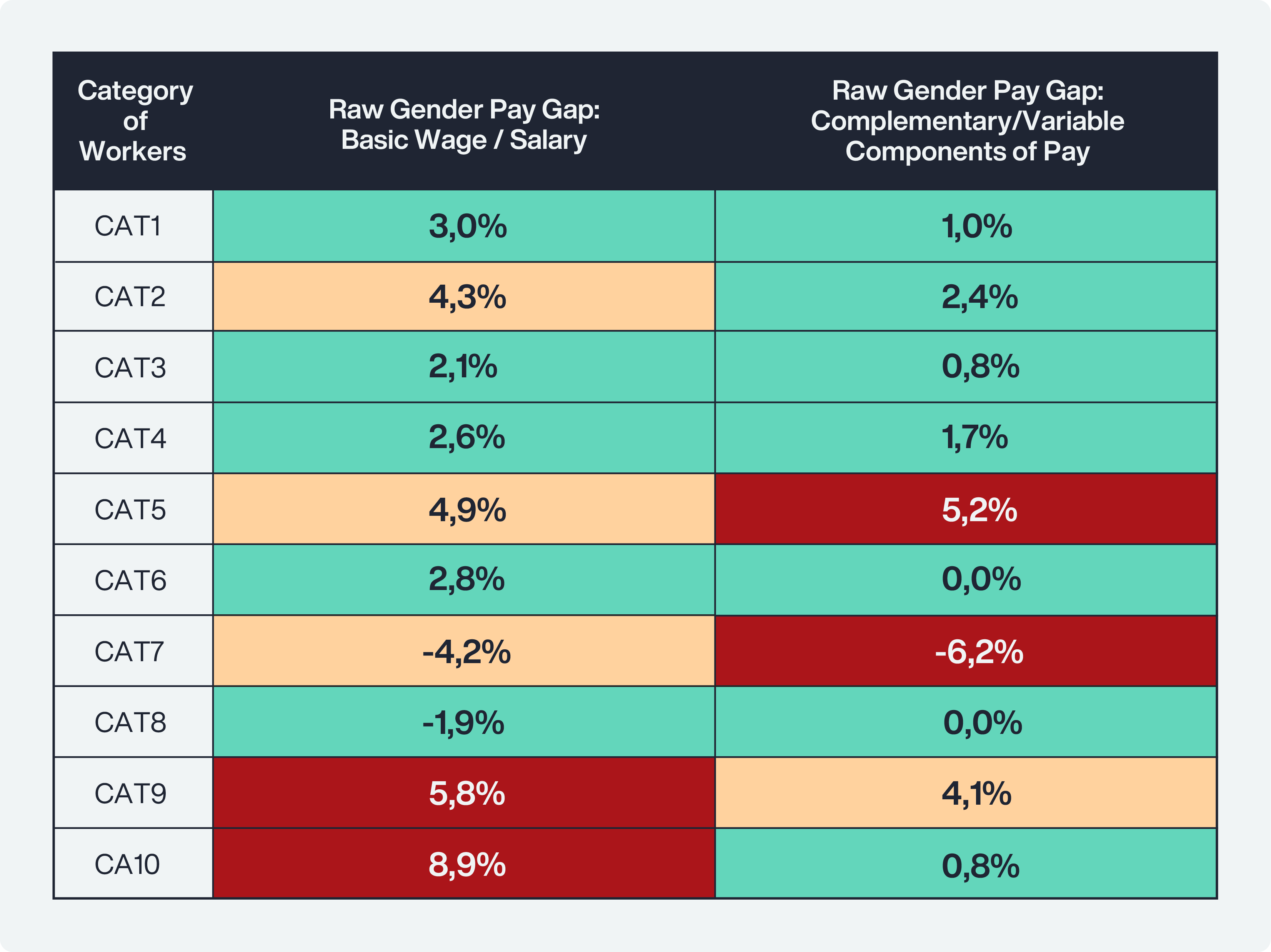

Table 1 illustrates when a pay equity analysis would be recommended based on raw pay gap statistics. The table shows the raw gender pay gap for ordinary basic wage/salary and for complementary/variable components of pay by category of workers. A positive figure indicates that women are paid less than men, while a negative figure indicates that men are paid less than women. Figures that meet or exceed the 5% threshold (whether positive or negative) are highlighted in red. A pay equity analysis is recommended for these cases. Those falling marginally below the 5% threshold are highlighted in yellow. You may want to consider conducting a pay equity analysis on these categories as well. Those well below the 5% threshold are highlighted in green. No further action needs to be taken for these categories.

