Introduction

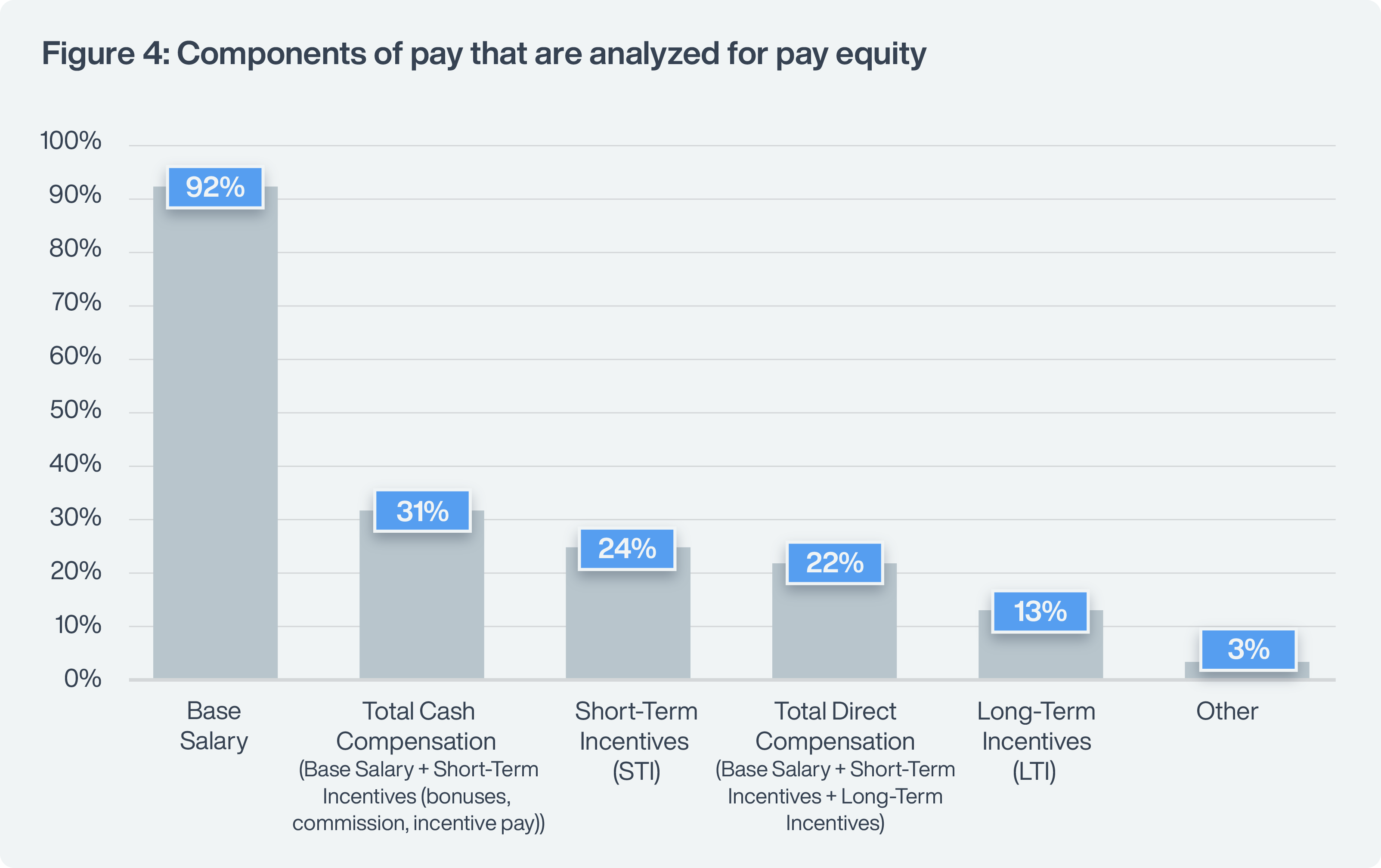

While companies are increasingly more diligent about monitoring the fairness of base pay, their vigilance has not extended to one often unexamined and overlooked form of compensation: equity awards. For companies that offer this type of compensation, this is a crucial misstep. The data from this survey of large organizations reveals this gap in managing pay equity. Many industries use long-term incentives (such as restricted stock and stock options) as an important part of their compensation strategy. Unfortunately, only 13% of organizations studied consider these incentives when doing pay equity analysis.

When organizations fail to identify and correct pay inequities, it can expose them to legal risk, damage their brand, and make it more difficult to attract and retain top talent. Worse, inequities can accumulate over time. The sooner organizations correct any inequities the better.

