Effortless ACA compliance monitoring and reporting services

ACA Complete® is ACA software that delivers everything you need to track, prepare, furnish, and file 1095-C forms and defend your ACA compliance.

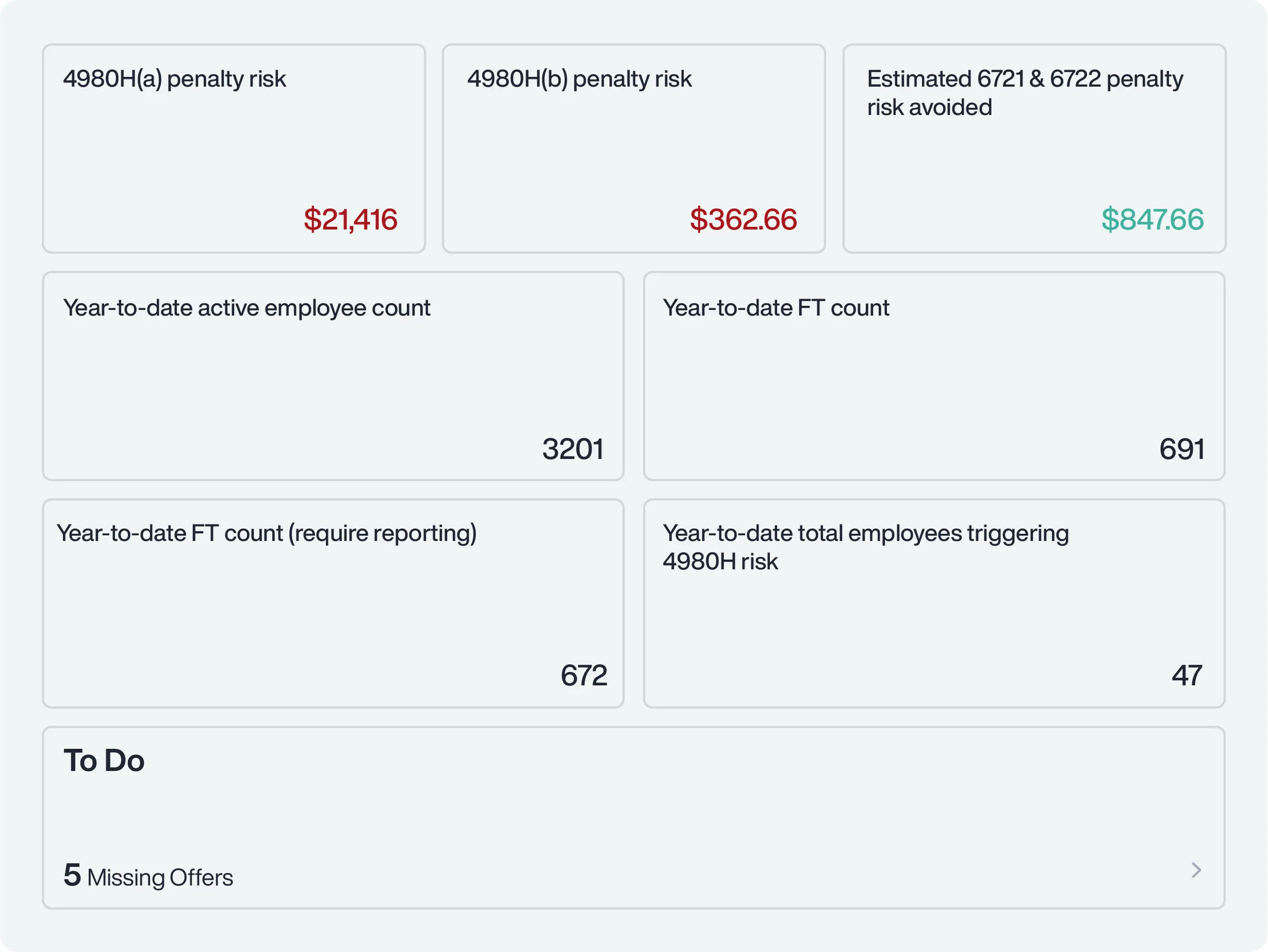

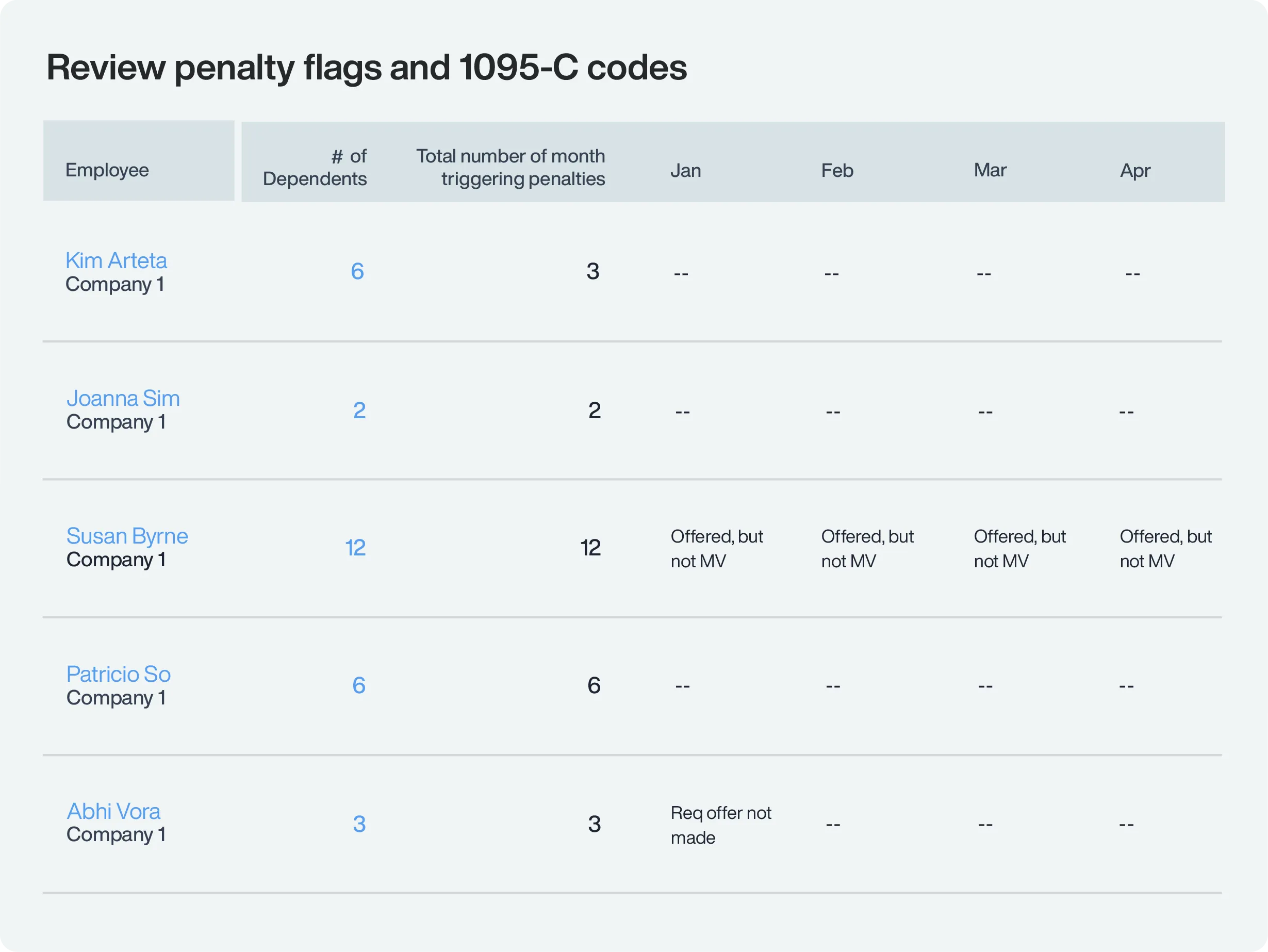

- Monthly monitoring: get alerts when offers of coverage are required

- Designated ACA specialist: expert support at your service

- Penalty risk assessment: identify coverage gaps and address liabilities

Seamless data transfer and quality automation

ACA Complete has certified integrations with leading HRIS platforms like Workday and UKG, ensuring fast, secure data transfers. Our ACA solutions solve the people and process failures that drive penalties. It consolidates, cleans, and transforms your data into accurate, actionable insights, so you can focus on compliance instead of errors.

