Introduction

Complying with the ACA’s Employer Mandate is one thing, coding the applicable health coverage information on the annual 1095-C and 1094-C forms is another. With the IRS now issuing penalties to employers that complied but failed to report accurately, the stakes are even higher for getting your annual ACA reporting right.

We created this detailed guide to:

- Provide you with a better understanding of what Forms 1095-C and 1094-C are

- Show you how to code Form 1095-C by providing several illustrative examples

First, we’ll dive into what these forms are and what their purpose is.

What are forms 1095-C and 1094-C?

Every year Applicable Large Employers are required to file information returns with the IRS to identify whether they offered health coverage to their full-time employees (and their dependents) and information about the type of coverage offered. Employers must provide this information to the IRS via Forms 1094-C and 1095-C. ALEs must also provide a copy of Form 1095-C to their full-time employees, including to any person employed full-time for one or more months of the reporting year.

Form 1094-C summarizes the ALE’s 1095-C information returns as well as details pertaining to the organization, such as EIN, address, point of contact, and certifications of eligibility regarding the health insurance offered for a particular year.

Specifically, Form 1094-C includes the following:

- ALE’s address, phone number, employer identification number

- Numbers of full-time and total employees

- Contact person

- How many 1095-C forms are being submitted

- Certifications of Eligibility

- Aggregated ALE Group Members

ACA Form 1095-C summarizes the information regarding healthcare offered to an ALE’s full-time employees and their dependents. The forms are provided to the IRS and copies are also provided to each full-time employee. Included on Form 1095-C is information regarding:

- Healthcare coverage offered to the employee

- Lowest-cost premium available to the employee

- Months of the year when the coverage was available

Employers that fail to submit ACA Forms 1094-C and 1095-C annually could be subject to penalties under IRC 6721/6722. These penalties are separate from those assessed by the IRS for failing to comply with the responsibilities of the ACA’s Employer Mandate.

Now that you have an understanding of what Form 1095-C and 1094-C are, it’s time to guide you through the process of coding form 1095-C.

Form 1095-C coding glossary

For your reference, we have provided all of the different codes that can be populated on the Form 1095-C for the 2025 tax year.

2025 Line 14 Codes:

1A: This code indicates that a Qualifying Offer was made and it complied with the responsibilities of the ACA’s Employer Mandate regarding Minimum Essential Coverage, Minimum Value, and affordability for a dependent to enroll. This code indicates a positive message to the IRS.

1B: A 1B code communicates to the IRS that the type of coverage offered met both Minimum Essential Coverage and Minimum Value, but was only offered to the employee and not their dependents. This code could expose employers to IRS penalties.

1C: The 1C code communicates that Minimum Essential Coverage and Minimum Value health coverage were offered to the employee and their children, but not the spouse.

1D: This code indicates that Minimum Essential Coverage and Minimum Value health coverage were offered to the employee and the spouse, but not to their children.

1E: A 1E code communicates that Minimum Essential Coverage and Minimum Value health coverage were offered to the employee, their dependents, and their spouse. It is important to note the difference between codes 1A and 1E, which is that code 1E may indicate an offer of coverage was not considered affordable, or was affordable under an applicable IRS safe harbor-excluding the federal poverty line (FPL) safe harbor.

1F: This type of code indicates to the IRS that the coverage offered only met Minimum Essential Coverage and not Minimum Value.

1G: The 1G code indicates that coverage was extended to an employee when they were not full-time under the ACA. That means under no circumstances should an individual have a 1G code on line 14 of the 1094-C for 12 months as only full-time employees are required to be reported on.

1H: This code could potentially be the most damaging for an employer as it communicates to the IRS that an offer of coverage was not made or that an offer of coverage was made but did not provide Minimum Essential Coverage.

1L: The 1L code communicates that an individual coverage health reimbursement arrangement (HRA) was offered to an employee and the affordability was determined using the employee’s primary residence ZIP code.

1M: Similar to the 1L code, the 1M code tells the IRS that an individual coverage HRA was offered to the employee and their dependent(s). The affordability is determined using the employee’s primary residency ZIP code.

1N:The 1N code tells the IRS that the employee and their spouse and dependent(s) were offered individual coverage HRA., with the affordability determined using the employee’s primary residence ZIP code.

1O:The 1O code is similar to the 1L code in that an individual coverage HRA was offered to the employee but the affordability for the 1O code is determined by using the employee’s primary employment location ZIP code.

1P: The 1P code tells the IRS that an individual coverage HRA was offered to the employee and their dependent(s), not their spouse. The affordability is determined using the employee’s primary employment location ZIP code.

1Q: A 1Q code communicates to the IRS that an individual coverage HRA was offered to the employee, their spouse, and dependent(s), with the affordability set using the employee’s primary employment location ZIP code.

1R: 1R codes are used to communicate that the Individual coverage HRA offered to the employee; employee and spouse or dependent(s); or employee, spouse, and dependents is NOT affordable. 1S: The 1S code should be used when an individual coverage HRA is offered to an individual that is not a full-time employee.