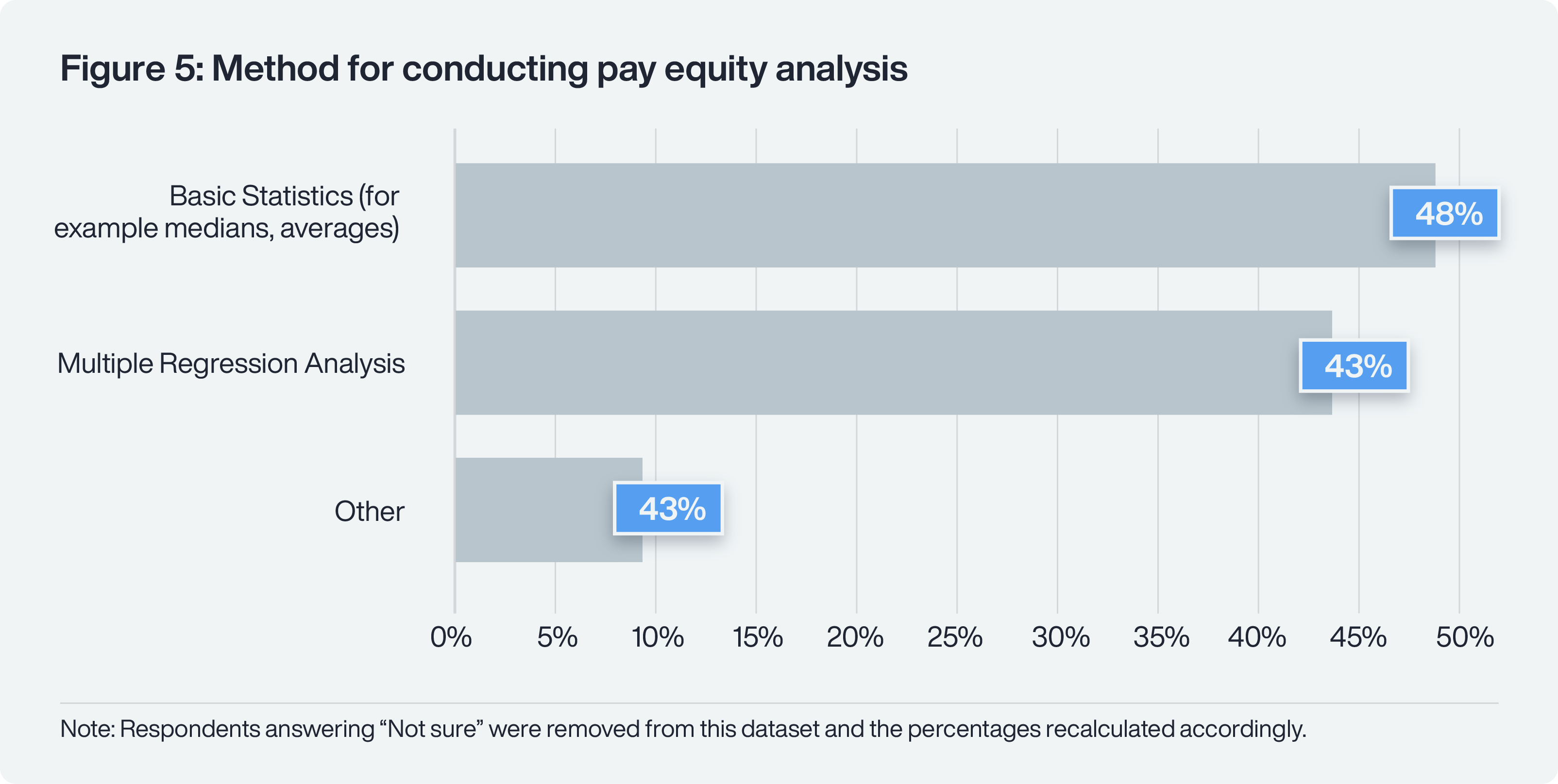

Another serious issue is that 45% of respondents use an unsophisticated approach to analysis, looking only at average or median pay. This approach overlooks relevant factors that drive pay differences and, as a result, this simplified analytical approach can lead to incorrectly identifying pay inequities. Where pay equity is analyzed, multiple regression, the gold standard approach, is used by only 40% of respondents.

In this report, we review the data in detail and outline practical steps to bring compliant practices to all forms of compensation.

Executive summary

This study, conducted in Q1 of 2024, gathered data from compensation professionals in 256 large organizations. It reveals gaps in how organizations are approaching pay equity, most of which can readily be corrected by updating their processes.

The key takeaways from this research are:

- Many industries emphasize long-term incentives as part of their compensation strategy, but few include them in their pay equity analysis. This can lead to hidden inequities.

- Over 40% of organizations use a relatively unsophisticated approach to pay equity analysis, focusing on median or average pay, but ignoring relevant factors that drive pay differences. This can lead to mismeasurement of pay inequities. The gold standard for pay equity analysis is to use multiple regression to account for relevant factors that impact pay.

- Some organizations conduct a pay equity analysis on total cash compensation or total direct compensation. This isn’t wrong per se, but it is not actionable since it doesn’t reveal which component of pay needs to be adjusted if any inequity is discovered. Pay equity analysis should be conducted separately on each component of pay.

