Spot risks before

regulators do

Submitting pay transparency reports is more than meeting a deadline — it’s about presenting clean, defensible data. Use PayParity to uncover and address pay inequities, then produce accurate reports and contextual narratives regulators expect to avoid scrutiny and meet compliance requirements.

Schedule Demo

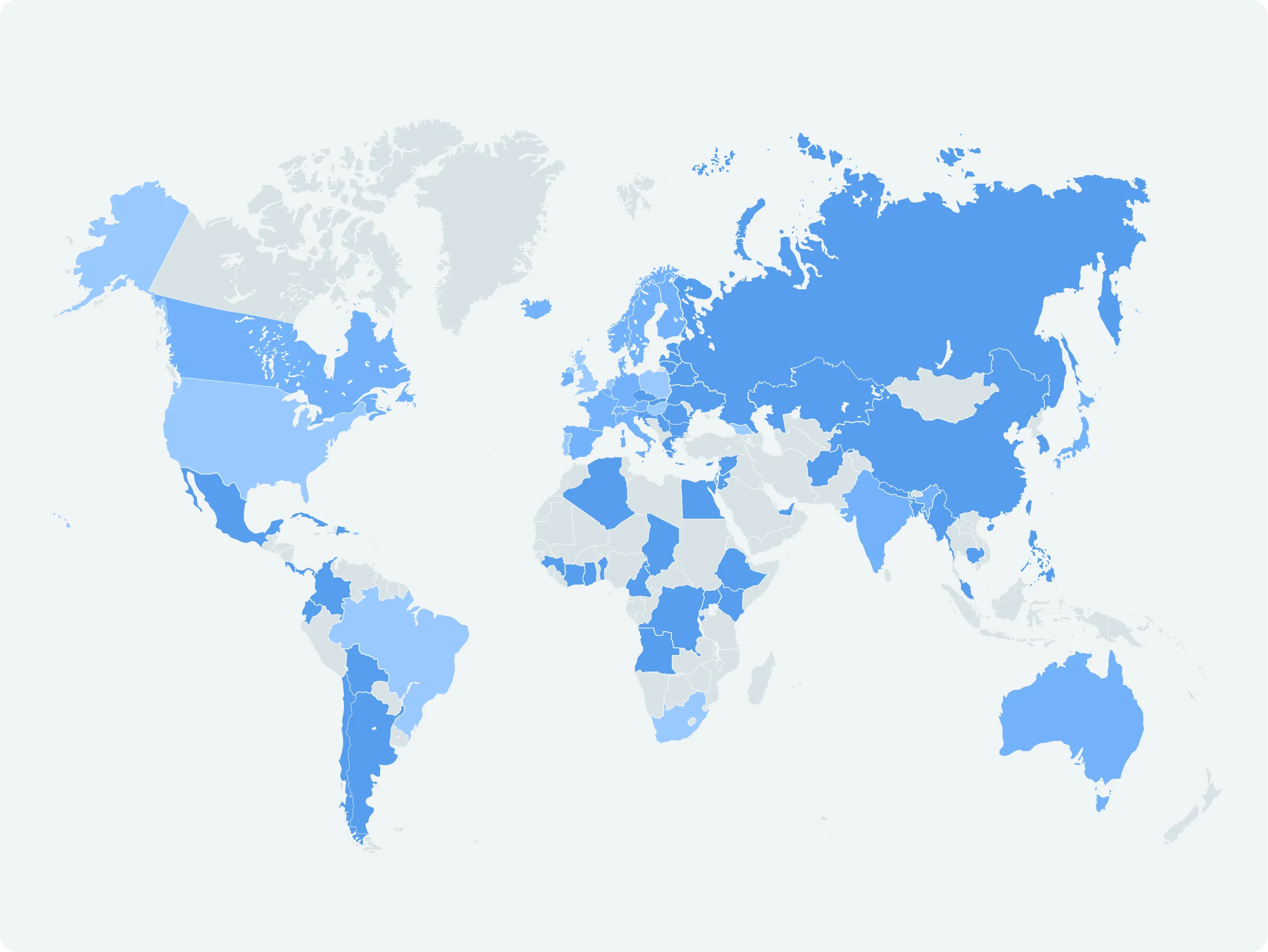

Analyze globally. Verify locally. Report confidently.

Pay transparency laws vary by jurisdiction — whether at the state, provincial, or national level — each with unique reporting requirements. Trusaic’s platform enables unlimited pay equity analyses globally and jurisdictionally, ensuring that your pay gap reports reflect defensible data and reduce regulatory risk.