1T: The 1T code is for use when the applicable individual and their spouse receive an HRA offer of coverage from the employer, where affordability was determined using the employee’s primary residence zip code. It should be noted that this code excludes dependents as recipients of the HRA coverage extended.

1U: The 1U code should be used when an applicable individual and their spouse receive an HRA offer of coverage from the employer where the affordability was determined using the employee’s primary employment site zip code affordability safe harbor. This code excludes the individual’s dependents as recipients of HRA coverage.

2025 Line 15:

For line 15, enter the lowest cost for self-only Minimum Essential Coverage (MEC) that meets Minimum Value (MV). If you are offering individual coverage HRA to your employees, including the excess amount that the employee is responsible for paying after the reimbursement. The coverage used for determining the excess employee balance should be the lowest-cost silver plan.

2025 Line 16 Codes:

2A: This code is simple; it means that the employee was not employed. It typically is seen with an accompanying 1H on line 14.

2B: The 2B code means that the employee was not full-time.

2F: The 2F code indicates the W-2 safe harbor was used for determining affordability for the employee. Employers should note that if this safe harbor was used, it is the only safe harbor code used for this particular employee for this specific reporting year.

2C: This code means the employee enrolled in the coverage offered and regardless of whether the coverage offered complied with the ACA. An employer should use this code if there is a choice between 2C and another code and either could be used in good faith.

2D: If an employee is in a Limited Non-assessment Period or “LNAP” and their ACA status has not yet been determined, the 2D code can be used.

2E: The 2E code indicates multi-employer relief. This code is typically used if some portion of the workforce is unionized and has an established multi-employer plan.

2G: The 2G code indicates that the FPL safe harbor was used for proving that the coverage offered was affordable.

2H: The 2H code indicates that the Rate of Pay safe harbor was used for proving that the coverage offered was affordable.

2025 Line 17

Line 17 of the 1095-C relates to ICHRAs and how the affordability of reimbursement coverage was calculated. If you are relying on location, then the zip code needs to be populated on Line 17 so that the IRS can review location-specific costs associated with it.

How to code ACA form 1095-C

Below we’ve provided real-world scenarios across three unique organizations. Included in this guide are coded 1095-C forms, analyses on why certain codes were used, and whether the coded forms pose any ACA risk to the organization. For your reference, we’ve also included a glossary of all the applicable 1095-C codes available for the 2024 tax year as well as an affordability chart to help you determine affordable rates for your employees.

Johnny’s Pizza Parlor

Employer overview

Johnny’s Pizza Parlor is a quick-service restaurant that employs a predominantly variable-hour workforce. The examples below depict employees working at Johnny’s Pizza Parlor and the types of coverage they received for the 2021 tax year.