- The most commonly cited barrier to establishing pay equity is the cost of correcting inequities that are identified. This fear is misplaced because even when resources are limited, there are ways to make progress on addressing pay inequities.

- 44% of respondents conduct a pay equity analysis once every two or three years, on an ad hoc basis, or not at all. This creates unnecessary risk. Hidden pay inequities can grow, leading to large remediation costs, as well as the potential for incurring back-pay liabilities in the case of a lawsuit. The best practice is to remediate pay inequities annually and monitor your pay equity situation throughout the year, either on a quarterly or semi-annual basis.

- The best approach to achieving pay equity is to proactively avoid inequities by running a pay equity analysis on proposed merit pay changes before those pay changes are finalized. About half of the respondents do so.

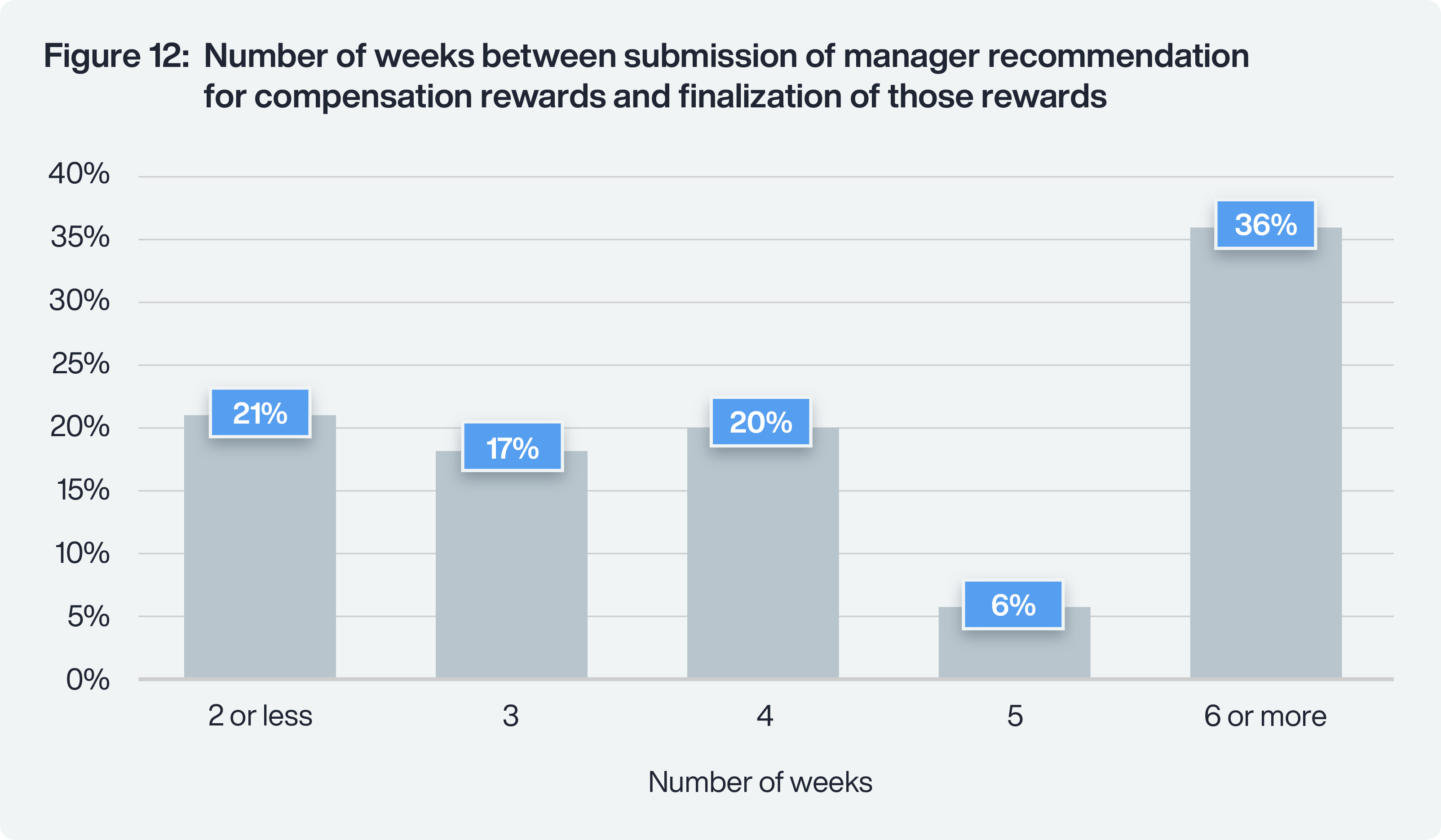

- Organizations make a proactive approach to pay equity more difficult than it needs to be by not allowing sufficient time between when a merit pay change is proposed and when it is finalized. Many respondents, 21%, have two weeks or less.

- Fewer than half of the respondents doing a pay equity analysis examine inequities based on age. Given the increased interest in age discrimination, this is an oversight we recommend correcting.