Table 1: Raw gender pay gap by categories of workers

Step 2. Conduct pay equity analysis for worker categories that exceed 5% threshold

A key step in conducting a pay equity analysis is deciding which compensable factors to include in the analysis. The Directive says that these must be “objective, gender-neutral” factors. The process of identifying these factors begins with an organization’s compensation philosophy. Broadly speaking, what are the factors that an organization values and rewards? For example, if an organization has a strong pay-for-performance philosophy, then it’s important to include performance as a compensable factor. Other customary factors include company tenure, position tenure, and relevant experience prior to joining the organization. Geographic differentials are relevant for organizations that pay differently based on work location.

As mentioned earlier, career level typically has a substantial impact on worker pay. For many organizations, it’s the single biggest driver of pay differences within the organization. A question that naturally arises is whether career level should be included as a compensable factor in a pay equity analysis that is conducted in support of the Directive. The answer depends in large measure on the categories of workers that an organization has created. If career levels were used to create an organization’s worker categories such that all workers in a given category are in the same career level, then it’s not necessary to include career level as a compensable factor. On the other hand, if a worker category includes workers in different career levels, then it’s likely appropriate to include career level as a compensable factor.

If the results of a pay equity analysis on the affected worker categories show that the gender pay gap falls below 5% in all categories of workers for both ordinary basic wage/salary and complementary/variable components, then no further analysis is needed, and you are in a position to share the results with workers’ representatives. If the results show that a pay gap of 5% or more persists in at least one category of workers for ordinary basic wage/salary or complementary/variable components, then the next step is to create and implement a remediation plan for impacted worker categories.