Form analysis

Form analysis

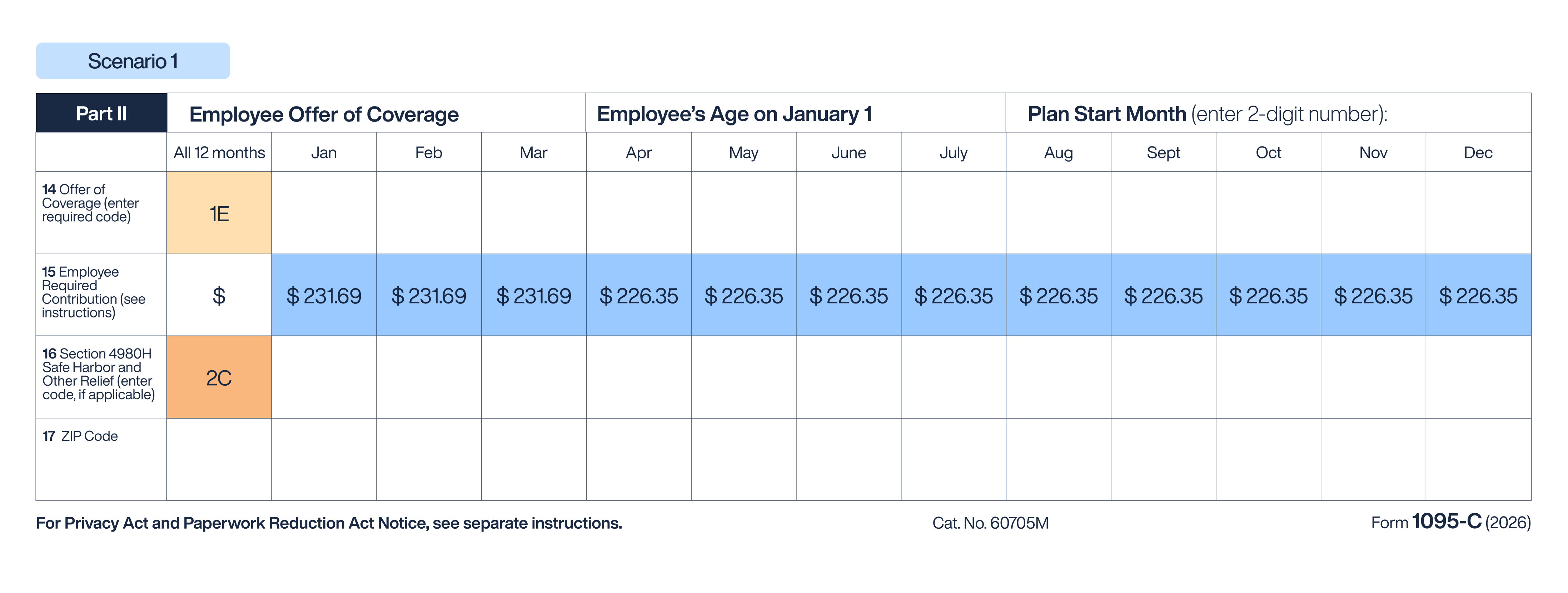

For this first scenario, we examine an employee who worked at Johnny’s Pizza Parlor for the entire reporting year. And for all 12 months of 2025, this employee receives an offer of coverage from Johnny’s Pizza Parlor that meets Minimum Essential Coverage (MEC) and Minimum Value (MV). The coverage was also extended to the employee’s spouse and dependents.

A “1E” code does not necessarily satisfy affordability, as this type of coverage can sometimes be unaffordable. Line 15 indicates the lowest cost for self-only coverage. If the cost is affordable under a safe harbor, such as the W-2 (“2F” code) or Rate of Pay Safe Harbor (“2H” code), a safe harbor for affordability code can be used in Line 16. In this particular situation, however, the employee has opted to enroll in the offered coverage (“2C” code). Because of this, the coding for affordability of the coverage is superseded by the coding for the employee’s enrollment (“2C” code”).

ACA penalty risk

Employers should note that an employee whose ACA participation looks like the example above poses zero ACA penalty risk. The reason for this is that the employee opted to enroll in the coverage, and therefore cannot obtain a Premium Tax Credit (PTC) from a state or federal health exchange.

Form analysis

Form analysis

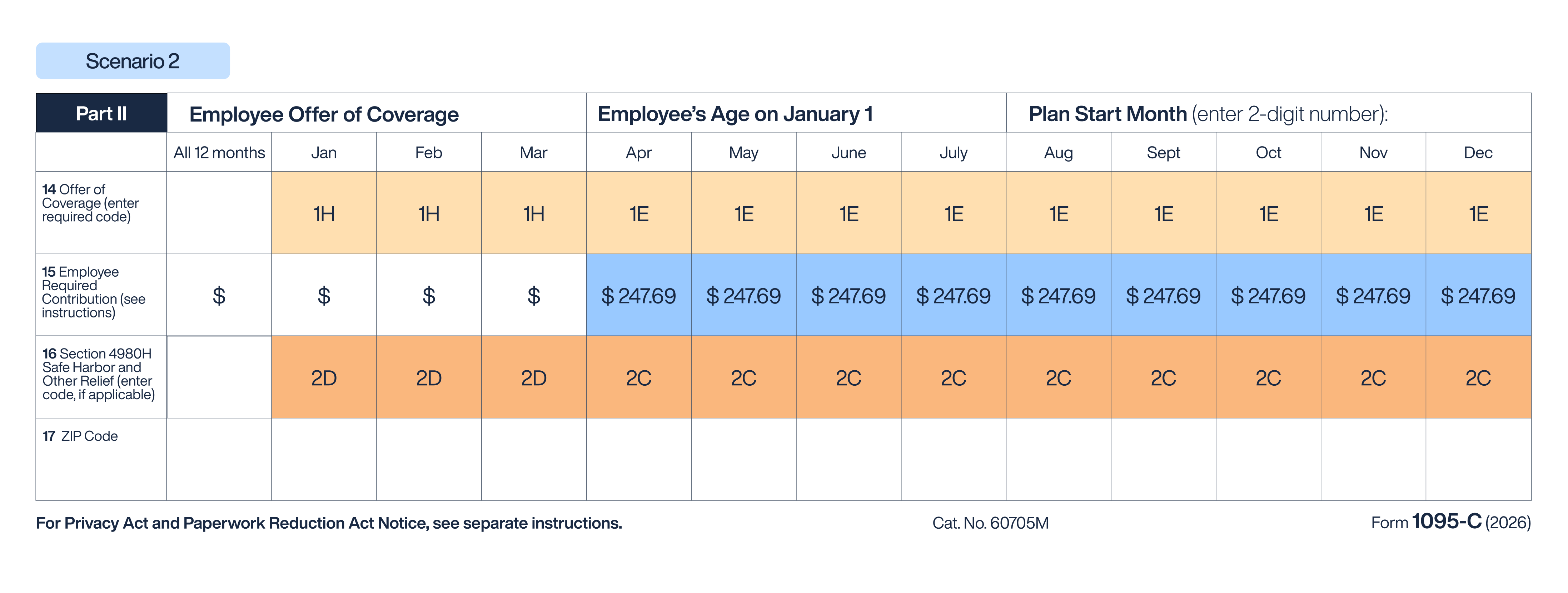

This scenario involves an employee who receives a delayed offer of coverage, and it is due to one of the IRS’ approved methods for not extending an offer. For the months of January through March, the employee was not offered coverage (1H) and the reason Johnny’s Pizza Parlor justifies for not offering coverage is due to a Limited Non-Assessment Period, (the “2D” code on line 16). Limited Non-Assessment Periods (LNAP) are time-frames in which an Applicable Large Employer cannot be subject to IRC 4980H penalty assessments for any employee under an LNAP.