Overview

This study was a joint project of Trusaic, a leading workplace equity technology company, and Empsight, a leading provider of specialized compensation data for Fortune 1000 & large multinational companies. We were inspired to do this study because our experience suggests there are still some serious gaps in how organizations conduct pay equity analysis.

Empsight gathered data from compensation professionals in 256 large organizations, between February and April of 2024. The study provided a comprehensive insight into their pay practices and how they approach pay equity analysis.

The study uncovered two notable problems. One was a lack of analysis of long-term incentives when examining pay equity. The other was a failure to use sufficiently sophisticated analytical methods to ensure the analysis considered all relevant factors.

The study also highlights practical opportunities for improving the approach to pay equity. One is to prevent inequities from arising in the first place by doing an analysis before pay decisions are finalized. The other is to use software specifically designed for handling pay equity so that the process isn’t burdensome and the appropriate analytical tools are used (i.e. multiple regression, which is the gold standard for pay equity analysis).

Where to learn more about pay equity

If you are interested in learning about pay equity in more detail, check out this series of blogs.

Why this study matters

This study sheds fresh light on how organizations are handling pay equity and the emerging risks they face. The survey participants included many large organizations with 45% having over $5 billion in revenue. The survey covers a wide range of industries and includes public, private, and not-for-profit organizations (see Figures 1, 2, & 3). This important group of respondents illustrates what organizations are getting right and what they are overlooking in pay equity.

This topic is important for four broad reasons: there is an ethical imperative, a legal imperative, a business imperative, and a compliance imperative:

- The ethical imperative is straightforward: achieving pay equity is the right thing to do. It’s not a question of whether we should strive for equity, only a question of how to do so in the most effective way.

- The legal imperative flows from the increasing number of class action and non-class action lawsuits relating to pay discrimination and pay transparency.

- The business imperative is driven by the need to maintain a positive reputation that will attract and retain both talent and customers. Arjuna Capital, a wealth management firm, publishes a racial and gender pay scorecard that grades select companies on how they are handling pay equity. Poor results on this scorecard may degrade an organization’s reputation.

- The compliance imperative refers to the variety of legislation around the world that requires actions and reporting related to pay equity. This compliance pressure continues to grow. The European Union Pay Transparency Directive is a recent piece of legislation that includes a variety of measures aimed at reducing pay inequities. Among the notable measures is the need to publish information on gender pay gaps, including information on variable components of pay.

Organizations may address these four imperatives by ensuring their pay equity programs cover all elements of compensation using the appropriate analytical methods.

About the survey participants

The 256 diverse participants in this survey provided excellent insight into how organizations are handling pay equity. The following three charts illustrate a breakdown of participants by revenue, industry, and type of organization.

A pressing need to analyze all the components of pay

Compensation has three main components: base salary, short-term incentives (e.g. annual bonus), and long-term incentives (e.g., restricted stock, stock options, performance shares). In organizations where short or long-term incentives are a part of compensation, they should also be subject to pay equity analyses.

We asked respondents about their compensation policy for 10 different levels that span the organization: EVP, SVP, VP, Sr Dir, Dir, Sr Mgr, Mgr, Sr Spv, Spv, and Individual Contributor. We wanted to know which industries emphasize short-term and/or long-term incentives. Any industry where employees at every one of these 10 levels were eligible for incentives was defined as “emphasizing incentives.”

Every industry met this criteria for short-term incentives. These results suggest that in large organizations in the US, short-term incentives are an important part of compensation policy and hence need to be considered in pay equity analysis. This is not always the case, with only 24% including short-term incentives in their pay equity analysis (Figure 4).

Nine of the 13 industries emphasize long-term incentives: consumer services, energy, healthcare, manufacturing, pharmaceutical/chemical, professional services, retail/wholesale, technology, and transportation/transportation services. In these industries, long-term incentives need to be considered in pay equity analysis.

Only 30% of the organizations that emphasize LTI, analyze pay equity for LTI. And overall, only 13% of organizations in our sample include long-term incentives in their pay equity analysis (Figure 4). The data suggests that many organizations are putting themselves at risk by failing to analyze short-term and long-term incentives when doing pay equity analysis. Unless short and long-term incentives have no discretion then it is simply prudent to do this analysis.

“Failure to include short and long-term incentives in pay equity analysis creates risk for an organization. An organization may have hidden pay inequities that can grow over time and become both expensive to fix and damaging to the organization’s reputation.”

— Gail Greenfield, EVP of Pay Equity and Total Rewards Strategy and Solutions Trusaic

Figure 4 also reveals a more technical problem in pay equity analysis. The data shows nearly a third analyze total cash compensation (base salary + short-term incentives) and about one in five analyze total direct compensation (base salary + short-term incentives + long-term incentives).

Figure 4 also reveals a more technical problem in pay equity analysis. The data shows nearly a third analyze total cash compensation (base salary + short-term incentives) and about one in five analyze total direct compensation (base salary + short-term incentives + long-term incentives).

