Introduction

At a conceptual level, pay equity is the practice of ensuring employee pay is based on legitimate, non-discriminatory factors, such as skill, effort, responsibility level, and working conditions. Implementing a global pay equity strategy enables employers to ensure that their pay is equitable. In this guide we explore the six pillars of an effective global pay equity strategy:

- Proactive Pay Equity

- Prevention of Pay Inequities

- Global Compliance & Reporting

- Strategic Pay Transparency

- Communication & Change Management

- Measurement & Accountability

We’ll also examine broader issues affecting pay equity, including the EU Pay Transparency Directive, the impact of opportunity equity, and how pay equity software equips your organization with the tools it needs to carry out data-driven pay equity analyses.

Why pay equity matters

Ensuring pay equity is a legal imperative. The last few years have seen pay equity regulations and legislation expanding around the world. Increased legislation means increased compliance and reporting activities for businesses. Employers also have an ethical imperative to ensure their employees are paid without bias. Pay equity is an important part of attracting and retaining top talent in a competitive labor market. Research reveals that:

- By 2030, the global talent shortage will reach 85 million people, at a cost of $8.5 trillion in unrealized revenue. (Korn Ferry).

- Data from the US Chamber of Commerce shows that there are 9.5 million job openings in the US, but only 6.5 million unemployed workers.

- Including salary in job postings attracts more applicants. 87% of employees participating in a ResumeLab survey agree that job postings should have a salary range. 80% say it is likely or highly likely that the lack of salary information in a job post would prevent them from applying.

- Job postings that include salary data receive 50% more applications, on average (Zip Recruiter).

- Research shows that two-thirds of workers would change jobs to work for an employer offering greater pay transparency than their current workplace.

- Indeed data shows that half of all US job postings now include salary, nearly triple the percentage recorded in February 2020. Not all this growth is due to compliance. While California unsurprisingly heads the list of states with the largest increase in pay transparency, South Dakota is in fifth place. South Dakota currently does not have pay transparency legislation in place.

Six pillars of an effective global pay equity strategy

Implementing an effective global pay equity strategy can be difficult for employers navigating expanding pay equity laws. For instance, US employers face increasingly complex challenges in creating an effective pay equity process and ensuring compliance:

- At least six states assess equal pay claims based on “substantially similar” work.

- At least nine states use “comparable work” to evaluate equal pay claims.

- In 21 states, plaintiff employees must prove they were paid less for “equal work”.

Pay transparency laws may also be interpreted differently across the 12 federal regional circuit courts. In the Seventh Circuit, prior salary justification was deemed an acceptable defense in the case of Korty v Indiana. That same defense cannot be used to justify unexplained pay gaps in at least six other circuits. At Trusaic, we have developed – and recommend – a global pay equity strategy framework, consisting of the following six pillars.

- Proactive Pay Equity

- Prevention of Pay Inequities

- Global Compliance & Reporting

- Strategic Pay Transparency

- Communication & Change Management, and

- Measurement & Accountability

We aim to enable employers to develop a pay equity strategy that aligns with their organizational needs. Below, we explore each pillar in detail.

Pillar 1: Proactive pay equity

The first pillar involves carrying out a proactive pay equity analysis on a regular basis to evaluate your organization’s pay equity situation and address any pay disparities identified. What do we mean by pay equity? Let’s start with the raw pay gap, which the International Labour Organisation defines as: “…the earnings of men minus the earnings of women. This can be calculated for average wages, median wages, or wages in different places in the distribution.” In essence, the raw pay gap tells us how average and median pay differs by demographic group, such as average, or median, pay for men versus average, or median, pay for women. As another example, it can be used to compare the pay of black employees with the pay of white employees.

Pew Research shows the gender – or raw – pay gap in the US hasn’t changed significantly in two decades.

Women earn 82 cents on the dollar in comparison to men.