ACA penalty risk

Since Johnny’s Pizza Parlor is an employer that predominantly employs a variable-hour workforce, they administer the Look-Back Back Measurement Method. The employee in this example was likely in their measurement period for the first 90 days of the year, which is why the LNAP, “2D” code was used in combination with a missing offer of coverage on Line 14. 90 days later, however, the employee received a MEC and MV offer of coverage and enrolled for the remainder of the year.

The employee finished their measurement period and was deemed ACA full-time and therefore was eligible to enroll in the employer-sponsored health coverage. This employee poses zero ACA penalty risk since they were in an LNAP or enrolled in the coverage throughout the reporting year.

Look-Back measurement method

The look-back measurement method generally involves using an employee’s average hours of service per week during a period to determine if an employee is a full-time employee during a subsequent period.

Form analysis

Form analysis

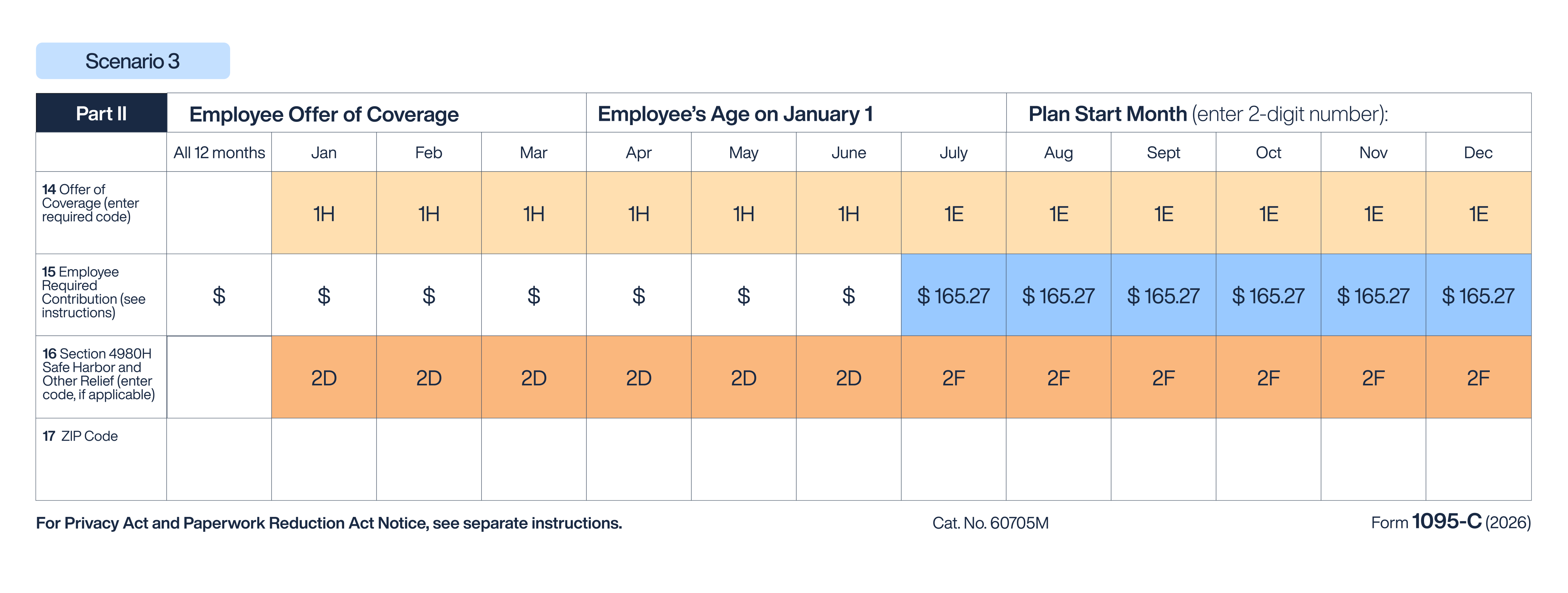

Our third and final scenario from Johnny’s Pizza Parlor involves an employee who received an offer of coverage that they chose not to enroll in. This particular employee was in a measurement period for January through June. The reason Johnny’s Pizza Parlor didn’t provide an offer of coverage is that the employee was in an LNAP (“1H” code on Line 14 and 2D” in Line 16). Given the length of the LNAP, it appears the employee was in either a standard or initial measurement period.

ACA penalty risk

Following the measurement period, it appears the employee was determined to be ACA full-time. An offer of coverage was extended starting in July that met MEC, MV, and was extended to the employee’s spouse and dependents. Johnny’s Pizza Parlor confirmed that the coverage extended was also affordable via the W-2 Safe Harbor and code “2F” on Line16.

This employee poses no ACA penalty risk. However, this employee could in fact go to a state or federal health exchange and erroneously obtain a PTC. If they do, Johnny’s Pizza Parlor will have to prove to the health exchange, with supporting documentation, that the employee was not entitled to the PTC since they received an offer of affordable coverage from them.