There is nothing wrong with doing these analyses; however, remediation of pay equity can only be accomplished by addressing each of the components individually and not by addressing total compensation. Remediating the wrong component of total compensation can worsen underlying disparities. Hence, it is essential to analyze each component separately.

Remediation of pay inequities can only be accomplished by addressing each component of compensation individually. Hence, an analysis of total cash compensation or total direct compensation is insufficient.

Organizations are failing to use the best analytical methods

Pay equity analysis can be complicated and organizations run the risk of inadequately addressing pay inequities if they use less rigorous methods for assessing pay equity. Almost half of the organizations in this study, 48%, only use basic statistics (e.g., medians, averages) to determine if employees are paid equitably. These analytical methods are generally insufficient.

The primary reason basic statistics are inadequate is that looking at average or median pay does not account for relevant drivers of pay differences, such as career level, job function, performance rating, and company tenure. Regression analysis, on the other hand, accounts for these “Wage Influencing Factors” in measuring pay inequities.

“An appropriate pay equity methodology will consider these other compensable factors using a method such as multiple regression, which is the gold standard,” Greenfield said. Many organizations, 43%, do indeed use multiple regression analysis, and these should be the role model for other organizations looking to identify and address pay inequities.

While regression analysis may sound intimidating, it is feasible even for small companies to use this approach by means of specialized software designed to analyze pay equity. Regression is the gold standard for conducting a pay equity analysis.