Schedule Demo

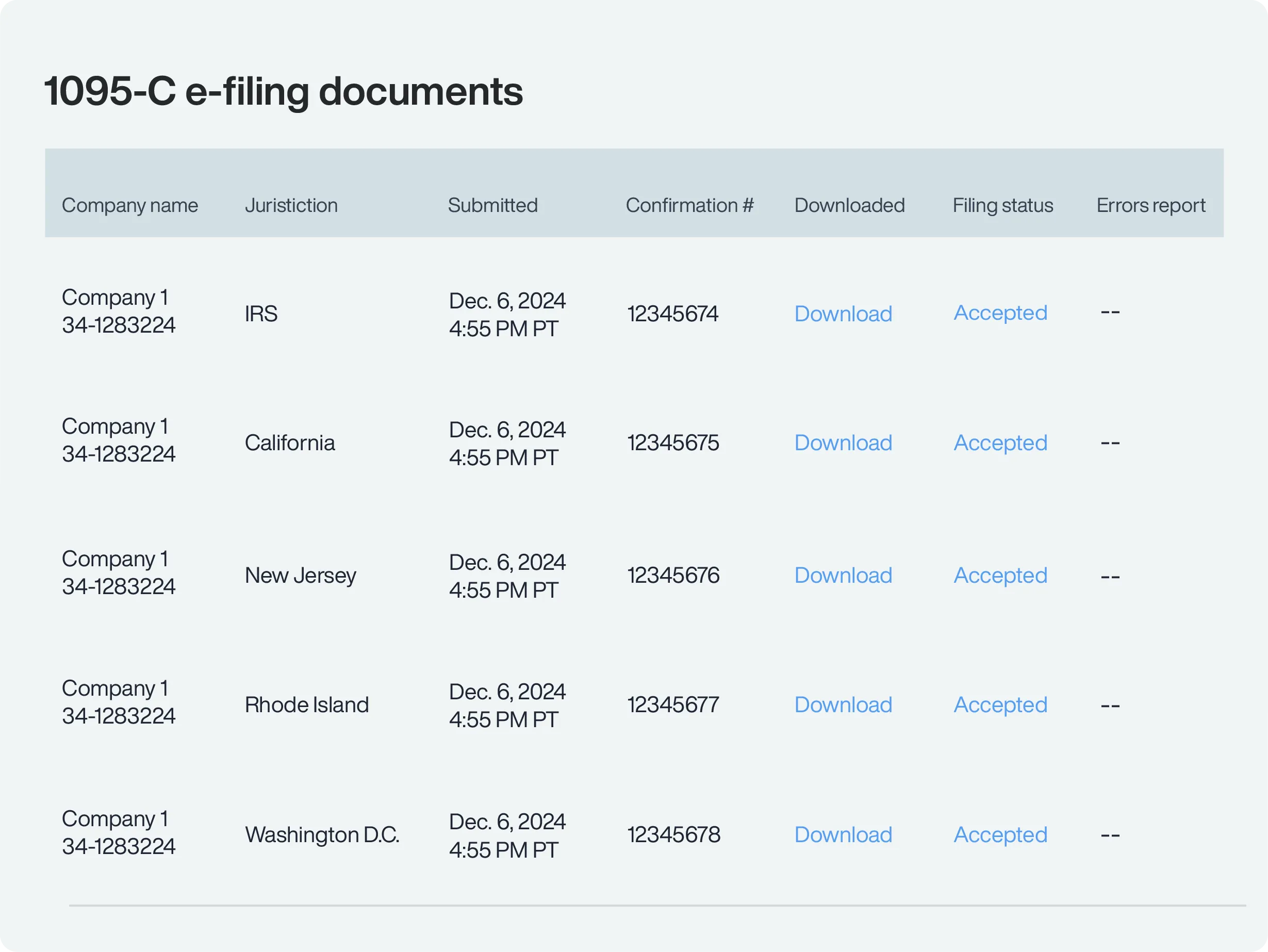

Satisfy federal and state ACA furnishing and filing requirements

Confidently meet strict furnishing and filing deadlines. ACA Complete ensures accurate, on-time filing and furnishing of 1095-C forms while supporting federal and state compliance.

