This is the fourth blog of our EU Directive in Practice series. Access the first blog on pay equity, the second blog on Article 7 Right to Information, and the third blog on going beyond the 5% threshold requirement.

The EU Pay Transparency Directive (EUPTD) requires covered employers to disclose gender pay gaps for each defined worker category. These categories group workers who perform the same work or work of equal value.

Employers must report raw gender pay gaps, defined as the difference in average pay between women and men. If a raw pay gap of 5% or more appears in any worker category, employers may avoid a joint pay assessment (JPA) by demonstrating that the difference is explained by objective, gender-neutral factors.

In these situations, employers will typically conduct a regression-based pay equity analysis to calculate unexplained or adjusted pay gaps—pay differences that remain after accounting for the effect of objective, gender-neutral Wage Influencing Factors (WIFs). If an adjusted pay gap of 5% or more persists, employers must implement a remediation plan for the affected worker categories.

Worker Categories Under the EUPTD

A job architecture defines how roles within an organization are structured and compared, typically through job families, levels, and job evaluation criteria. For most organizations, this framework provides an objective basis for creating worker categories as required by the Directive.

Validating worker categories with internal leaders and worker representatives helps ensure they are appropriate and defensible. Using job architecture in this way promotes consistency, transparency, and compliance while aligning with an organization’s existing compensation practices.

Under the Directive, worker categories must be based on “skills, effort, responsibility, and working conditions.” In practice, many organizations are forming categories around job levels (e.g., individual contributors, managers, directors). However, even large employers may find that some of these categories contain relatively few workers (e.g., fewer than 100). While the Directive requires employers to report raw gender pay gaps using these categories, this level of granularity is often not suitable for regression-based pay equity analyses.

Regression analyses require sufficient statistical power and reliability to accurately measure pay disparities (see our blog post on this topic). To help ensure this, we recommend forming groupings, called Pay Analysis Groups (PAGs), of at least 100 workers. While a minimum of 50 workers may be acceptable in some cases, creating PAGs with less than 50 workers is inadvisable because PAGS of this size may be too small to detect pay disparities.

These PAGs are not used for reporting raw pay gaps; instead, they serve as the basis for pay equity analyses to determine whether adjusted pay gaps exceed the Directive’s 5% threshold and, if so, to guide remediation planning.

Translating EUPTD Reporting Groups into Pay Analysis Groups

To translate your EUPTD reporting groups into PAGs for pay equity analysis, we recommend combining reporting groups that are “logically proximate” until each PAG’s headcount approaches or exceeds 100 workers.

Logically proximate groups are those that are close to one another in responsibility, scope, and required skills. For example, adjacent job levels such as IC1 and IC2 are typically proximate and can be combined into a single PAG. In these cases, job level should be included as a WIF in the pay equity analysis to allow pay differences between IC1 and IC2 to be appropriately accounted for.

Once you have proposed PAGs, we recommend testing them for statistical power and reliability and iterating as necessary until all groups meet minimum thresholds. At Trusaic, our rule of thumb is that each PAG should have at least an 80% chance of detecting a pay disparity of 5%. We cover statistical power in more detail in this blog.

Our core reliability guidelines are as follows (explained further here):

- Adjusted R-squared of at least 70%.

- A ratio of at least five workers per WIF (i.e., PAG headcount ≥ 5 × number of WIFs).

- At least 70% of the WIFs in the model are statistically significant.

A Note About Very Small EUPTD Reporting Groups

Some EUPTD reporting groups may be very small (e.g., fewer than five workers). When converting reporting groups into PAGs for pay equity analysis, there are three primary ways to handle these cases:

- Exclude very small groups.The primary downside to excluding small groups is that a group may require a joint pay assessment (JPA) if the raw pay gap is ≥ 5%.

- Review these cases manually (qualitative assessment). This approach can be administratively burdensome and may introduce legal risk if the process is viewed as subjective or insufficiently evidence-based.

- Consolidate very small groups into larger groups. This is a common method for increasing sample size so that very small groups can be included in a pay equity analysis.