Ralph’s Construction

Employer overview

Ralphs Construction employs a mix of salaried and variable hour employees. They do not, however, administer the Look-Back Measurement Method, and as a result, might miss employees who are ACA full-time.

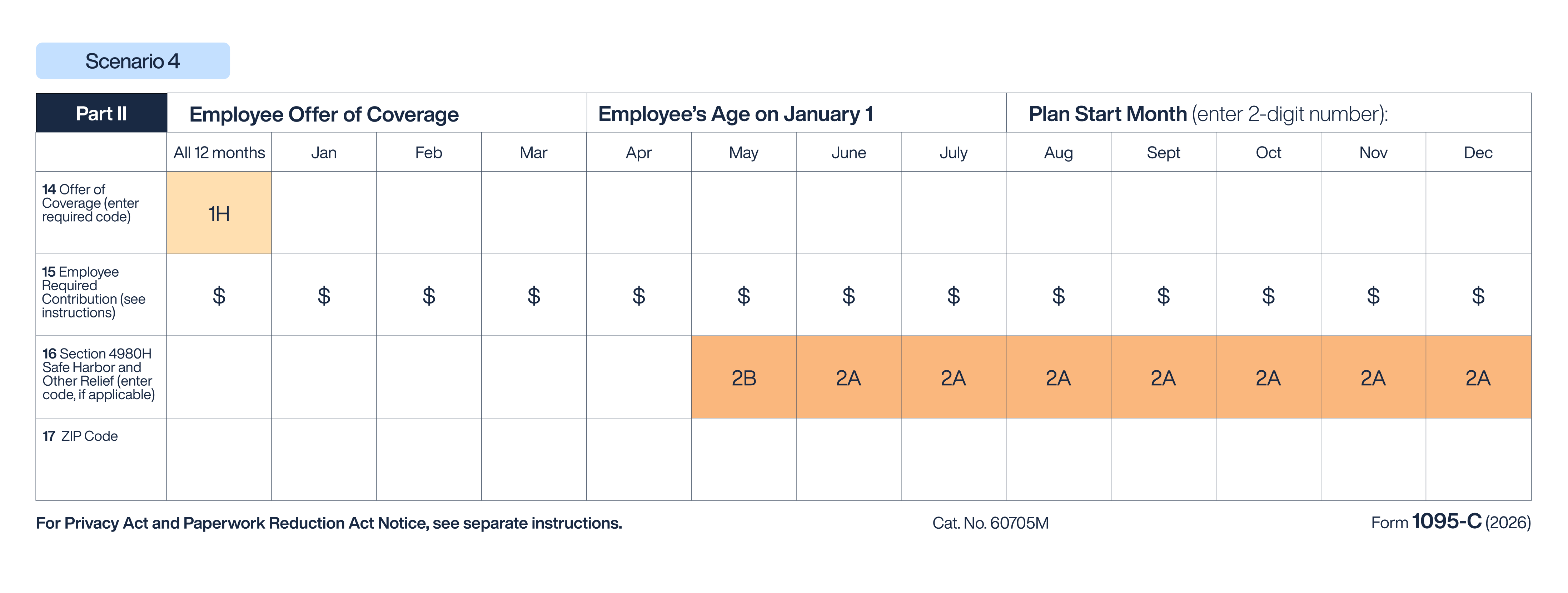

Form analysis

Form analysis

For this first scenario, we review an employee that worked at Ralphs for only a portion of the year. The form indicates that this particular employee did not receive an offer of coverage for the entire tax year. The “2B” code in May indicates that the employee was not full-time, and therefore not eligible for an offer of ACA coverage. The “2A” code for June through December simply indicates that the employee was no longer employed at Ralphs. Since they were not employed as a full-time employee, the ACA Employer Mandate does not obligate Ralphs to extend an offer of coverage. ACA penalty risk Because there are no codes on Line 16 for January through April, Ralphs Construction could be exposed to penalty risk for this time frame. For the remainder of the year, however, Ralphs Construction does not have a penalty risk for this employee because the employee was not full-time and subsequently not employed from June through December.

