Comprehensive Form 1095-C preparation and distribution

Trusaic manages the end-to-end process of preparing and distributing your 1095-C forms, ensuring compliance with IRS deadlines and requirements. We will print and mail your IRS and state forms, e-distribute them, or both — customized to your needs — on time and accurately.

Schedule Demo

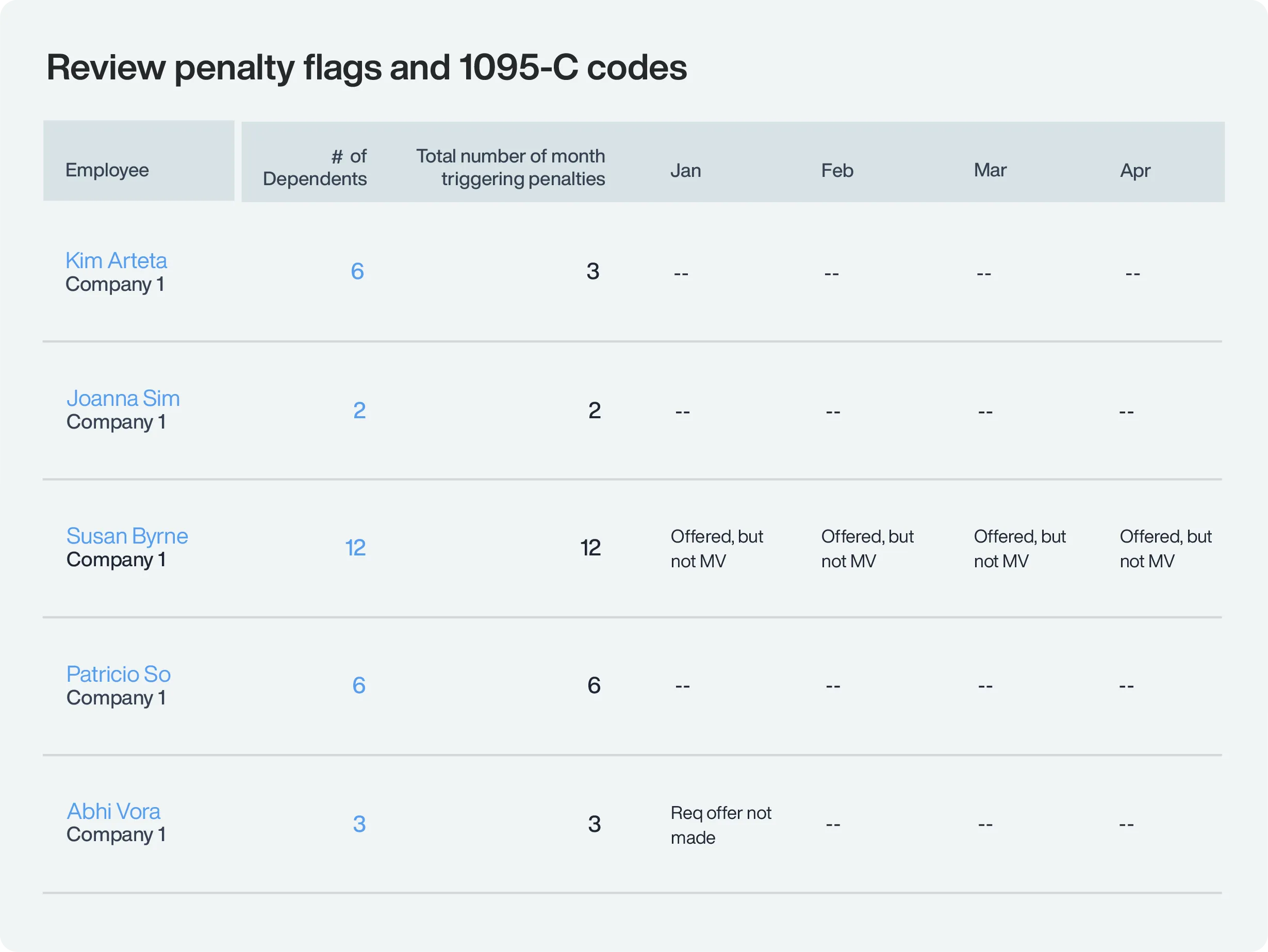

Advanced compliance assurance with penalty risk assessment

Beyond standard print and mail services, Trusaic offers an advanced penalty risk assessment to identify and rectify issues in your data files before distribution, mitigating the risk of IRS penalties.

- Data validation: thorough review of XML or CSV files to detect inaccuracies

- Risk mitigation: proactive correction of identified issues

Ensure regulatory compliance with robust audit support

Avoid penalties and stay ahead of ACA regulations with Trusaic’s comprehensive audit support.

- Document retention: securely store 1095-C and 1094-C forms for easy retrieval in the event of an IRS audit

- Compliance validation: cross-check federal and state requirements for consistent filings

- Penalty mitigation: expert support to help respond to IRS inquiries or discrepancies in ACA filings

Key Features

Timely distribution

Ensure 1095-C forms are distributed

to employees on time to meet deadlines

and avoid costly penalties.