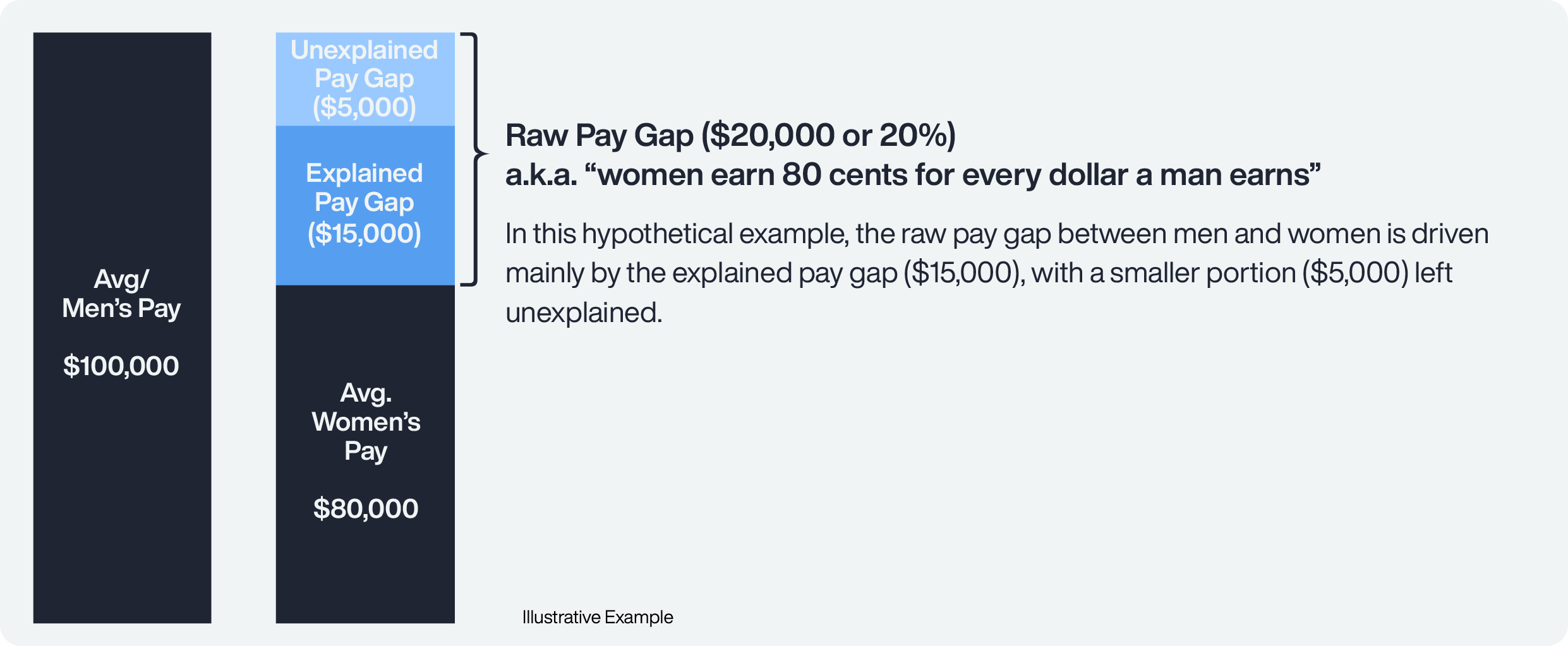

Conceptually, the raw pay gap consists of two components: “Explained” pay gap: This component reflects the extent to which pay differs by demographic group due to relevant differences in compensable factors. Such factors include occupation, career level, education, and experience. Looking at differences in occupation, occupational segregation occurs when one demographic group is overrepresented or underrepresented in a specific job category. For example, according to the American Association of University Women (AAUW), women make up about two-thirds of workers in low-wage jobs in the US, with women of color particularly over-represented in these jobs. In the UK, a Parliament briefing cites the following as reasons for the gender – or raw – pay gap:

- occupational segregation;

- the part-time pay penalty;

- women’s disproportionate responsibility for unpaid caring; and,

- women’s concentration in low-paid sectors.

Explained pay gaps are best addressed via career and opportunity equity policies to ensure that women and people of color are provided with equal access to career development opportunities. “Unexplained” pay gap: The remaining portion of the raw pay gap is not explained by relevant compensable differences. This unexplained pay gap may be attributable to differences in gender, race/ethnicity, or another protected characteristic. You may also see this pay disparity referred to as the “adjusted” or “controlled” pay gap.

