Introduction

As pay transparency laws continue to surface in the U.S., it’s crucial for employers to stay compliant. The task of ensuring compliance with these regulations can be complex and time-consuming. In this guide, we will show you how software can simplify the process by providing tools to determine unbiased salary ranges, report pay data to agencies, and reduce the risk of enforcement. Read the guide below to gain a better understanding of the increasing pay transparency requirements and learn how to stay compliant in today’s legal landscape with the use of specialized pay equity software.

Step 1: Assess where you are

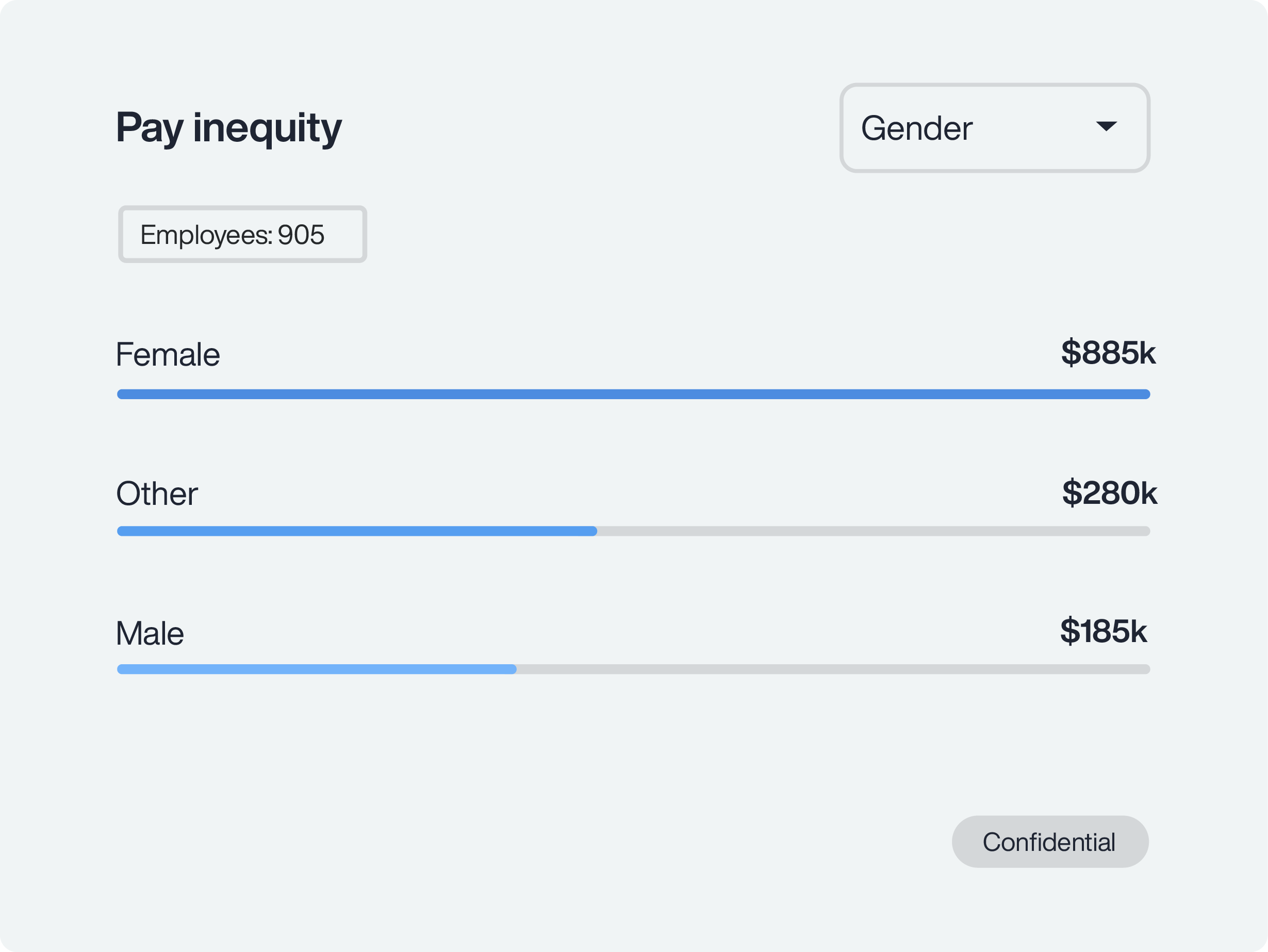

The first step in complying with pay equity regulations like; and New York City’s pay transparency law, is to assess your current pay equity situation. This includes identifying any pay disparities that may exist within your organization, which requires conducting a pay equity audit.