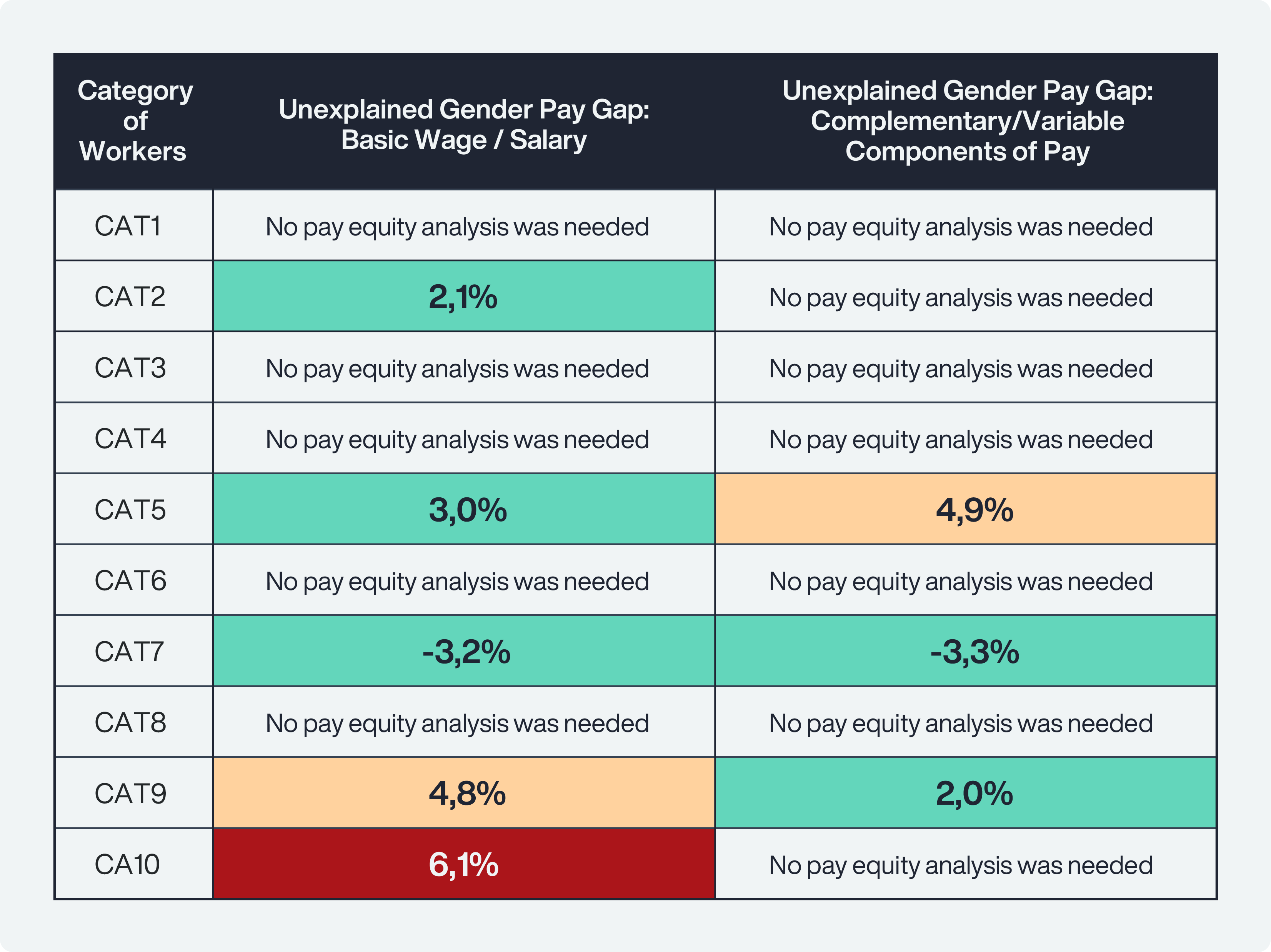

Table 2 illustrates when a remediation plan would be recommended based on the results of a pay equity analysis. The table shows unexplained gender pay gaps for ordinary basic wage/salary and for complementary/variable components of pay by category of workers. As in Table 1, a positive figure indicates that women are paid less than men, while a negative figure indicates that men are paid less than women. Figures that meet or exceed the 5% threshold (whether positive or negative) are highlighted in red. A remediation plan is recommended for these cases. Those falling marginally below the 5% threshold are highlighted in yellow. You may want to consider a remediation plan for these categories as well. Those well below the 5% threshold are highlighted in green. No further action is needed for these cases.

Table 2: Unexplained gender pay gap by categories of workers

Step 3. Create and implement remediation plan for impacted worker categories

As mentioned earlier, the Directive requires gender pay gap metrics to be calculated based on ordinary basic wage/salary and complementary/variable components of pay relating to the previous calendar year. In essence, the pay gap metrics are backward looking in that they require an organization to examine past compensation. Once these payments to workers have been made and pay gap statistics have been computed based on these payments, it is not possible to go back and change these historical payments. Thus, an effective remediation plan requires a forward-looking approach in which changes are made to a worker’s current wage rate or annual salary (or current complementary/variable components of pay). According to the Directive, employers have six months from the submission date of the pay gap report to remediate pay gaps that exceed the 5% threshold.

Crafting a forward-looking remediation plan requires a slightly different pay equity analysis than the one detailed in Step 2. The compensation outcomes examined as part of the earlier pay equity analysis in Step 2 were basic wages/salaries and complementary/variable components paid during the previous calendar year. A pay equity analysis performed for remediation purposes will examine a worker’s current wage rate or annual salary, as well as current complementary/variable components of pay, and make adjustments as needed to address any unexplained gender pay gaps that are 5% or higher.

As an example, let’s assume the pay equity analysis in Step 2 revealed, for one worker category, an unexplained gender pay gap of 7% when examining ordinary basic wages and salaries paid during 2024. Remediating this gender pay gap will require an examination of the wage rate or annual salary for workers currently in this category of workers. Let’s further assume this analysis reveals that pay adjustments totaling €200.000 are needed to reduce the unexplained gender pay gap to the point where it falls below the 5% threshold. Once this remediation strategy is implemented and pay adjustments have been made, it would be appropriate to share the results with workers’ representatives.

Remediating complementary/variable components of pay requires a different approach than examining wage rate or annual salary. The gender pay gap statistics required by the Directive sum together all complementary or variable components of pay into a single figure. However, remediation of unexplained gender pay gaps for complementary or variable components of pay requires an examination of each component separately. Otherwise, it’s not possible to know which specific components are driving the gender pay gap and require remediation.

Summary

The EU Pay Transparency Directive aims to enforce equal pay for equal work or work of equal value between men and women through pay transparency and enforcement. Employers must report gender pay gaps by worker categories, which are defined by the principle of equal work or work of equal value. A job evaluation can help create these categories, enabling employers to compute the required pay gap statistics.

If a raw pay gap of 5% or more exists for a category of workers, employers can conduct a pay equity analysis to determine if the gap can be explained by objective, gender-neutral factors. If not, a remediation plan needs to be put in place to ensure gender pay gaps are reduced below the Directive’s 5% threshold.

Bringing it all together: pay transparency recommendations

Project roadmap for compliance with pay transparency legislation

To align with the Directive, organizations must adopt structured approaches to job architecture, data collection, compensation systems, pay equity audits, and training. Below are six detailed recommendations, each concluding with actionable steps to help your organization achieve compliance while fostering fairness and transparency in pay practices.

Step 1. Introduce a job architecture based on point-factor grading and job families

A robust job architecture serves as the foundation for equitable pay practices. Point-factor-based job grading provides an objective framework for evaluating the relative value of roles. By combining this with a job family structure, organizations can group jobs based on similar content, responsibilities, or skills. This approach also enhances clarity in career paths, facilitates workforce planning, and supports fair compensation.