Illustrative example of pay gaps (Fig.1)  Both the explained and unexplained pay gap are important but are addressed in different ways. The unexplained pay gap can be addressed directly by conducting a pay equity analysis and, as needed, adjusting individual compensation. The primary objective of a proactive pay equity analysis is to measure an organization’s unexplained pay gap and close it where appropriate. Measuring pay gaps using multiple regression During a pay equity analysis, unexplained pay gaps are measured using multiple regression.

Both the explained and unexplained pay gap are important but are addressed in different ways. The unexplained pay gap can be addressed directly by conducting a pay equity analysis and, as needed, adjusting individual compensation. The primary objective of a proactive pay equity analysis is to measure an organization’s unexplained pay gap and close it where appropriate. Measuring pay gaps using multiple regression During a pay equity analysis, unexplained pay gaps are measured using multiple regression.

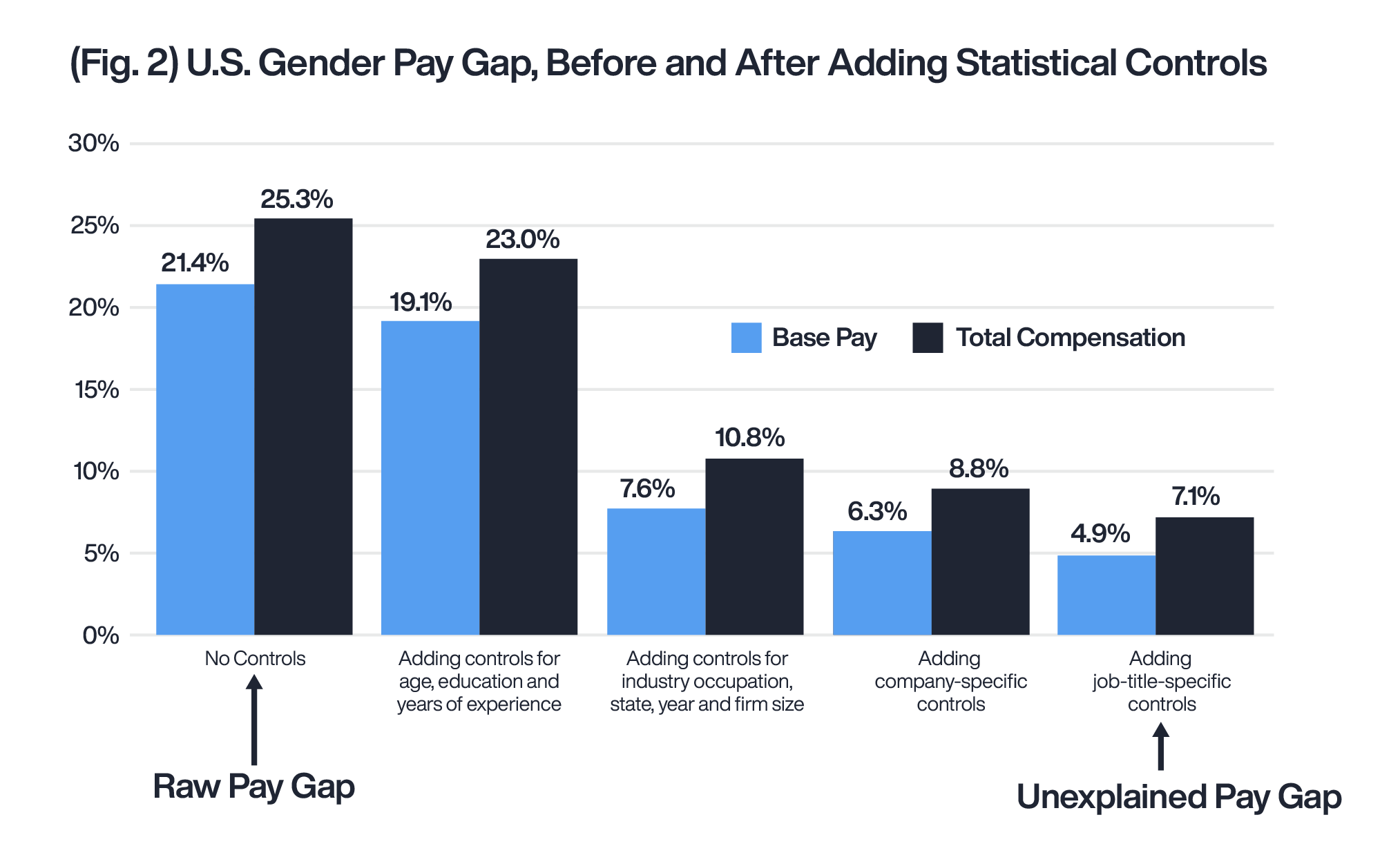

The illustration (Figure 2) below is an example from a Glassdoor report that provides a good example of how pay gaps are measured.