Obstacles to achieving pay equity

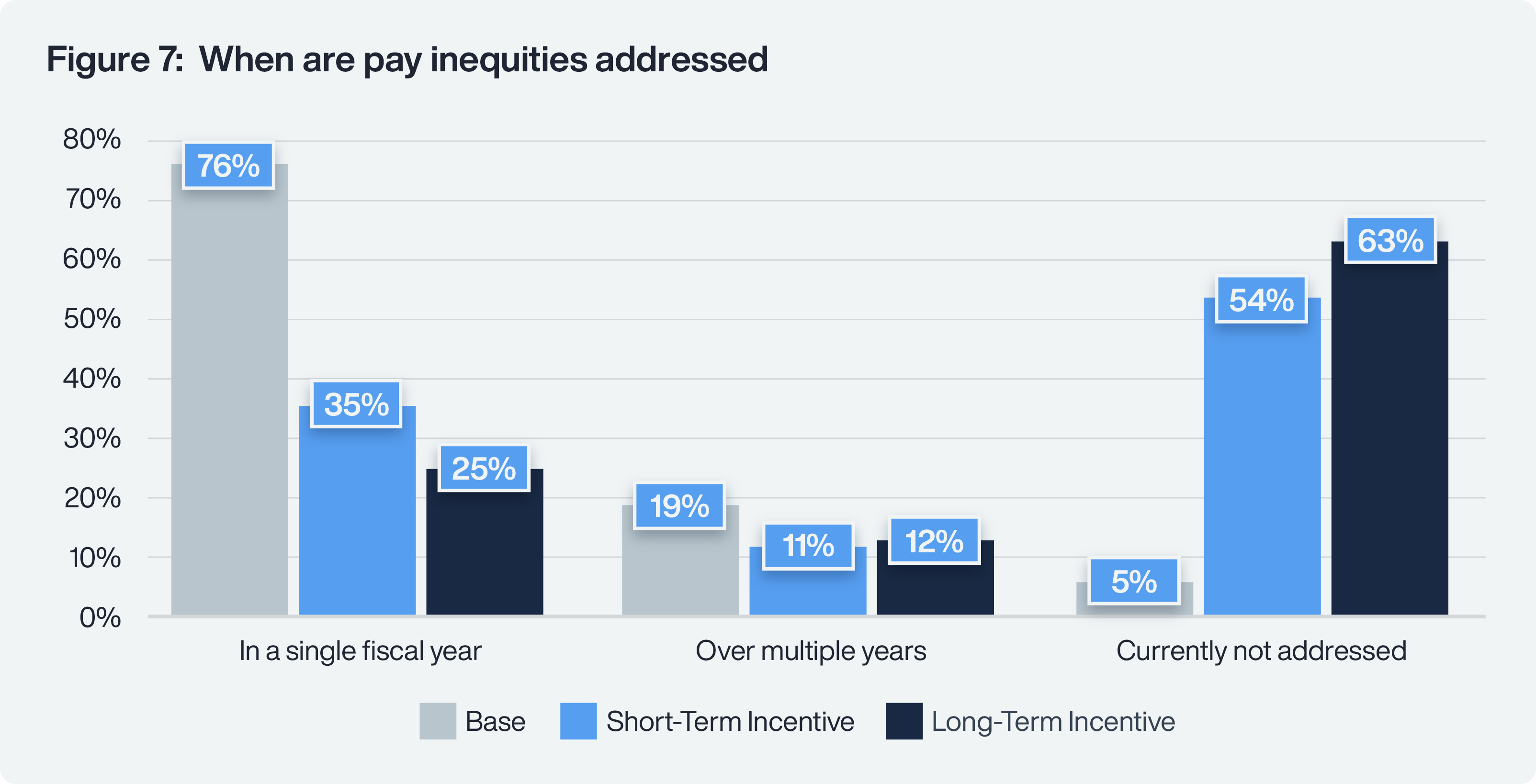

Nearly two-thirds of organizations cite the potential cost of addressing inequities as the most significant obstacle when aiming to establish pay equity (Figure 6). However, in our experience, the cost of addressing pay inequities often requires a relatively modest investment. According to the survey results (Figure 7), more than 75% of organizations choose to address base pay inequities in a single fiscal year, with a smaller percentage (19%) addressing pay inequities over multiple fiscal years. A much smaller percentage (5%) are not currently addressing pay inequities.

Organizations see the cost of remediation as a barrier to establishing pay equity. In practice, the cost of remediation is typically manageable.

The next two most commonly cited obstacles to establishing pay equity are:

- Ensuring proper job grouping & leveling for analysis (51%)

- Dealing with the root causes (37%)

Organizations are right to cite proper job grouping & leveling as an issue to be taken seriously; it can be a tricky process, especially if job leveling (the process of assigning jobs to levels or grades) has not been kept up to date. However, job grouping & leveling can be handled concurrently with the pay equity analysis-it shouldn’t be seen as a barrier, just a necessary step in the process.

Obstacles to dealing with root causes often reflect cultural norms within the organization that HR leaders feel they cannot control. They believe they need leadership or board support to address root causes and are not confident they will receive that support. However, with new pressures to achieve pay equity as discussed earlier (e.g., EU Pay Transparency Directive, Arjuna Capital’s Racial and Gender Pay Scorecard), there will likely be more support from leadership and the board than in the past.

There is also a more technical solution to dealing with root causes. If you adopt compensation tools that help managers and recruiters make equitable pay decisions, this can potentially counteract the root causes that are creating inequities. Furthermore, pay equity software can help pinpoint root causes. For example, inequities may arise from a particular manager, office, geography, or some other reason. Software can help detect these anomalies. Once the problem area is pinpointed, it can be addressed.

The data in Figure 7 suggests HR is uncertain about how to manage pay inequities in short-term and long-term incentives. More than 50% of organizations report that they currently do not address inequities in short-term incentives and more than 60% report that they do not address inequities in long-term incentives. (See the guide for more information about this issue.)

The data in Figure 7 suggests HR is uncertain about how to manage pay inequities in short-term and long-term incentives. More than 50% of organizations report that they currently do not address inequities in short-term incentives and more than 60% report that they do not address inequities in long-term incentives. (See the guide for more information about this issue.)

How frequently is pay equity analyzed?

Many organizations (42%) conduct a pay equity analysis once a year (Figure 8). However, even more, 44%, do it once every two or three years, on an ad hoc basis, or not at all. This is not recommended. For most organizations, it’s advisable to remediate pay disparities annually. Remediating less often runs the risk of allowing pay inequities to fester, leading to large remediation costs, as well as the potential for incurring back-pay liabilities in the case of a lawsuit.

It is worth paying attention to the 11% that analyze pay equity more than once a year (i.e. twice a year or quarterly). From a budgeting standpoint, most organizations are not in a position to make pay equity adjustments multiple times per year.

Moreover, making pay equity adjustments outside of the merit process runs the risk of drawing unwanted attention to the adjustments. That said, we recommend monitoring your pay equity situation throughout the year, either on a quarterly or semi-annual basis.

This periodic audit can help you understand how demographic changes within your workforce, changes in organizational structure, and changes in external market forces are affecting your pay equity outcomes.

On-going monitoring of pay equity can be made easier by implementing software to assist with the process.

For most organizations, it is appropriate to conduct a pay equity analysis and remediate disparities on an annual basis, ideally as part of your regular compensation cycle. In addition, we recommend monitoring your pay equity situation throughout the year, either on a quarterly or semi-annual basis.

Preventing inequities before they occur

Rather than discovering inequities after they occur, organizations should aim to proactively prevent inequities. They can do this by running a pay equity analysis simulating what that would look like if managers’ recommended merit pay changes were implemented. This approach will help identify issues that can be resolved before the pay changes are finalized.

Somewhat fewer than half of the respondents in this study (46%) analyze proposed changes to base pay before they are implemented. Slightly more analyze proposed changes to short-term incentives (51%) and long-term incentives (52%). See Figures 9, 10, and 11.

Allowing time to review proposed pay changes

To proactively avoid pay inequities, it is essential to have enough time between a manager’s recommendation with respect to a change in pay and the implementation of that change. That is the period when you can run the pay equity analysis simulating what it would look like if those recommendations were implemented and resolve any issues before they become problems.