One way to do this is by using software like PayParity®. PayParity conducts a pay equity audit across your workforce at the intersection of gender, race/ethnicity, age, disability, and more in a single statistical regression analysis. The results of the audit will help you understand where your risk areas are and point you in the right direction for where you need to focus on any necessary remediation.

Step 2: Implement a plan to address pay disparities

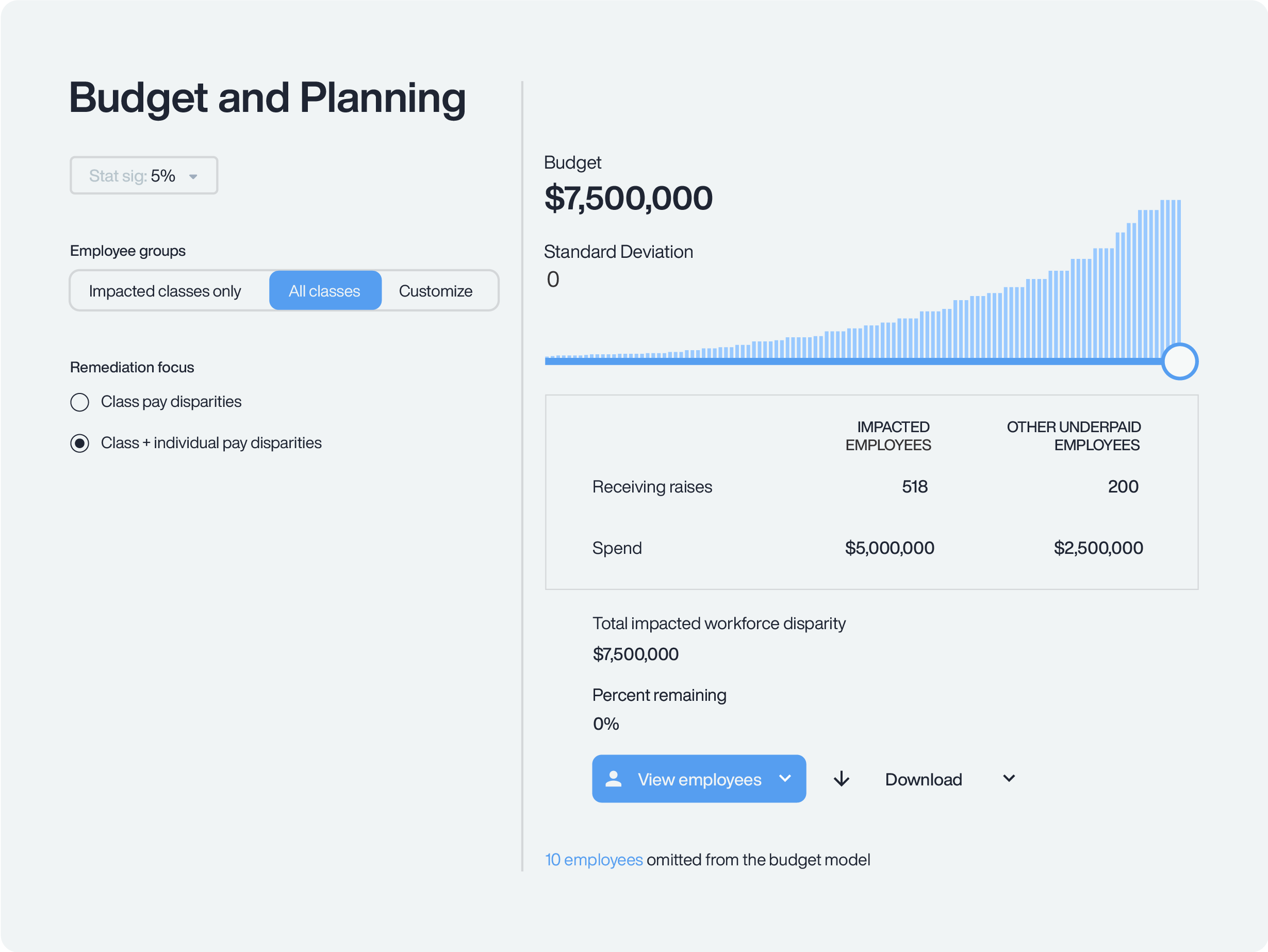

Once you have identified any pay disparities within your organization, the next step is to develop a plan to address them. A solution like PayParity can help you develop a custom budget and remediation strategy to address pay disparities over time. As opposed to correcting everything all at once, which can be costly, PayParity allows you to make progress toward your pay equity goals on a timetable that suits your business needs.