- Select an HRIS: Use an HRIS that supports a job catalog to manage roles, grades, and job families efficiently.

- Define job families: Categorize roles into logical groupings (e.g., finance, engineering) based on their purpose and skillsets.

- Perform job grading: Evaluate each role using a point-factor system such as gradar that accounts for factors like responsibility, skills, and if need be working conditions.

- Document the architecture: Maintain a centralized repository with clear definitions, levels, and career progression pathways.

Step 2. Gather employee data and map roles

Accurate data is essential for aligning employees with your job architecture and ensuring transparency. This includes demographic details, employment history, and compensation components.

- Collect data: Gather data such as job tenure, company tenure, biographical data (esp. gender and age), pay components (base, complementary and variable), performance evaluations, current job descriptions, and labor contracts.

- Validate data: Ensure accuracy by cross-referencing information with HR records and payroll systems.

- Map roles: Align employees with appropriate job levels based on the newly established job architecture, ensuring consistency and transparency in the mapping process.

Step 3. Simplify the compensation landscape

The Directive requires organizations to account for both base pay and complementary or variable components. A simplified compensation structure reduces complexity, supports compliance, and enhances transparency.

- Review pay components: Identify and classify all forms of compensation, including bonuses, allowances, and benefits in kind.

- Standardize systems and contracts: Update employment contracts to reflect consistent compensation standards across roles and levels.

- Streamline benefits: Consolidate or simplify variable pay components to reduce administrative burdens and improve clarity.

Step 4. Introduce compensation structures and processes

Establishing structured pay scales and compensation processes ensures alignment with the Directive’s requirements for transparency and fairness during recruitment, promotions, and reviews.

- Develop pay scales: Create pay structures tied to grades and possibly job families, ensuring alignment with your job architecture.

- Define processes: Document procedures for providing pay information to candidates, employees and managers during recruitment, promotions, and salary reviews.

- Link to performance or tenure: Establish clear, documented processes for performance management or tenure tracking, ensuring objectivity and consistency in pay development.

Step 5. Conduct a thorough pay equity audit

A pay equity audit identifies and addresses disparities in compensation to ensure compliance and equity.

- Audit pay data: Compare employee pay by gender within the same grades and job families to identify potential disparities.

- Analyze discrepancies: Use multiple regression analysis to evaluate differences using objective, gender-neutral criteria, documenting justifications where applicable.

- Remedy issues: Collaborate with employee representatives to address unjustified disparities and implement corrective actions.

- Repeat regularly: Schedule periodic audits to maintain compliance and equity over time. This process is simplified with pay equity analysis software like Trusaic’s PayParity®.

Step 6. Train and communicate

Training leaders and managers on pay transparency and organizational processes is crucial for fostering trust and ensuring compliance. Trusaic’s TrueTransparency™ solution supports this effort.

- Educate leaders: Host workshops to explain the Directive’s requirements and your organization’s job architecture and pay policies.

- Provide tools: Equip managers with the resources needed to communicate pay decisions effectively and answer employee questions.

- Foster transparency: Encourage open discussions about pay practices through regular updates and Q&A sessions with employees.

- Monitor understanding: Assess manager and employee knowledge periodically and refresh training as necessary.

gradar and Trusaic as market-leading tools for pay transparency

By implementing the above recommendations, organizations can build a transparent and equitable pay system that not only complies with the Directive but also fosters employee trust and engagement.

Structured processes, thorough audits, and effective communication are key – with gradar and Trusaic emerging as powerful software solutions to help achieve those targets and make your pay transparency journey smoother. Each platform addresses pay equity and compensation management with unique focuses and strengths.

gradar is a global job evaluation and grading platform that helps organisations align job roles with compensation structures. It uses a proprietary framework to assess job levels, ensuring pay transparency by standardizing compensation decisions. Trusaic’s pay equity analysis software helps global organizations identify and remediate pay inequities across gender, race, age, and more. Our innovative tool R.O.S.A. helps you remediate pay inequities with precision by running hundreds of simulations quickly to find the most impactful pay adjustments. This ensures your budget is spent where it matters most.

Together, we offer a powerful, end-to-end solution for organizations looking to drive pay transparency and support pay equity. gradar’s structured job evaluation system ensures that roles are assessed based on clear, objective criteria, establishing consistent and equitable pay structures. Trusaic then complements this by providing advanced analytics and tools to identify, analyze, and address pay inequities, ensuring compliance with the Directive’s transparency and equity requirements.

This combined approach allows businesses to not only evaluate and structure their compensation in line with legal mandates but also actively monitor and close any gender or demographic pay gaps. By integrating gradar’s job evaluation with Trusaic’s pay equity analytics, organizations can confidently navigate regulatory demands while fostering a fair, transparent, and compliant workplace.