Schedule Demo

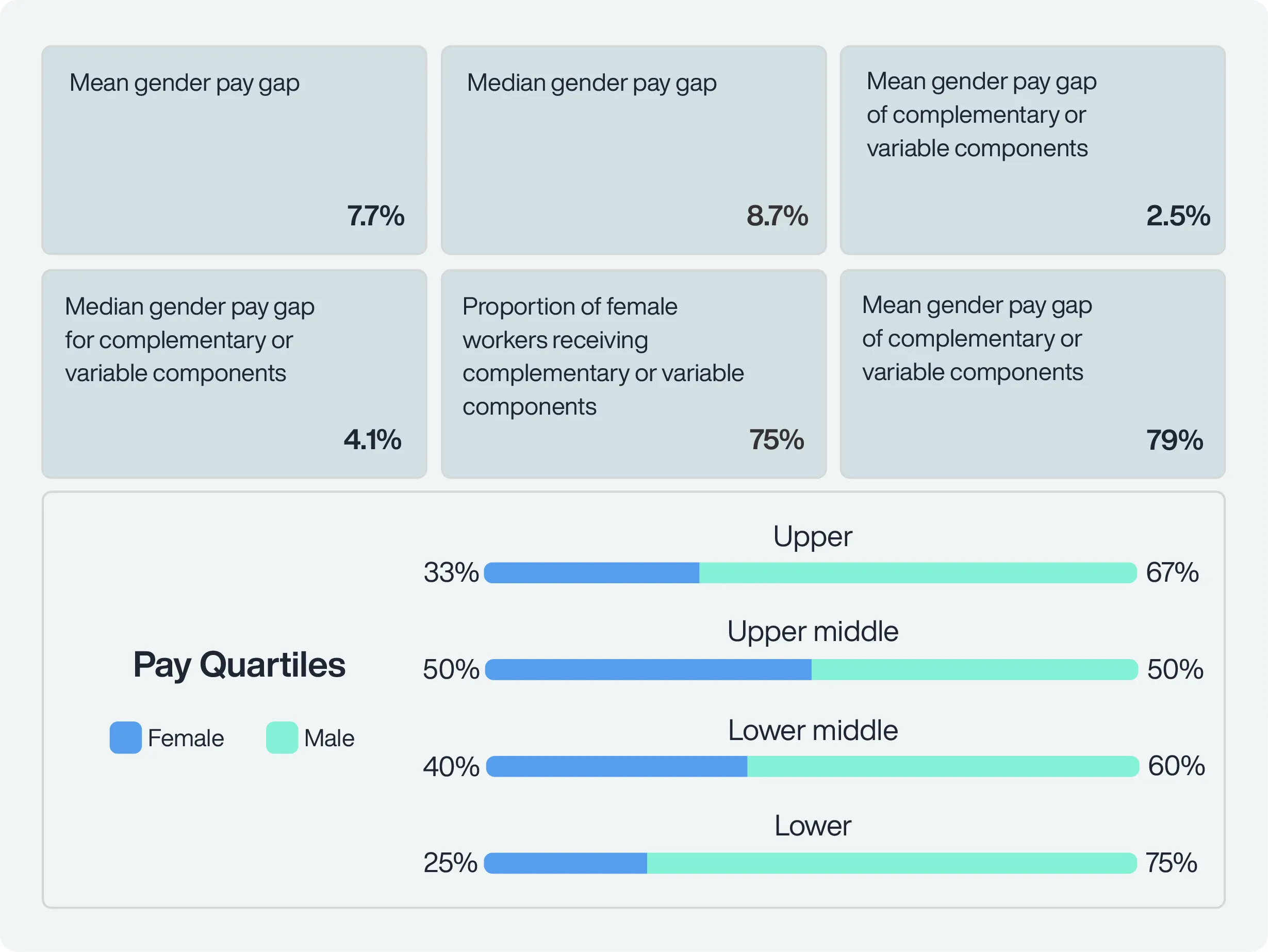

More than numbers. Defensible reports require context.

Submitting pay gap reports without context leaves your data open to interpretation — and scrutiny. Trusaic’s platform simplifies the process by providing the tools and guides you need to craft the narratives regulators expect, helping you explain your progress and ensure your reports are defensible. Control the narrative before others do.

Schedule Demo

Global compliance guides updated in real time

Navigating pay transparency laws is challenging, with new regulations constantly emerging. Trusaic’s Global Pay Transparency Reporting Center provides 50+ detailed compliance guides, continuously updated by our regulatory experts to ensure you’re always informed. Our platform helps you meet local reporting requirements worldwide with confidence.