Source: Glassdoor Economic Research, Progress on the Gender Pay Gap: 2019

In this example, the “No Controls” gender pay gap is the raw pay gap, which is 21.4% for base pay and 25.3% for total compensation. These pay gaps fall as relevant compensable factors are accounted for in the regression analysis. The remaining gaps, which are 4.9% for base pay and 7.1% for total compensation, represent the unexplained pay gaps. Closing these gaps further may require employers to make adjustments in compensation.

Pillar 2: Prevention of pay inequities

Your workforce is dynamic. Employees are promoted, change jobs, or leave and new employees are hired. Even if organizations carry out a regular proactive pay equity analysis and address pay inequities, new pay disparities may emerge when you carry out your next pay equity analysis.

As your workforce evolves, your pay equity status evolves with it. Preventing pay inequities requires the implementation of policies, processes, and tools throughout the employee lifecycle.

Every compensation decision-whether it’s a new hire pay decision, a merit pay adjustment, a promotion decision, or an off-cycle pay adjustment-is an opportunity to help prevent, or potentially exacerbate, a pay inequity.

Compensation decisions must be made in alignment with internal equity at every stage. At Trusaic, we recommend two key methods to ensure your compensation decisions do not jeopardize your pay equity situation:

Policies & processes: Implement reasonable procedures to review compensation decisions before they are finalized. Create a process that enables you to set equitable, explainable, and competitive salary ranges. We recommend that compensation decisions be made within these ranges. A degree of flexibility is vital to attract and retain talent but paying salaries outside of your equitable, explainable, and competitive salary ranges should be the exception, rather than the rule.

Tools: Use technology such as pay equity software to assist the process. Pay equity software provides decision-makers with real-time access to the data needed to make unbiased pay decisions aligned with internal equity. Software tools such as Trusaic’s PayParity® and Salary Range Finder® enable employers to create equitable pay ranges and can help companies comply with pay transparency legislation.

Pillar 3: Global compliance & reporting

Navigating pay transparency legislation is a challenge for many companies, especially those operating in multiple jurisdictions globally. The objective in this third pillar is to ensure compliance with all compensation-related laws, regulations, and reporting requirements where your business operates. More than two dozen jurisdictions around the world now have pay reporting requirements. The increase in legislation runs the risk of having local HR teams inundated with reporting and compliance responsibilities. In terms of ways to manage jurisdiction-based compliance and reporting efforts, there is a continuum from completely local on one end to completely centralized on the other. In our experience, employers have typically relied on local management – such as local HR teams – for compliance and reporting.

EU Pay Transparency Directive, we recommend the adoption of a more centralized approach, to ensure a more efficient compliance and reporting process.

The inherent challenges of compliance are illustrated by the rise in class action lawsuits since the introduction of the Equal Pay and Opportunities Act in Washington state on January 1, 2023.

Pillar 4: Strategic pay transparency

Adopting a strategic pay transparency approach moves your organization beyond what is legally mandated. It refers to the extent to which an organization chooses to share information about its compensation philosophies, policies, and practices, both internally and externally. Every organization needs to decide what information it wants to share about its compensation practices and who it wants to share it with, recognizing the quickly shifting norm toward greater pay transparency. While employers must comply with legally mandated pay transparency requirements, how far they go beyond those requirements is a choice. Employers must decide what information they will share-e.g., pay ranges, pay equity gaps, raw pay gaps-and who that information will be shared with-e.g., Board, company leaders, managers, employees, applicants, candidates, the public. In making that choice, employers may wish to consider additional benefits of pay transparency.

The discretionary component of your pay transparency strategy sets your organization apart.

Each company’s decision on discretionary sharing is unique, but decisions will require ongoing review as legislation evolves. For example:

- UK employers face a degree of post-Brexit uncertainty over equal pay requirements and the impact of amendments to The Equality Act 2010, effective January 1, 2024. As pay transparency in job postings falls in the UK, pay transparency may help employers to stand out in a competitive labor market.