Form analysis

Form analysis

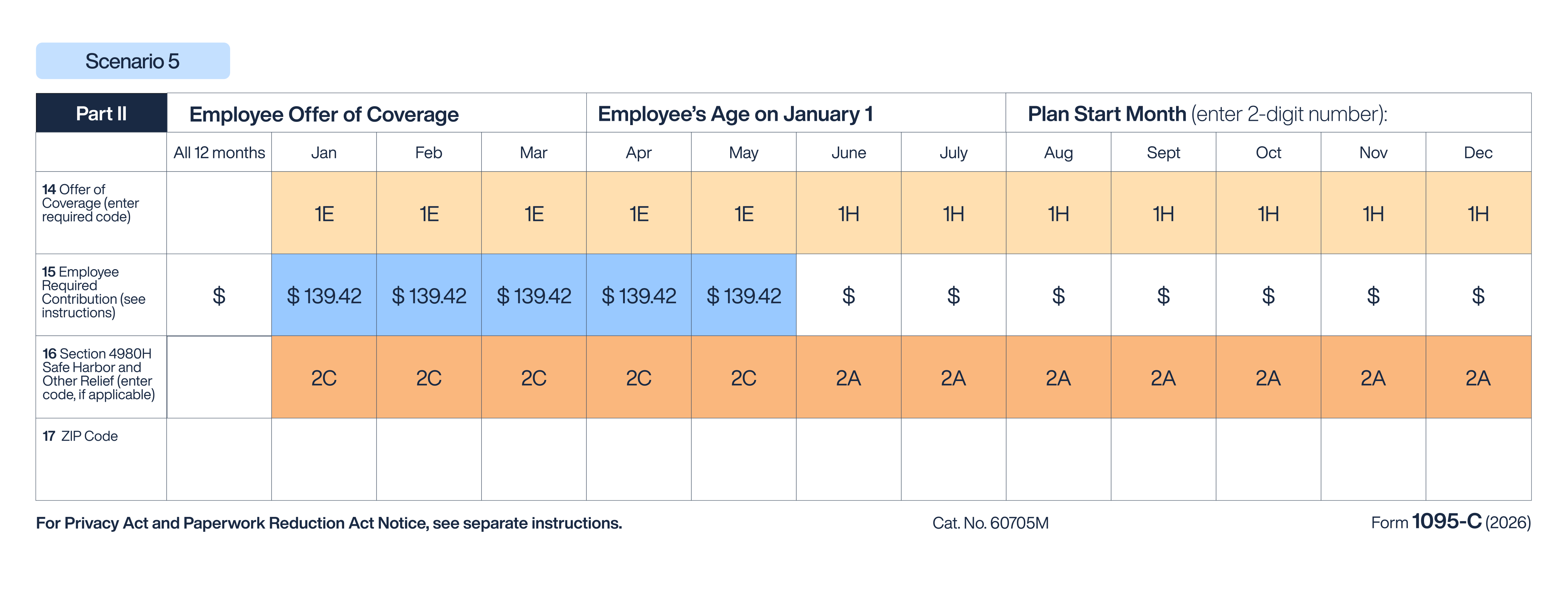

In this scenario, the employee was working at Ralph’s Construction for the entire year. For January through May of 2025, the employee received an offer of coverage from Ralphs Construction that met MEC and MV. The employee’s spouse and dependents were also allowed to enroll in the coverage. The minimum monthly contribution for self-only coverage was $139.42 a month — whether that coverage met the ACA affordability threshold is moot as the employee elected to enroll into the coverage regardless of affordability.

ACA penalty risk

Following the remainder of the 1095-C form, the coding indicates that the employee terminated from Ralphs Construction in June, and the coverage was no longer offered after that. A “1H” code indicates that no offer of coverage was made and a “2A” on Line 16 confirms that the employee was not employed. This employee poses no ACA penalty risk.

MEC and MV

Under the Affordable Care Act’s Employer Shared Responsibility Provisions, certain employers (called applicable large employers or ALEs) must either offer Minimum Essential Coverage (MEC) that is “affordable” and that provides “Minimum Value” (MV) to their full-time employees (and their dependents), or potentially be subject to an employer shared responsibility payment to the IRS. An employer-sponsored plan provides Minimum Value if it covers at least 60 percent of the total allowed cost of benefits that are expected to be incurred under the plan.

Form analysis

Form analysis

The final Ralphs Construction scenario involves a full-time employee who worked for the entire 12 months. The 1095-C form indicates that the employee was in an LNAP in January and an offer of coverage was made in February. The “1E” code again indicates the coverage met MEC, MV, and was offered to the employee’s dependents and spouse. The Rate of Pay Safe Harbor was claimed for establishing 4980H(b) affordability (“2H” code) for February. The employee enrolled in coverage in March and for the remainder of the year (“2C” code).

ACA penalty risk

Following the month where coverage was first offered, the employee opted to enroll in the coverage for the remainder of the year. This employee should not pose any ACA penalty risk. However, as noted before, for the month of January or February, the employee could have erroneously received a PTC from a state or federal health exchange and it would be up to Ralphs Construction to prove that the employee was in an LNAP in January and an ACA-qualified and affordable offer was received in February.

As part of Trusaic’s ACA Complete solution, documentation retention and record keeping are included. In the event of an IRS inquiry or penalty assessment, we can defend against situations like this.

ART Corporation

Employer overview

ART Corporation is a staffing organization that places workers for marketing and creative job roles. ART corporation has a unique relationship with the workers it places and as such, offers Individual Coverage Health Reimbursement Arrangements (ICHRAs) to its workforce. The company employs predominately full-time employees and administers the Monthly Measurement Method accordingly.

Line 14: 1N for all 12 months Line 15: $180.72 for all 12 months Line 16: 2C for all 12 months Line 17: zip code for all 12 months – 90010

Line 14: 1N for all 12 months Line 15: $180.72 for all 12 months Line 16: 2C for all 12 months Line 17: zip code for all 12 months – 90010

Form analysis

ART Corporation’s first scenario relates to an employee who was working at the company for the entire year. This particular employee received an ICHRA from ART Corporation. The offer was also extended to the employee’s spouse and dependents. The “2C” code indicates that the employee enrolled in the offer and thus poses no penalty risk for ART Corporation. Line 17 is where the employee’s primary residence zip code is entered.