- e-Distribution: furnish forms electronically

- State reporting: compliance for California, New Jersey, Rhode Island, and Washington D.C.

IRS audit defense and penalty mitigation

Reduce penalty risks and experience peace of mind. With ACA Complete, you’re backed by comprehensive audit defense and proactive compliance measures.

- Penalty reduction: prevented over $1 billion in penalties

- Audit assistance: respond to IRS letters (226J, 972CG, etc.)

- Proactive monitoring: prevent penalties before they happen

Key Features

Monthly compliance monitoring

Proactively stay compliant with

monthly tracking, penalty risk

assessments, and timely alerts.

ACA data quality assurance

Ensure accurate and timely Form

1095-C and Form 1094-C reporting

through error-free data processing.

IRS audit defense guarantee

Receive comprehensive and effective

defense for your business in the event

of an IRS or state audit.

State compliance reporting

Easily meet ACA filing and furnishing

requirements for California, New Jersey,

Rhode Island, and Washington D.C.

Certified HRIS integrations

Connect seamlessly with Workday,

UKG, SAP, ADP, and other HRIS

platforms for secure data transfer.

Employee 1095-C distribution

Furnish 1095-C forms via print and

mail or electronically from the platform

to ensure timely and secure delivery.

Capabilities

FAQs

-

How does ACA Complete® help maintain compliance?

Trusaic’s combination of data analytics, monthly tracking, and expert support ensures your ACA compliance is done right.

-

Can you help with IRS penalty letters?

Yes. We’ve helped clients reduce penalties for notices like 226J, CP220J, and more.

-

What's the difference between ACA Complete and ACA Essential®?

ACA Essential is our entry-level compliance solution, offering everything you need to file 1094-C/1095-C forms and meet federal reporting requirements. ACA Complete® goes further, providing ongoing monitoring, penalty risk assessments, and full audit defense — keeping you compliant every step of the way.

-

Does ACA Complete integrate with my HRIS?

Yes, it integrates with major platforms like Workday, SAP, and UKG.

-

What's the best way to know if I'm at risk for ACA penalties?

We offer a free penalty risk assessment, giving you an actionable analysis of your potential exposure, so you can act now and avoid costly penalties.

-

Do you offer 1095-C e-Distribution?

Yes. Clients can utilize our 1095-C furnishing option, or electronically distribute forms to employees who can then access them from our platform. This ensures all your forms are distributed on-time and can be easily tracked for compliance purposes.

-

I've already received a penalty notice. Can Trusaic still help me?

Yes, we can perform a retroactive audit of your HR data and create a penalty letter response for you while, in parallel, developing ongoing ACA tracking to prevent future penalty letters.

-

What is the benefit of the audit defense feature?

With ACA Complete, your IRS penalty risk is minimized. But if an audit happens, we’ll be there to provide full ACA audit defense. We’ve helped prevent over $1 billion in IRS penalties, ensuring your compliance remains strong, even under scrutiny.

-

What is an Applicable Large Employer (ALE)?

If an employer has at least 50 full-time employees, including full-time equivalent employees, on average during the prior year, the employer is an Applicable Large Employer (ALE) for the current calendar year, and is therefore subject to the Employer Shared Responsibility Provisions (also referred to as the ACA Employer Mandate) and the Employer Information Reporting Provisions, which requires ALEs to report annually to the IRS information about the health care coverage, if any, they offered to full-time employees. The IRS will use this information to administer ACA penalties for non-compliance.