- Employers in the Canadian province of Ontario may choose to adopt pay transparency, regardless of the success of Bill 149, which would require including a compensation range in publicly advertised job postings.

- Massachusetts is also poised for pay transparency legislation and pay data reporting. Companies operating here may decide to share pay ranges in job postings before the bill is signed into law.

Pillar 5: Communication & change management

The fifth pillar of our global pay equity strategy framework is communication and change management. Every facet of your global pay equity strategy likely will require some degree of communication, education, and training to support your approach. As you roll out your strategy, ask yourself a few key questions to assist with developing an effective communication plan:

- Who needs to know? For example, HR, Managers, Leaders, Board, Employees, Candidates.

- What information do you want to communicate to each audience? For example, an overview versus an in-depth understanding.

- How is the information best communicated to each audience? For example, via email, in-person meetings, a toolkit or FAQ, recorded or instructor-led training.

As an example, if you decide as part of your global pay equity strategy to share with every employee the pay range for their current role, you will likely want to communicate this change to HR, leaders, managers, and employees.

To support leaders and managers, and address employee questions, HR will require an in-depth understanding of the company’s pay philosophy, how pay ranges were created, and how pay within the range is determined. You may have your compensation team lead a series of in-person or virtual training events with HR.

Leaders and managers will require a more basic understanding, plus talking points and an FAQ to use in discussions with employees. You may choose to have your HR business partners meet with leaders and managers virtually or rely on a recorded training session (or a combination of the two).

Your employees will require a high-level overview. In this case, you may choose to prepare a series of one-pagers to convey your company’s pay philosophy, how pay ranges were created, and how pay within the range is determined. This information could be available on your internal company website.

When communicating with employees about pay, it’s important to remember that an employee’s perception of their pay situation is as important as their actual pay situation.

Only 34% of employees believe their pay is equitable, and less than one-third believe they are fairly compensated for their work. We recommend working with your legal counsel on developing your communication plan.

Pillar 6: Measurement & accountability

In developing a pay equity strategy, it’s important to implement a measurement framework to track progress and drive accountability. The sixth and final pillar of our pay equity strategy draws together the previous five pillars by creating and implementing a measurement framework.

This framework enables every employer to monitor progress on their pay equity strategy and drive accountability for pay equity outcomes. Your framework should align with your lines of authority. While an enterprise-wide view may be suitable for some companies, others may prefer to measure progress by leader or line of business.