Data quality assurance

Robust validation processes deliver

error-free forms ensuring precise

ACA compliance and reporting.

Penalty risk assessment

Identify and correct compliance

issues proactively to minimize risks

and potential IRS penalties.

Capabilities

FAQs

-

How does Trusaic identify errors in my XML or CSV files before printing and mailing my 1095-C forms?

Trusaic employs advanced technology and expertise to meticulously review your XML or CSV files for any inaccuracies or discrepancies. Our comprehensive penalty risk assessment process examines the data in your files to ensure compliance with IRS requirements. We utilize sophisticated algorithms and thorough validation checks to detect and rectify errors before proceeding with printing and mailing. By identifying and addressing potential issues upfront, we help minimize the risk of IRS penalties and ensure accurate reporting for your organization.

-

Which employers are responsible for furnishing and filing 1095-C forms?

All Applicable Large Employers (ALEs), which are employers with an average of 50 or more full-time employees, are required to offer full-time employees qualifying healthcare coverage. These employers are responsible for furnishing and filing 1095-C forms as well.

-

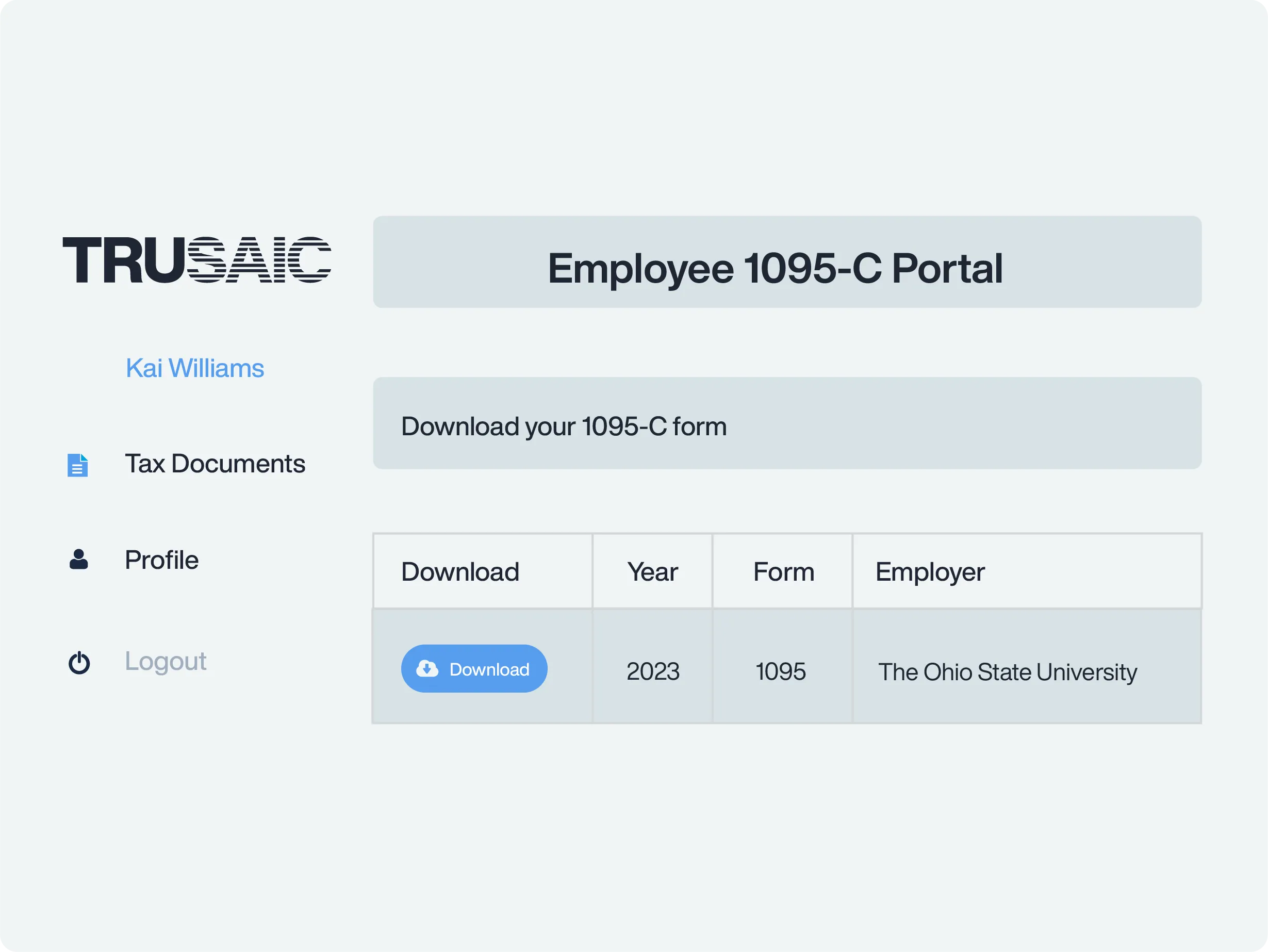

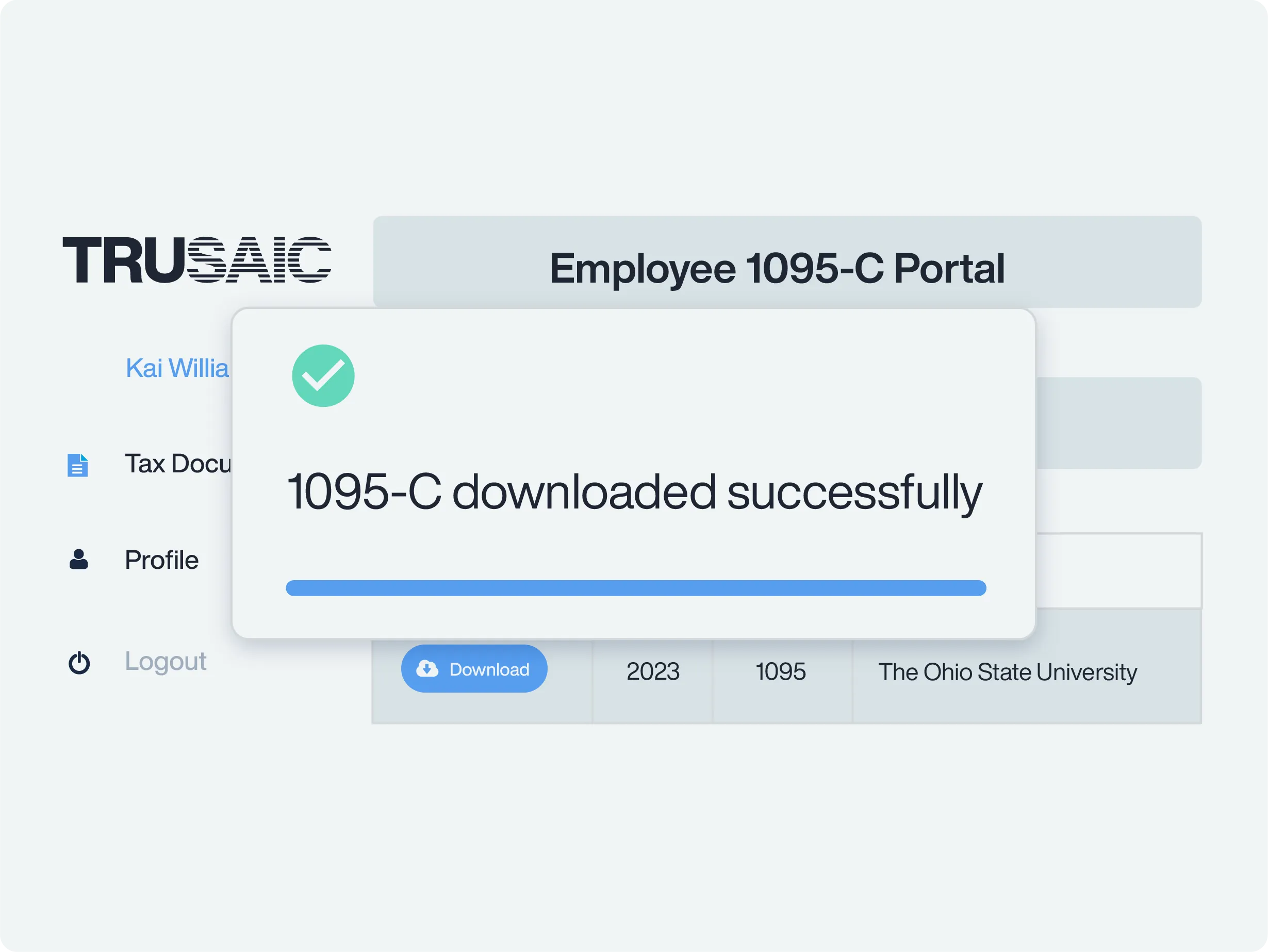

Do you offer 1095-C e-Distribution?

Yes, this software feature allows you to electronically furnish forms to employees who can then access them in our platform. This ensures all your forms are distributed on-time and can be easily tracked for compliance purposes.

-

When is the 1095-C print and mail deadline?

The print and mail paper filing deadline for employers is March 3, 2025 for the 2024 tax year. The IRS reduced the amount of paper filings that an organization can submit to 10, which significantly reduces the amount of employers eligible for paper filing.

-

How can I add the U.S. Mail Distribution service to my existing agreement with Trusaic?

To add the U.S. Mail Distribution service to your existing agreement, simply contact Trusaic and request the service. A separate amendment will be made to your agreement, detailing the terms of the service.

-

What does the U.S. Mail Distribution service entail?

The U.S. Mail Distribution service involves Trusaic mailing out Forms 1095-C to your applicable employees on your behalf. This add-on service is provided at an additional cost and is separate from the standard services outlined in your agreement with Trusaic.

-

Can I utilize Trusaic's U.S. Mail Distribution service without additional services?

If you provide Trusaic with the necessary 1095-C data, we can assist you with our U.S. Mail Distribution service as a standalone offering. Simply reach out to us to discuss your needs and get started with the service.