ACA penalty risk

For determining ICHRA amount and affordability, the employee’s primary residence should be used. In this case, 90010 is the zip code used and reflects Los Angeles, California. Line 15 reflects the amount that the employee had to pay every month after receiving the reimbursement. Since the employee opted to enroll in the offered ICHRA, they do not pose any ACA penalty risk.

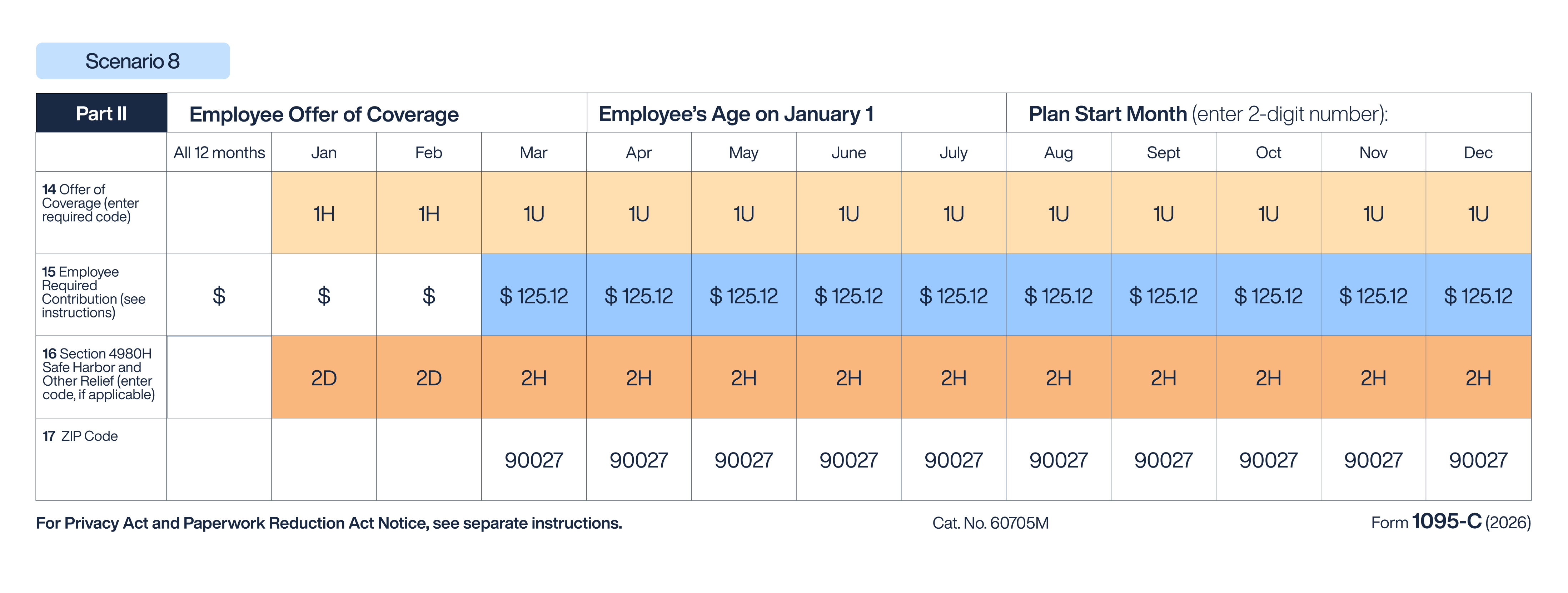

Line 14: 1H for January and February. 1U for all 10 months beginning March Line 15: $125.12 for all 10 months March Line 16: 2D for January and February. Beginning March use code 2H Line 17: Zipcode for all 10 months beginning March – 90027

Line 14: 1H for January and February. 1U for all 10 months beginning March Line 15: $125.12 for all 10 months March Line 16: 2D for January and February. Beginning March use code 2H Line 17: Zipcode for all 10 months beginning March – 90027

Form analysis

For this scenario, we see the employee and their spouse received an ICHRA from ART Corporation. For determining the affordability component, the employee’s primary work location was used in combination with the Rate of Pay Safe Harbor. For the first two months of the year, the employee was in a “waiting period” and didn’t receive an offer of coverage, hence the “1H” code on Line 14 and the 2D on Line 16 for January and February. For the remainder of the year, the employee and spouse (but not dependents) receive an HRA offer of coverage where the affordability was determined using the employee’s primary employment site zip code affordability safe harbor.

ACA penalty risk

ART Corporation does have ACA penalty risk associated with this scenario because:

“An ALE is not considered to have made an offer of coverage to a full-time employee’s dependents unless it provides the employee an effective opportunity to enroll the dependents in the coverage (or to decline that coverage) at least once for each plan year.”