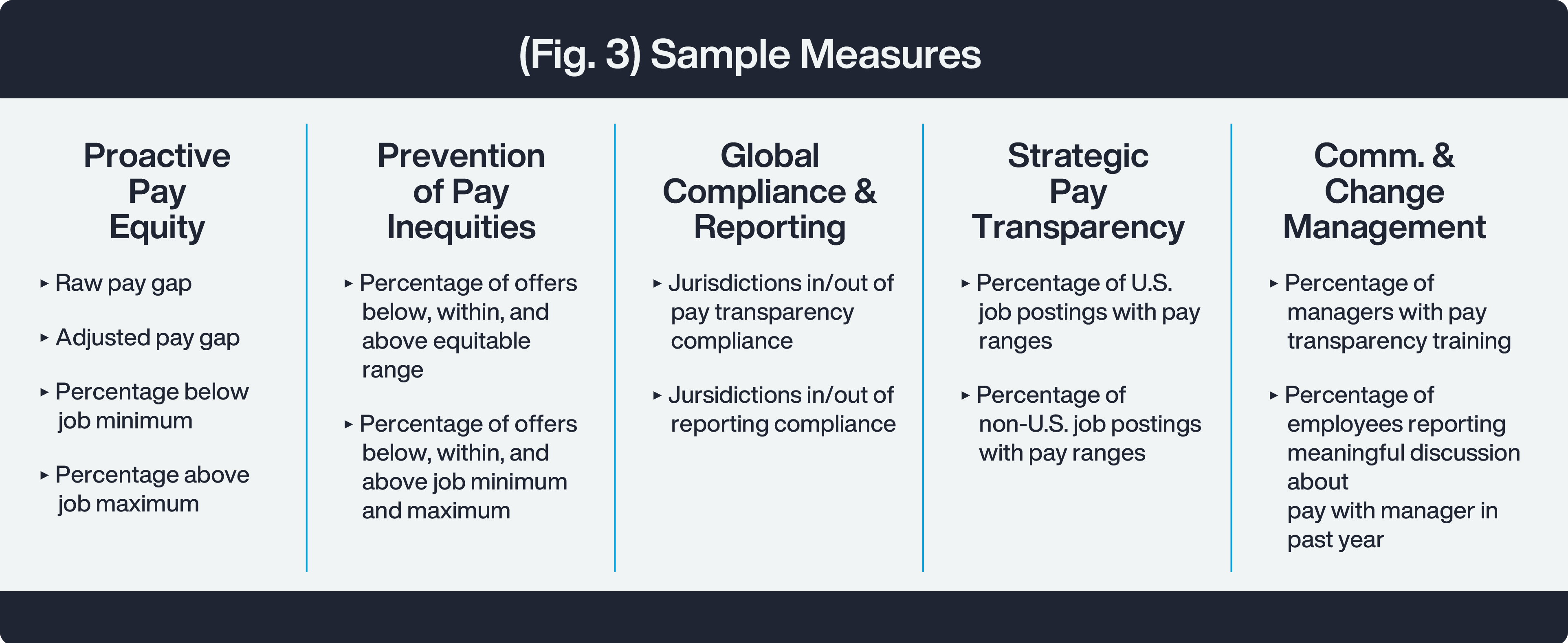

We recommend developing measures for each pillar of your pay equity strategy that we have discussed. (Fig 3)

Proactive pay equity measures might include raw and adjusted pay gaps for gender and race/ethnicity, as well as the percentage of employees paid below the minimum or above the maximum salary range for their role, categorized by gender and race/ethnicity.

Prevention of pay inequities may include a review of offers to new hires in the past year to measure the percentage of offers below, within, and above an “equitable pay range.” The results of your proactive pay equity analysis can help you to design an equitable pay range for a specific role. You may also want to measure the percentage of offers that are below, within, and above the standard job minimum and maximum.

Global compliance & reporting might require you to evaluate and track the jurisdictions where you are in or out of compliance, both on the pay transparency side and the pay reporting side. For organizations that have decided to include pay ranges in all of their US job postings, an example of a strategic pay transparency metric is the percentage of US job postings throughout the past 12 months that included a pay range. For organizations that have decided to do this globally, an additional measure is the percentage of non-US job postings over the past year that included a pay range.

For communication and change management, one metric for organizations that have become more transparent about pay is the percentage of managers that have received pay transparency training. Another potential metric to track is the percentage of employees that have had a meaningful conversation with their manager about pay in the past 12 months. This question can be included as part of your regular employee engagement survey. An employee sentiment survey can also uncover specific and actionable insights into the way your employees feel about issues such as pay equity.