Learn More

Key Features

Jurisdictional pay gap reporting

Produce reports that meet the unique

reporting requirements of over

50 jurisdictions worldwide.

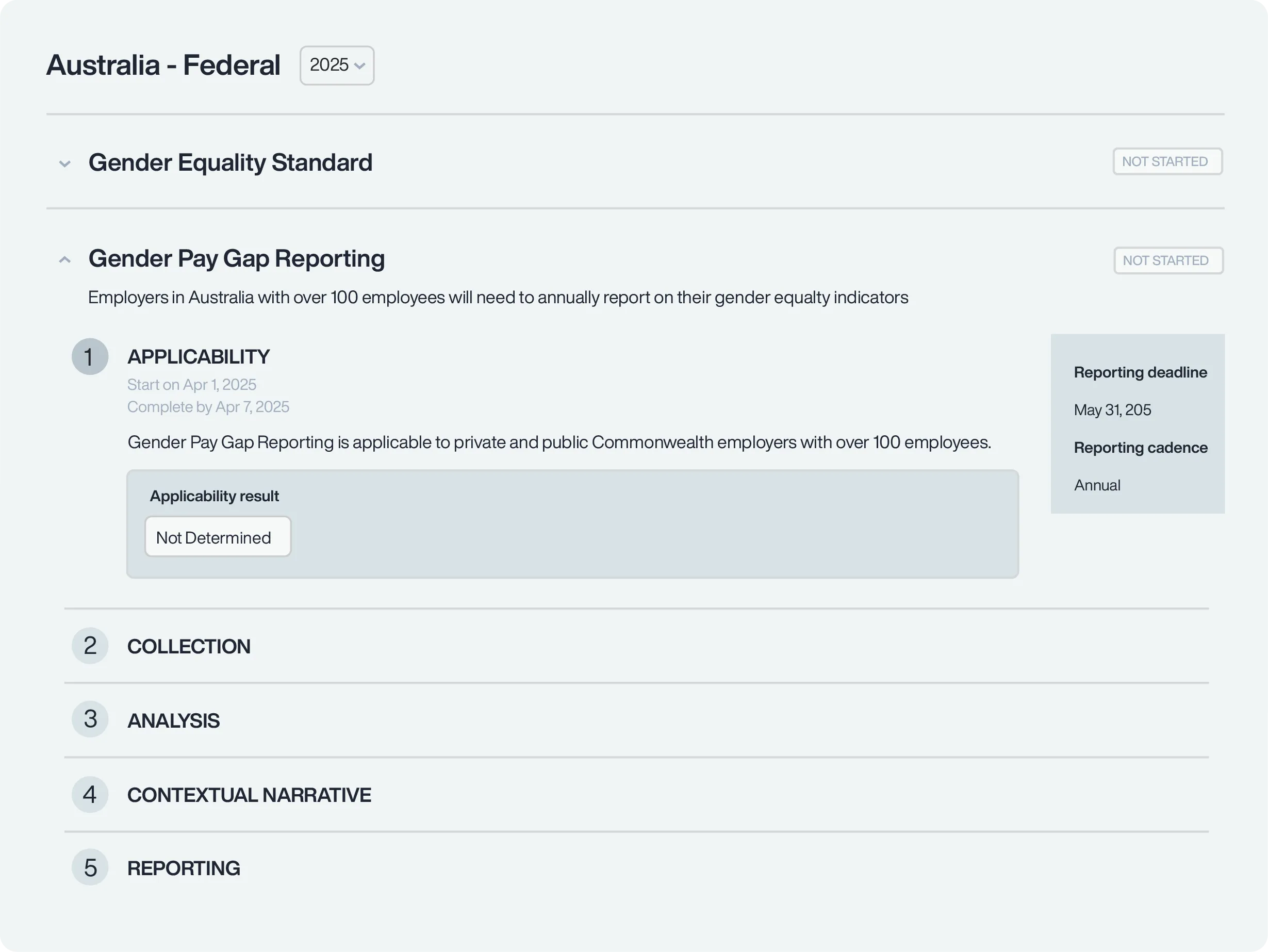

Streamlined report submission

Prepare compliant pay gap reports and

contextual narratives that are submission

ready for local regulatory agencies.

Guided narrative creation

Receive built-in guidance to craft

jurisdiction-specific narratives that

explain pay gaps and reduce scrutiny.

Unlimited pay equity analyses

Run global and jurisdiction-specific

pay equity analyses to ensure your

data is defensible and ready to report.