If coverage was offered to dependents, ART Corporation would not have ACA penalty risk Associated with this scenario. The Limited Non-Assessment Period was claimed for the first two months of the year and affordable coverage offer thereafter. As a reminder, employers must extend an offer of coverage to an ACA full-time employee within the first 90 days of employment if administering the Monthly Measurement Method. This 90-day time frame is referred to as the “waiting period.” The ICHRA was offered first after 60 days of employment and reflects the ICHRA code of “1U” beginning in March.

Even if coverage was offered to dependents, since the employee did not enroll in coverage, there is a risk they could go to a health exchange to receive a PTC. This would subsequently trigger an ACA penalty via Letter 226J. The burden of proof would then fall on Art Corporation to prove that the employee received the PTC erroneously and that Art Corporation should not be assessed an ACA penalty.

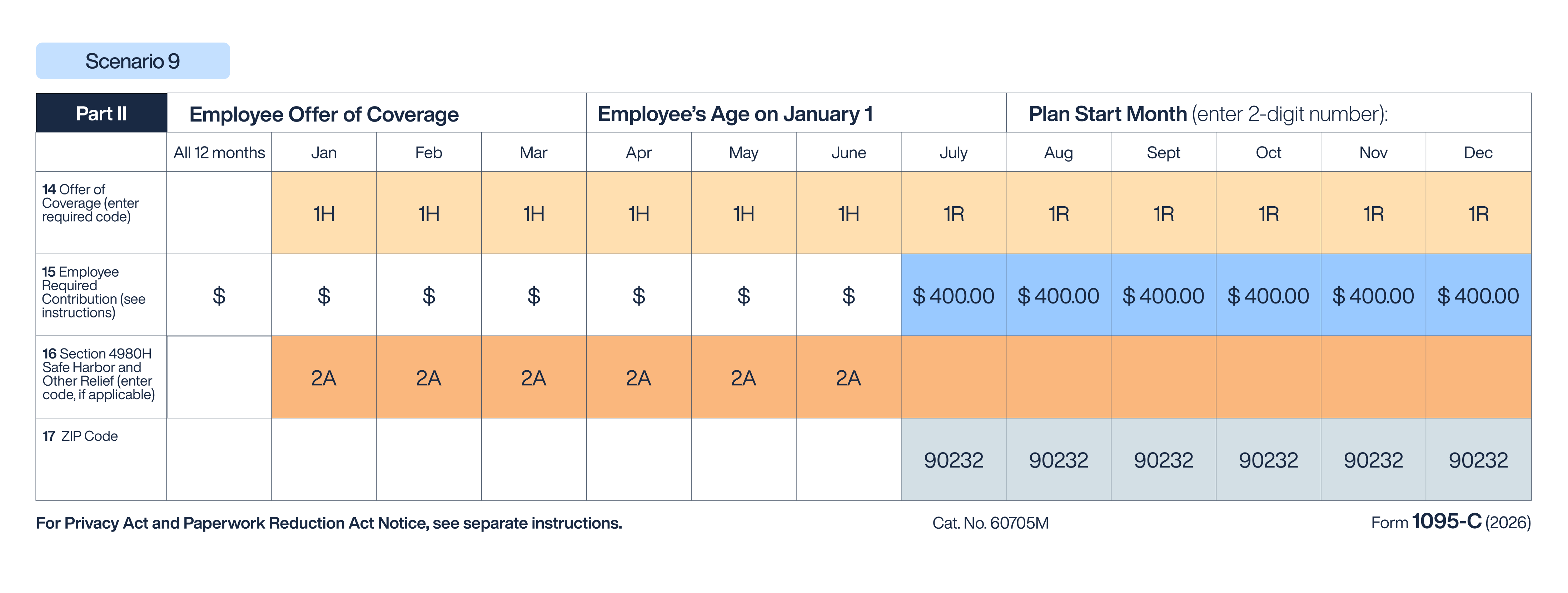

Line 14: 1H January – June. 1R July – Dec Line 15: no code Jan – Jun. $400.00 July – Dec Line 16: 2A January – June. No code remainder of the year Line 17: 90232 zip code July – Dec.

Line 14: 1H January – June. 1R July – Dec Line 15: no code Jan – Jun. $400.00 July – Dec Line 16: 2A January – June. No code remainder of the year Line 17: 90232 zip code July – Dec.

Form analysis

The final scenario involves an employee who poses ACA penalty risk due to the ICHRA offered not being affordable. For the first six months of the year, the employee was not employed at the company and therefore did not receive an offer of coverage. Once they received an offer of coverage in July, however, the ICHRA was not affordable for the employee, hence the “1R” code.

ACA penalty risk

For July through December, if the employee went to a state or federal health exchange and received a PTC, ART Corporation could receive an ACA penalty under IRC 4980(H).

ACA reporting is complex — let us help

Coding the 1095-C forms correctly can be a daunting task, especially if you have a large workforce and/or made up of multiple entities. The IRS is increasing its enforcement efforts and is assessing penalties on employers that comply with the ACA but fail to correctly code the annual ACA reporting forms. If you need assistance with ACA compliance and ACA reporting, contact us to learn how we can help your organization keep up with the complex requirements.

ACA affordability chart