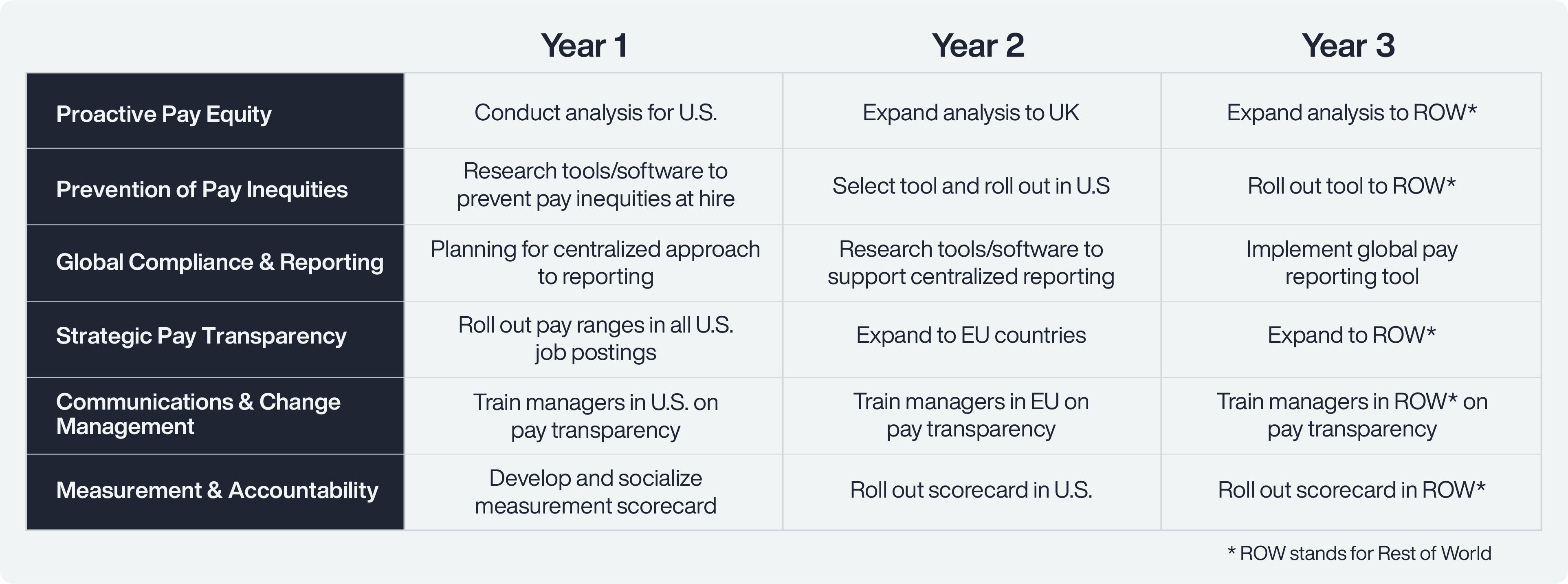

Creating a global pay equity strategy roadmap (Fig 4) A pay equity roadmap connects the various facets of your pay equity strategy. The example below illustrates a three-year plan. Essential activities are identified under each pillar and the plan can be refined and adjusted as you review progress. This roadmap clearly demonstrates that the development of an effective global pay equity strategy is an ongoing process and a long-term commitment. Creating a roadmap helps employers identify near-term priorities and develop a plan for the future. (Fig.4)

Developing a pay equity strategy – exploring broader trends

Additional trends both in the US and globally will influence your organization’s pay equity approach and development of a pay equity strategy roadmap. Some of the key legislative developments to be aware of are highlighted in this section.

EU Corporate Sustainability Reporting Directive (CSRD)

Pay equity is integral to sustainable business practices, and a vital element of the CSRD, effective from January 1, 2024.

European Sustainability Reporting Standards (ESRS) 1 and 2 require employers to report on pay data and explain their approach to effectively managing impacts on areas including “equal treatment and opportunities for all (for example, gender equality and equal pay for work of equal value…)”

Over 50,000 European organizations in EU member states are required to comply, as well as 10,000 non-EU companies, including 3,000 US firms. Employers should also note the following reference.

Sustainability reporting standards that address gender equality and equal pay for work of equal value should specify, amongst other things, information to be reported about the gender pay gap, taking account of other relevant Union law. “Other relevant Union law” may refer to the EU’s Pay Transparency Directive. As pay equity emerges as a key measure of social responsibility and sustainable business practices, employers making claims about their pay equity situation must ensure these claims are supported by relevant data.

U.S. Equal Employment Opportunity Commission (EEOC) moves to eliminate discrimination

During 2023, the EEOC has taken strategic steps that will shape the future of pay equity processes and must be considered when developing an effective pay equity strategy. These are summarized below:

Equal pay is one of six targeted priorities: Released in September 2023, the EEOC’s Strategic Enforcement Plan (SEP) 2024 through 2028, names advancing equal pay as one of its targeted priorities. Specifically, the EEOC’s focus will be on employer practices that may “impede equal pay or contribute to pay disparities.” Reliance on salary history and discouraging or prohibiting employees from asking about pay are two of those practices. Additional emphasis is also placed on employment practices and decisions where the use of technology results in or contributes to discrimination. The aims of the SEP align with EEOC Title VII guidance.

Strategic alliance: In September 2023, the EEOC and the Department of Labor Wage and Hour Division (WHD) entered into an alliance to enhance and maximize the enforcement of federal laws and regulations. Its Memorandum of Understanding allows sharing of data to support either agency’s regulatory enforcement. Target areas for investigation and enforcement include unlawful compensation practices, including wage discrimination laws.

