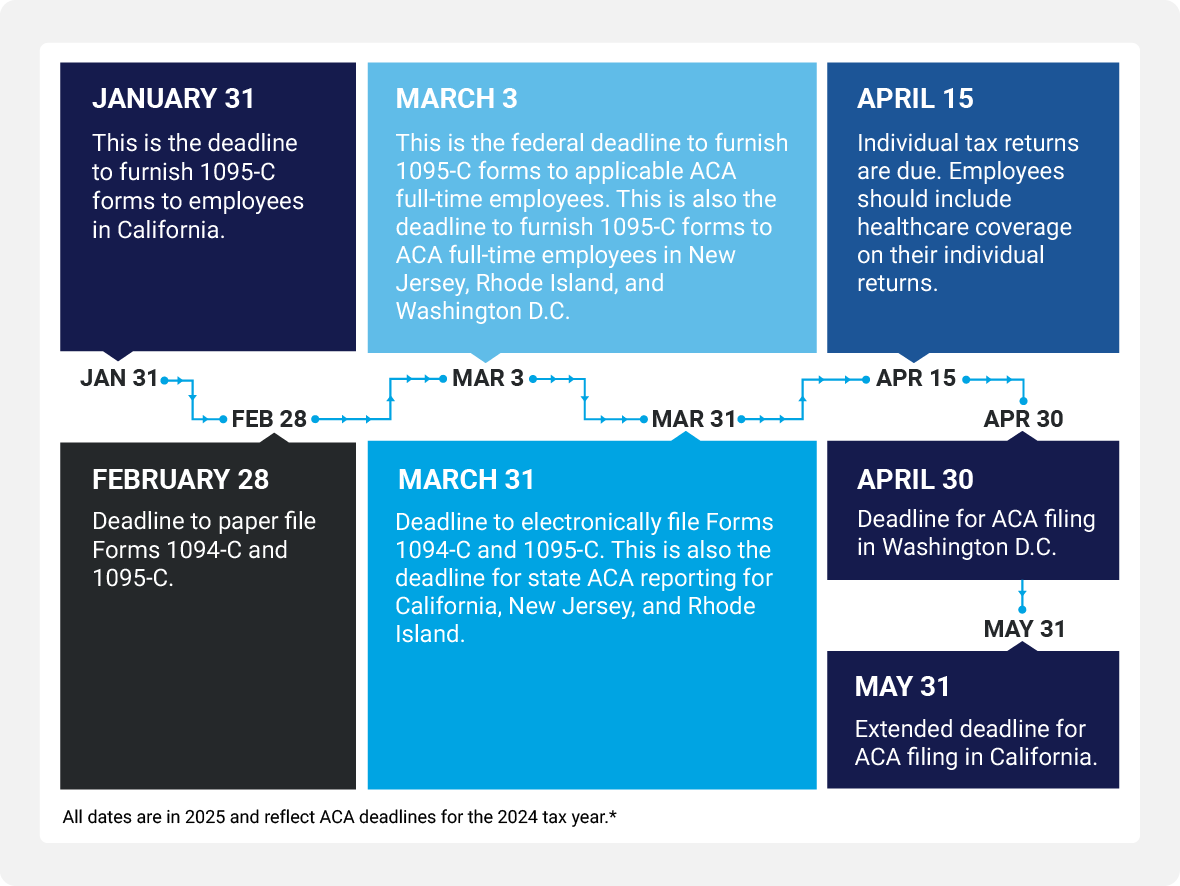

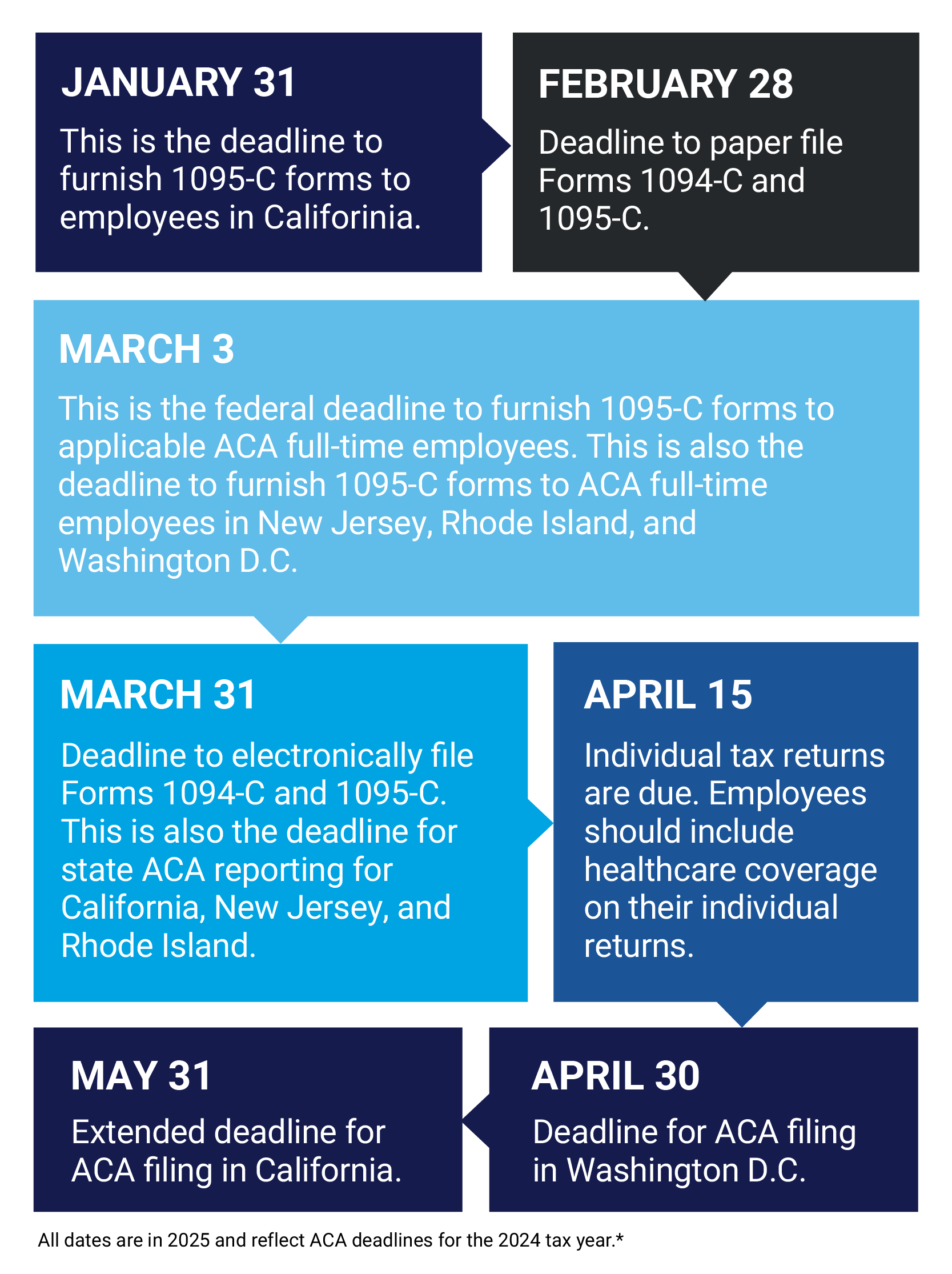

ACA filing dates for the 2024 tax year

Employer filing and furnishing penalties

Failure to File Penalty - IRC 6721: Failure to file correct information returns. If the return is not filed by the late filing Aug. 1 deadline, the full penalty is assessed per applicable individual returns not filed.

Failure to Furnish Penalty - IRC 6722: Failure to furnish correct payee statements. If the ACA-mandated health insurance information is not provided to applicable employees by the deadlines established by the IRS, the penalties are assessed per applicable individual not receiving this information.