Illustrative Example

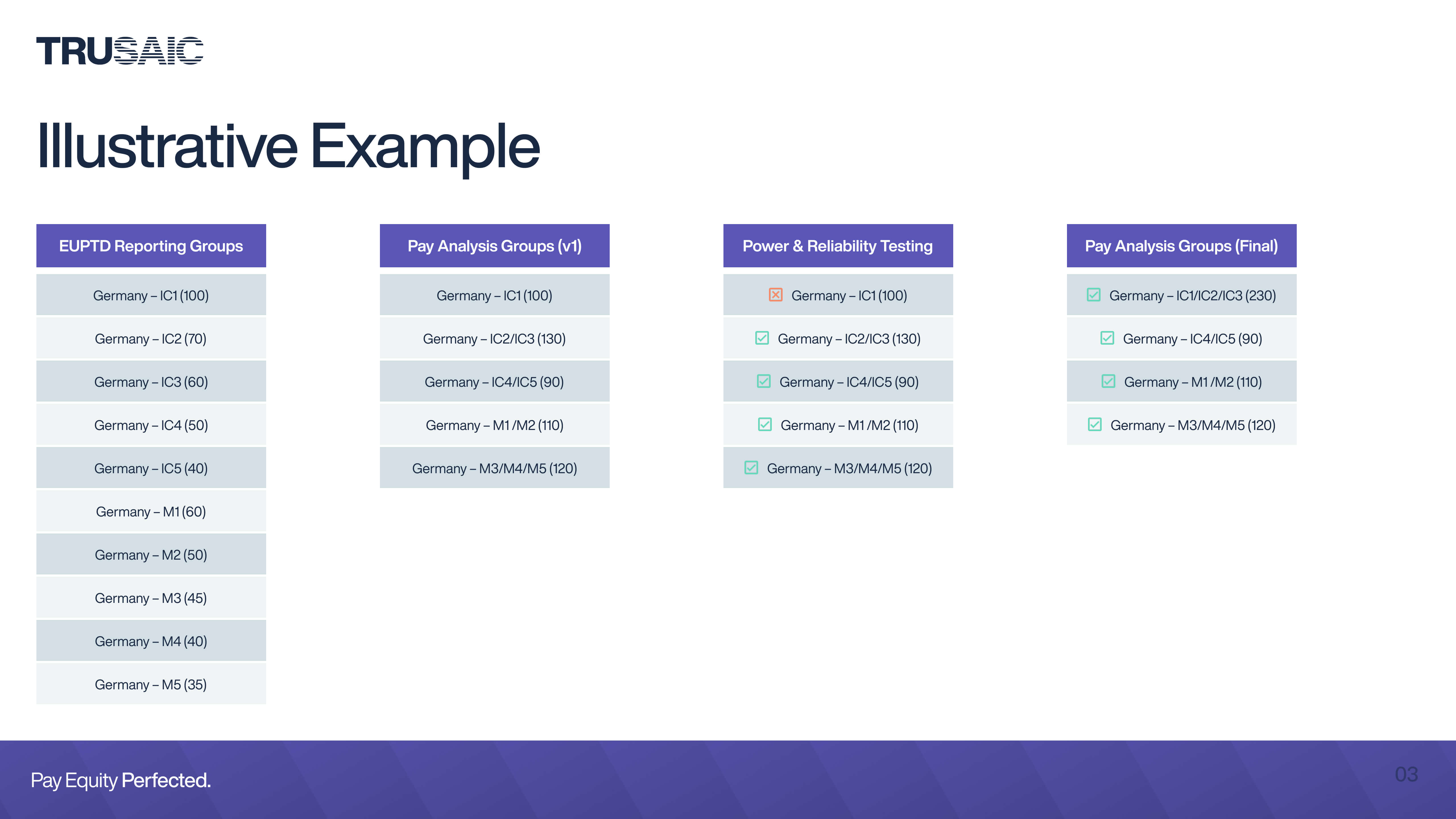

Below is an illustrative example of how EUPTD reporting groups can be translated into PAGs for pay equity analysis. The first column lists each EUPTD reporting group, which in this example is defined as job level within a country (e.g., Germany–IC1). Here, Germany has ten reporting groups, and the number in parentheses indicates the worker headcount within each group.

In Version 1 of the PAGs, IC2 and IC3 are combined because each has fewer than 100 workers and the two levels are logically proximate. The same logic is applied to the remaining job levels, resulting in five initial PAGs. After conducting statistical power and reliability testing, we determine that the IC1 PAG does not meet the required thresholds. As a result, it is combined with the IC2/IC3 PAG, producing the final set of four PAGs.

Some organizations hesitate to combine EUPTD reporting groups into larger PAGs for calculating adjusted pay gaps. While this concern is understandable, aggregation is often necessary for EUPTD compliance. When raw pay gaps reach 5% or more, calculating adjusted pay gaps that account for objective, gender-neutral factors is a necessity.

Achieving this requires pay equity analyses that have sufficient statistical power and reliability.