Half of the respondents give themselves four weeks or less to do this review; a quarter three weeks or less. These short periods can make it difficult to proactively avoid pay inequities. It is not so much the analysis itself that takes time-today’s software solutions crunch the numbers quickly. The challenge is in reviewing any problematic manager recommendations and deciding how to respond. That needs to be handled case-by-case and may involve the manager responsible for the pay recommendation.

Ideally, the goal is to embed pay equity analysis into the standard annual compensation process, rather than treating it as an add-on after the fact.

The compensation cycle in many firms feels etched in stone, so it may be difficult to get more time, but it is certainly worth raising the issue. Even one extra week will make proactively avoiding pay inequities much easier.

If organizations are unable to get more time between the submission of managers’ recommendations for compensation rewards and the finalization of those rewards, then the focus needs to be on having a well-honed review process that can handle the pay equity simulation and subsequent adjustments in the time available. Software integrated with an organization’s main HR system can facilitate quick bi-directional data flow.

Proactively avoiding pay inequities by running a pay equity simulation on proposed pay changes can take some time. Organizations can make things easier by extending the time between a pay change recommendation and finalizing the pay change. Embed the pay equity process into the annual compensation process rather than treating it as an add-on after the fact.

Age discrimination is a rising concern

Over three-quarters of organizations are looking at the pay equity of gender and race, but fewer than half do a pay equity analysis based on age. Age discrimination is a rising concern. In the US, the concern is about discrimination against older workers, and in the European Union, there is concern about pay discrimination for both older and younger workers. As with gender and race, best practice is to analyze age intersectionally, within the same pay equity regression models that also measure gender and race effects.

The takeaway is that it is prudent to add an analysis to check for pay inequities based on age. Organizations that have established the processes and software for a pay equity analysis of gender and race will find that these methods translate easily to an analysis of age.

Fewer than half of the respondents do a pay equity analysis based on age. It is usually not difficult to add this analysis to an existing pay equity analysis. Given that age discrimination is a rising concern it is prudent to do this analysis.

Attitudes toward pay transparency

The norm is shifting toward greater pay transparency, but we advise organizations to address any identified inequities before being transparent about pay equity, especially when being transparent with the public.

Arjuna Capital publishes a Racial and Gender Pay Scorecard with select companies rated from A to F, so poor performance on pay equity may attract unwanted attention. That said, companies that at least disclose their analysis of pay equity will receive a better rating on Arjuna’s scorecard than those that do not disclose at all. The takeaway is to get started in the near future with a high-quality pay equity analysis and remediation plan, and then consider what to disclose.

Currently, only about 5% of respondents share pay equity results publicly (see Figure 14). Even when it comes to sharing results internally, organizations are circumspect. Over three-quarters of organizations share results with leadership and HR.

Surprisingly, fewer than half of organizations share results with their legal department. When examining pay equity, we recommend working with legal counsel to ensure appropriate protocols are followed. Only 13% share results with employees. This caution with employees is appropriate until the organization ensures that its pay equity house is in order.