Outside of EEOC priorities, the “Salary Transparency Act,” HR 1599, would require all employers nationwide to disclose pay ranges in job listings, provide wage ranges to job applicants, and provide that same information to existing employees.

Opportunity equity

Opportunity equity ensures all employees have equal access to opportunities for employment, development, and career advancement irrespective of gender, race/ethnicity, age, and other personal attributes. Opportunity equity is designed to create a level playing field for all employees. Legislation related to opportunity equity has been passed in the following jurisdictions:

EU Pay Transparency Directive: Employers must disclose the criteria used to determine pay ranges and career progression. That information must be easily accessible, and criteria must be objective and gender neutral. The Directive must be transposed into law by all member states by June 7, 2026.

Illinois: Bill HB3129 comes into effect on January 1, 2025. As well as pay transparency requirements, employers must ensure “all current employees” are aware of all promotional opportunities no later than 14 calendar days after making an external job posting. HB3129 applies only to jobs physically performed at least in part in Illinois, or outside of Illinois where employees report to a supervisor, office, or other work site in Illinois. Employers with fewer than 15 employers are exempt.

Colorado: Effective January 1, 2024, Colorado’s expanded Equal Pay Act states that employers must make “reasonable efforts” to “announce, post, or otherwise make known” the identity of the candidate selected for each job opportunity within 30 calendar days of their start date. The candidate’s name and job title must also be provided. Employees must be provided with information on how to show interest in similar job opportunities in the future. As highlighted in Pillar 1 above, opportunity equity can help to address explained pay gaps, and create equal opportunities for all employees.

Support your pay equity strategy with pay equity software

Pay equity software transforms how employers identify and address pay inequities by leveraging data analytics and automation. Best-in-class pay equity software supports your pay equity process by contributing to legally-compliant compensation practices, compliance with legislation and in creating a more inclusive workplace.

Achieving pay equity begins with an intersectional pay equity audit.

A traditional approach towards pay equity analysis adopts a one-dimensional perspective. A single-demographic audit can lead to potentially inaccurate results, as it doesn’t identify the full extent of pay disparities, or the causes of unexplained pay gaps. Intersectionality is one of the key differentiators for Trusaic’s PayParity pay equity audit software.

Trusaic PayParity carries out a pay equity analysis through the intersection of gender, race/ethnicity, and other demographic groups in a single statistical regression analysis. Employers can understand compensation differences across their workforces, accounting for multiple demographic details.

Trusaic PayParity finds the root causes of pay disparities using advanced analytics and algorithms that pinpoint problematic factors, including biases and faulty systemic processes.

A pay equity software solution like Salary Range Finder determines competitive and unbiased salary ranges by overlaying internal pay equity audit data with that of external labor market data provided by Lightcast. Unbiased salary ranges are instantly determined in real-time by combining the two data points. Results ensure equitable compensation decisions, and new hires receive competitive pay offers, reducing unplanned and expensive pay remediations.

By using both internal pay equity audit data and external labor market data, Salary Range Finder can generate an internally and externally equitable salary range for all jobs.

More than a pay equity solution

Trusaic PayParity pay equity software enables organizations to create an effective global pay equity strategy:

- Save time and resources and comply with increasingly complex legal and regulatory requirements across multiple jurisdictions.

- Identify root causes of pay disparities and implement steps to close unexplained pay gaps by conducting an intersectional pay equity audit.

- Ensure compliance with pay transparency legislation in the US, the EU’s Pay Transparency Directive and globally.

- Commit to pay equity in your compensation structures.

- Create equitable, explainable, and competitive salary ranges to comply with pay transparency laws.

- Ensure compliance with EEOC Title VII guidance.

- Ensure GDPR Compliance: Trusaic is GDPR compliant and can assist any organization in any EU state in meeting its obligations under both the EU Pay Transparency Directive and CSRD.

Conclusion

A global shift towards pay transparency means it is fast becoming the norm. By adopting a pay equity process that provides visibility into pay inequities, employers can be confident of meeting compliance and reporting requirements and mitigating risks. As legislation evolves to close the gender pay gap more rapidly, pay equity is not simply a matter of compliance, it is the right thing to do. A good place to start is by developing a global pay equity strategy and roadmap.