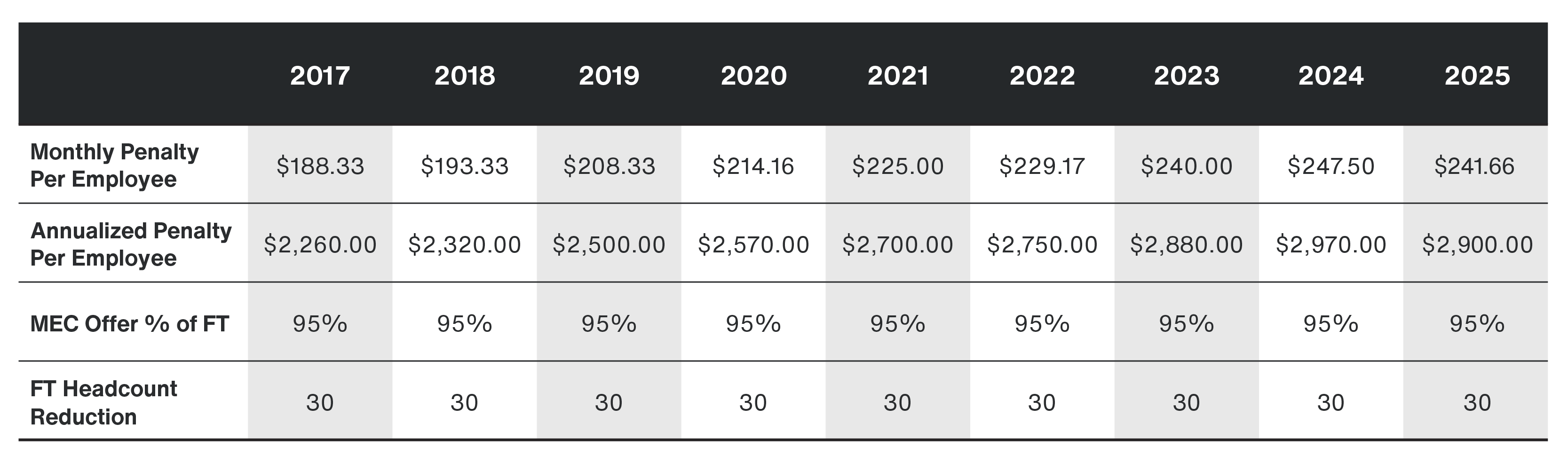

Employer Mandate penalties

The "A" Penalty - IRC 4980H(a)

Employer Shared Responsibility Payment for Failure to Offer Minimum Essential Coverage. On a monthly basis, applies to each month that the employer failed to offer a Minimum Essential Coverage to at least 95% of a company's full-time employees (and their dependents) AND at least one full-time employee received a Premium Tax Credit for purchasing coverage through the Marketplace for that month.

The "B" Penalty - IRC 4980H(b)

Employer Shared Responsibility Payment for Failure to Offer Coverage that Meets Affordability and Minimum Value (assessed if a 4980H(a) penalty is not triggered). On a monthly basis, applies to every full-time employee who did not receive an offer of coverage or received an offer, but the offer was either not affordable or did not provide Minimum Value or both, AND the employee received a Premium Tax Credit for purchasing coverage through the Marketplace for that month.

ACA penalty letter 226J process

Step 1

Receipt of Letter 226J

- Letter attaches Employee Premium Tax Credit (PTC) Listing (Form 14765), which

reflects names and months of the year employee(s) received subsidies from the marketplace/exchange - Letter includes an Employee Shared Responsibility Payment (ESRP) Summary Table, which identifies the number of penalties assessed on an employer

- Employer must respond within 30 days of receipt of the letter

Step 2

Form 14764 ESRP Response

- Form used to respond to Letter 226J

- Employer can contest the imposition of penalties for one or more employees

Step 3

Letter 227

- Acknowledges the IRS's receipt of an employer's response to the penalty notice

- Five different versions available

- Outlines next steps for the employer to follow

Step 4

Pre-assessment Conference with IRS

- The employer can request a conference with the IRS Office of Appeals if the employer disagrees with the contents of Letter 227

- Employer to review IRS Publication to file an appeal

- Appeal to be filed within 30 days of the receipt of Letter 227

Step 5

Notice CP 220J, Demand of Payment

- Notice requires employers to pay stated ACA penalty amounts and is issued after the appeals process, or if an employer fails to respond to Letter 226J or Letter 227

- Notice will instruct the employer on the amount to pay and how to pay it

Review your ACA data monthly

Best practice for ACA compliance to prevent IRS penalty assessments is to incorporate a monthly ACA Compliance process. Why? Because the IRS assesses penalties for ACA non-compliance based on monthly compliance information provided in your annual ACA information filing. The best way to avoid penalties is to address any compliance issues monthly.

Your monthly ACA process is formulated around these six areas:

Regulatory knowledge

A complete understanding of the mechanics of the ACA is required. If employers do not have staff members who have this deep level of understanding of the ACA, consider hiring third-party consultants who have intimate knowledge of ACA regulations, and understand how to interpret and take action in accordance with the requirements of the law. Mastery of ACA regulatory concepts, such as IRS Approved Measurement Methods, Affordability Safe Harbors, and Limited Non-Assessment Periods, can come in handy as you navigate monthly compliance, particularly if you want to minimize or eliminate penalties.

Documentation and record-keeping

Monthly ACA compliance relies heavily upon supporting documentation to be "audit ready" in the event you receive a penalty assessment from the IRS. Documentation should include items such as Summaries of Benefits and Coverage, rate contribution sheets, offers of coverage, medical invoices, enrollment forms, waiver forms, and acknowledgment of offers for the relevant reporting year.

Data quality management

This relates to the management of your HR workforce data. The raw inputs matter. Data fields, such as census information, time & attendance, employment type, wage and rate information, as well as contribution structure, must be accurately tracked in order to comply with the ACA.

For some employers who also use paper files, unstructured HR data is another factor to consider. In the end, the analytical data outputs are only as good as the quality of the raw data inputs that feed into the calculations required to meet ACA regulations to avoid IRS penalties. This is particularly true if you use do-it-yourself software packages that will automatically complete IRS forms without checking if the data is accurate. This is a significant trigger of ACA penalties issued by the IRS.

Organizations should consider the Triangle of Trustsm when handling their data quality management in regards to the ACA. The Triangle of Trustsm is the intersection of data, analytics, and regulatory expertise necessary to move raw data to successful regulatory compliance.