In addition to custom remediation planning, PayParity can help you develop important communications for stakeholders, such as investors, employees, and the public at large. These strategic talking points will help ensure that your organization is confidently discussing pay equity, and will help reinforce your pay equity law obligations.

Step 3: Identify systemic root causes

Pay disparities occur for a reason, and PayParity offers a solution for identifying and correcting the root causes. Utilizing advanced analytics and algorithms, PayParity helps employers pinpoint specific factors that may be creating disparities in pay, such as biases or systemic processes. By addressing the root causes, employers can take proactive steps to prevent future instances of pay inequity.

With the insights provided by PayParity, businesses can confidently report accurate, risk-free pay data to states that require it and post equitable salary ranges in jobs as required by pay transparency laws. Addressing the root causes driving pay inequity is critical for managing unbiased compensation going forward but the process can be difficult.

Step 4: Conduct sentiment surveys

You cannot have pay equity if your employees do not agree that you have pay equity. This misalignment is often referred to as the pay equity perception gap. It’s a notion that describes the disconnect between pay equity audit data and employee feelings. If pay equity audit data reveals your organization has no pay equity issues, but your employees disagree, or vice versa, you have a perception gap. To ensure that your employees feel that pay equity exists within your organization, it is important to conduct a sentiment survey.

A solution like PayParity can help you identify employee sentiment and gather feedback on pay equity in your organization. Collecting this valuable feedback will help drive your pay transparency efforts as well. This is particularly important if your organization is issuing Environment, Social, and Governance (ESG) reports and other correspondence relating to pay equity. Interested in learning more about the pay equity perception gap?