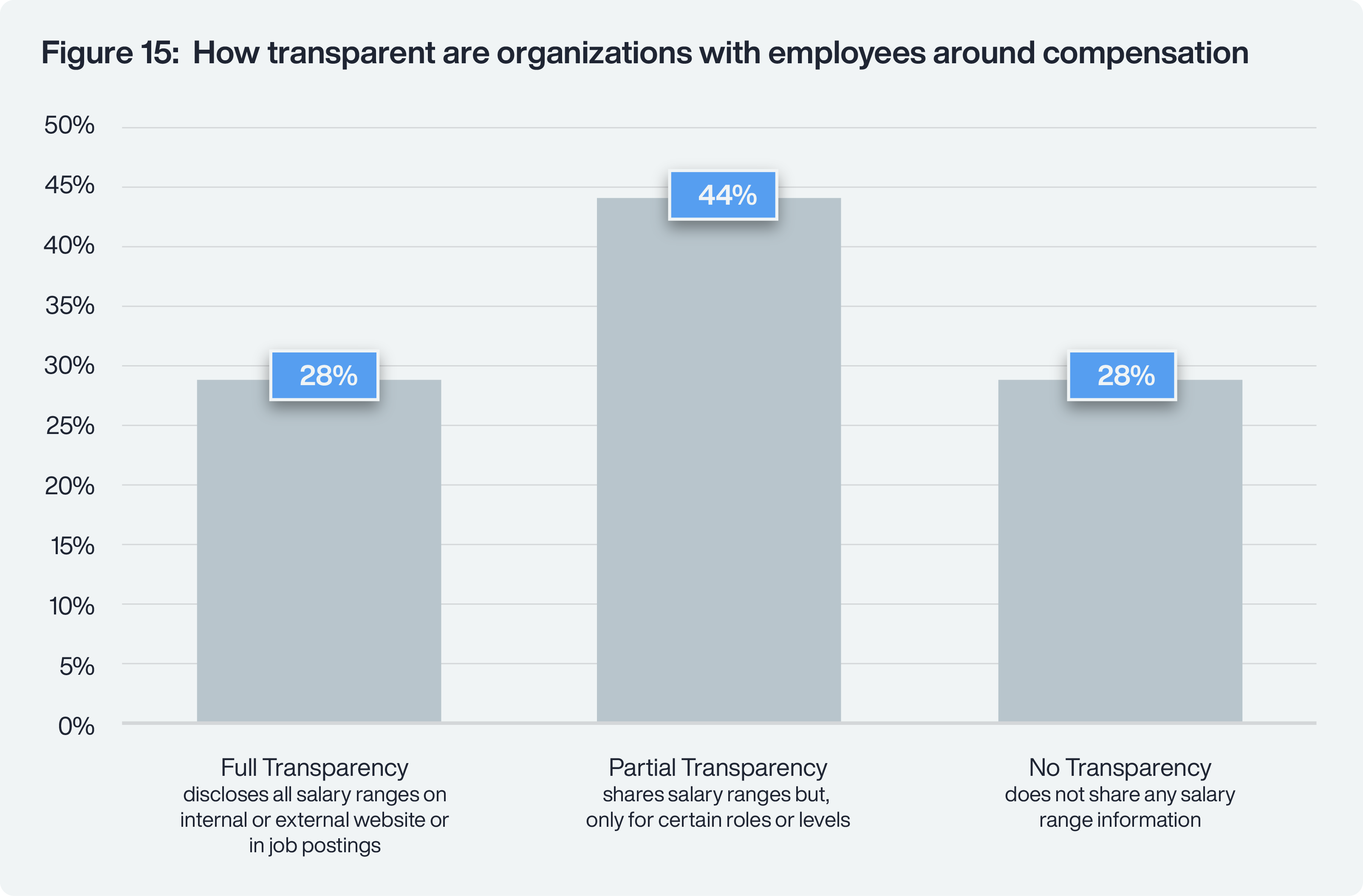

Another aspect of pay transparency is sharing information on salary ranges. As shown in Figure 15, 28% of organizations don’t share salary ranges with employees at all, and 44% only share salary ranges for certain roles or levels. There will likely be more transparency in the future since many jurisdictions have pay transparency laws that require including pay ranges in job postings. Organizations are being forced to be more transparent about pay, one job posting at a time.

Another aspect of pay transparency is sharing information on salary ranges. As shown in Figure 15, 28% of organizations don’t share salary ranges with employees at all, and 44% only share salary ranges for certain roles or levels. There will likely be more transparency in the future since many jurisdictions have pay transparency laws that require including pay ranges in job postings. Organizations are being forced to be more transparent about pay, one job posting at a time.

The takeaway is that we are moving to a world of more pay transparency and this shift will increase pressure on organizations to share their pay equity results. The appropriate action to take is to get analysis and remediation of pay inequities underway now, before organizations are pressured into pay equity disclosures that damage their reputation.

Conclusion

Even among large organizations, there is room for improvement in how pay equity is addressed. Fortunately, the shortcomings noted in this study can be addressed by updating pay equity processes. Specialized software and partnering with experts can also help.

The most important actions to take include:

- Analyze all components of pay separately. In particular, do not overlook short-term and long-term incentives.

- Use multiple regression analysis as the foundation for your pay equity analysis. It is not sufficient to look only at medians or averages.

- Remediate pay inequities annually and monitor your pay equity situation throughout the year, either on a quarterly or semi-annual basis.

- Consider conducting an analysis that also checks for pay inequities based on age.

- Proactively prevent pay inequities by running a pay equity simulation between the time manager merit pay changes are recommended and when they are finalized.

- Build pay equity analysis into the standard annual compensation process. Do not treat it as an after-the-fact add-on.

- Don’t let perceived obstacles to achieving pay equity lead to inaction. There are powerful ethical, legal, business, and compliance reasons for getting pay equity right.

- Ensure you have access to deep expertise in pay equity, either by developing internal resources or finding an external partner.

To learn more click here to see the Empsight report.

Leverage the world’s most trusted pay equity software solution

Pay equity software solutions support organizations in achieving pay and opportunity equity. However, an important part of your due diligence is ensuring that your software solution is legally compliant.

Trusaic’s pay equity software solution conducts a pay equity audit across your workforce at the intersection of gender, race/ethnicity, age, disability and more in one statistical regression analysis, taking a neutral approach in looking for pay disparities. This empowers you to address and prevent pay inequities in a legally compliant manner.

And now, PayParity® with R.O.S.A. helps you optimize your pay equity remediation efforts. Developed by Trusaic’s market-leading data science team, R.O.S.A. (Remediation Optimization Spend Analysis) enables you to:

- Remediate pay disparities with enhanced precision; and

- Prioritize remediation efforts based on the ROI of each dollar spent.

By leveraging the right pay equity software solutions, you can help your organization achieve pay equity in a legally compliant way with confidence.