Workforce data

Successful application of the Triangle of Trustsm for ACA compliance starts with workforce data, such as HR data, time and attendance data, payroll data, and health benefits data. These data are frequently scattered across various siloed databases and platforms. Processes must be in place to ensure that this data is aggregated into a "Single Source of Truth'' to ensure data accuracy

Analytics

Once you've validated your data, it must be analyzed properly to perform key ACA calculations. Understanding how to interpret data so that it answers the requisite questions is critical to a successful ACA filing to the IRS. Organizations must have the right information and processes to correctly interpret data.

Regulatory expertise

Given the severity of the financial risk of regulatory non-compliance, you want people reviewing your data who have a deep knowledge of applicable regulations and how to correctly apply them to your data.

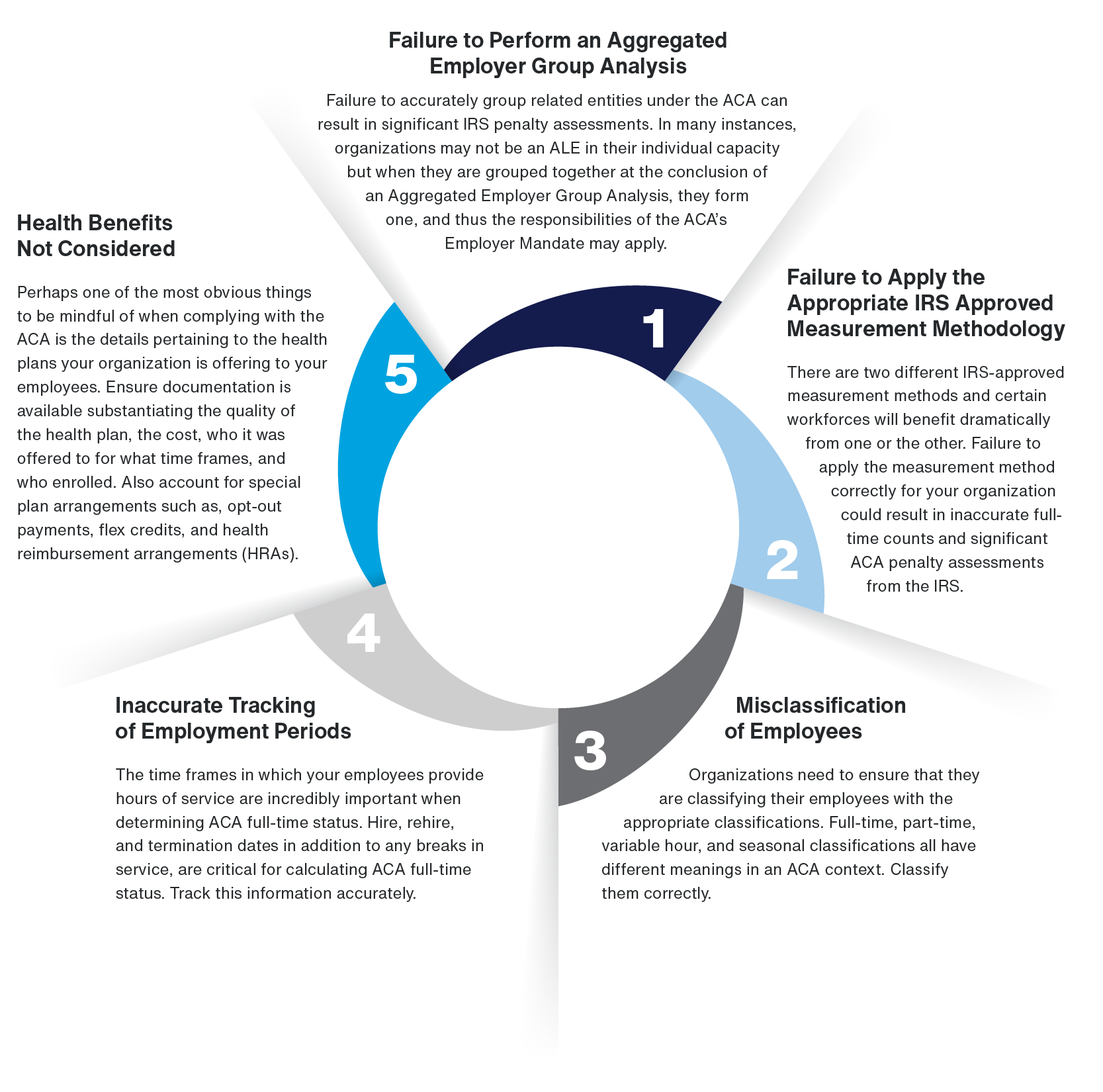

Avoid these 5 common ACA compliance mistakes