Step 5: Choose unbiased pay ranges

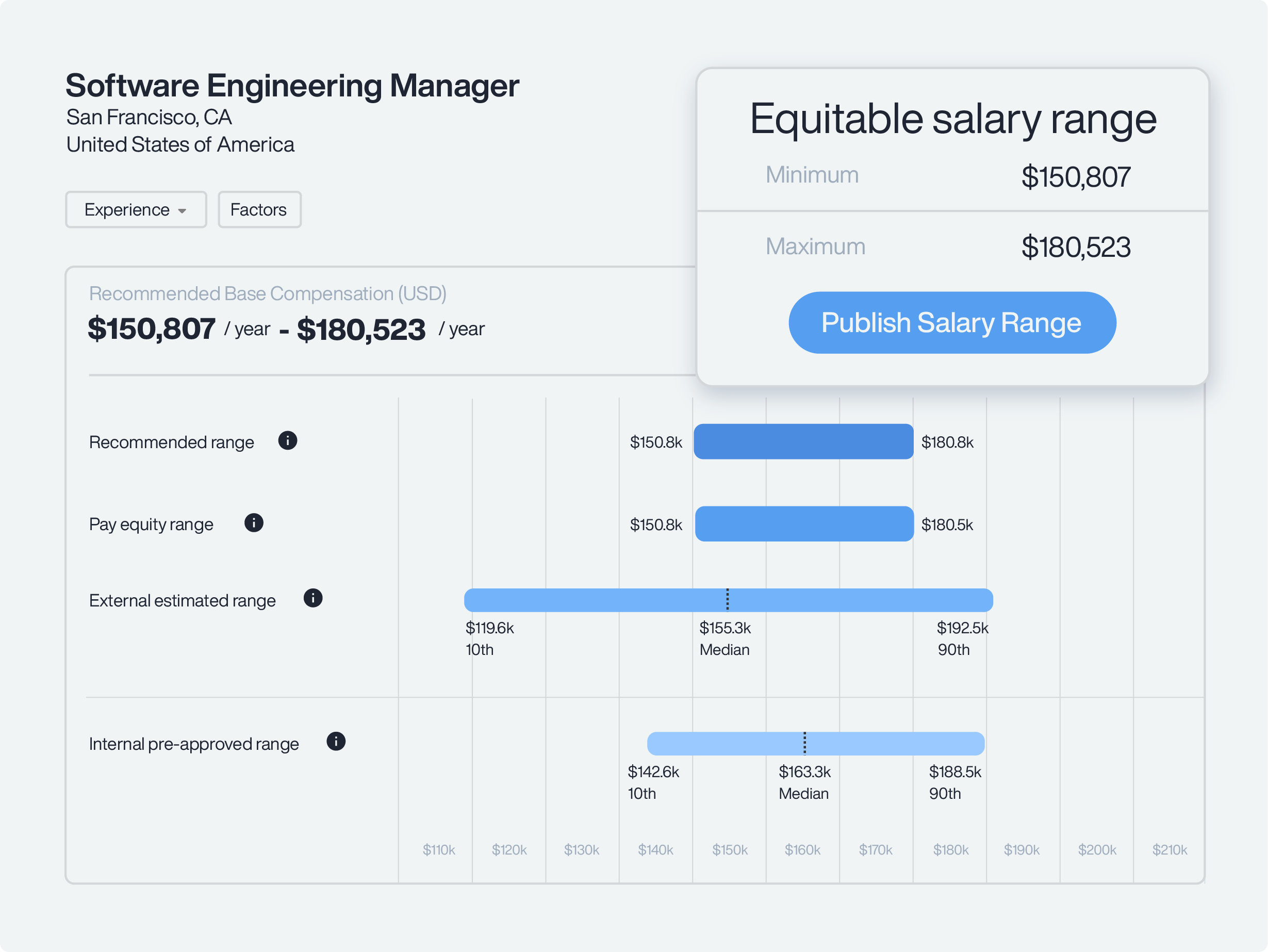

After conducting a pay equity audit, identifying pay disparities, resolving the root causes, and implementing a remediation plan, you’re ready to begin evaluating your pay equity law requirements. Numerous states across the country and several cities require employers to post salary ranges in their job listings. To comply with these pay transparency laws, it is important to choose unbiased pay ranges for your job postings. A solution like Salary Range Finder™ can help you determine competitive and unbiased salary ranges that prevent future pay inequity, but still, allow you to attract top talent.

Salary Range Finder, a component of PayParity overlays internal pay equity audit data with that of external labor market data provided by Lightcast™ or your own market survey data. By combining the two data points your organization can instantly determine unbiased salary ranges for your job posts and eliminate the need to remediate disparities later. And since you’ve evaluated your current pay equity situation, you can be sure that your ranges are not creating new pay equity issues, like wage compression.

Step 6: Confidently report your pay data

Many pay equity laws like California’s pay data reporting law and Illinois’ pay data reporting law require employers to report pay data information to state governments. This never before seen requirement imposes steep penalties for non-compliance. In fact, employers that fail to file pay data reports could be fined up to $200 per employee. Organizations that utilize pay equity software have a significant advantage in fulfilling pay equity requirements, as they are able to continuously evaluate and address any disparities in compensation within their workforce.

Tools like PayParity and Salary Range Finder can help ensure unbiased pay, minimizing the risk of enforcement and allowing for confident pay data reporting. Pay equity laws are coming into effect around the world all the time.

Step 7: Monitor pay equity continuously

As new pay transparency laws continue to take hold across the U.S. and abroad, using pay equity software can not only help you meet the requirements as outlined above, it can help you proactively establish compliance with laws that have yet to come into effect. PayParity software continuously monitors your workforce’s pay equity profile so that there are never any surprises when it comes time to post a salary range or file a pay data report.

This kind of visibility solves the “outdated analysis” problem and provides real-time pay equity insights any time a change occurs within your workforce, whether it be a promotion, termination, new hire, or departmental change.

The cost of inaction

Employers should also be aware of the potential risks and consequences of non-compliance with pay transparency regulations. This may include penalties, class-action litigation, and damage to an organization’s reputation. In addition, non-compliance with pay transparency regulations can also lead to a lack of trust and morale among employees, which can negatively impact productivity and retention.

Ensuring constant compliance with pay transparency regulations

By following these steps and utilizing software solutions like PayParity and Salary Range Finder, you can ensure compliance with pay transparency regulations and establish an unbiased and transparent pay system within your organization. Of course, as new pay equity laws come into effect and amendments to regulations roll out, it’s important to stay abreast of the requirements.

Be sure to stay up-to-date on the latest pay transparency laws and regulations affecting your organization and review any changes or updates to ensure that your policies and practices are compliant.