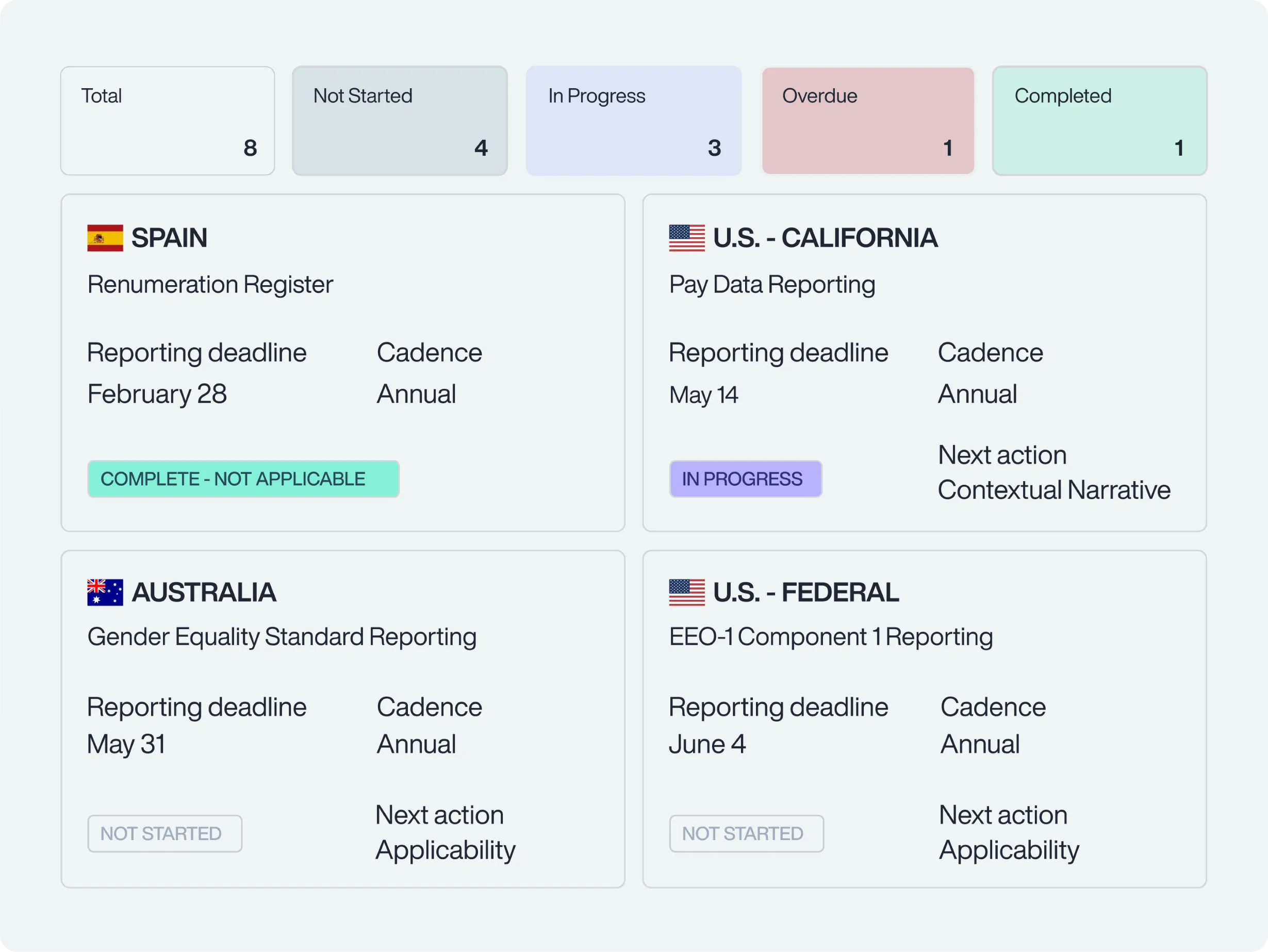

Centralized compliance dashboard

Track reporting deadlines monitor

progress, and manage workflows across

jurisdictions in one platform.

Future-ready compliance tools

Stay ahead of evolving pay transparency

laws with a platform that adapts to

new reporting requirements worldwide.

Capabilities

FAQs

-

Can Trusaic's platform handle global pay transparency requirements?

Yes. Trusaic supports pay transparency reporting across 50+ jurisdictions worldwide. The platform helps you track deadlines, generate reports, and submit narratives to local regulatory agencies.

-

What happens if my pay transparency report shows a pay gap?

Pay gaps are common, but unexplained gaps can attract regulatory scrutiny. Trusaic helps you craft narratives to show progress toward pay equity and reduce enforcement risks.

-

How does Trusaic ensure our reports meet jurisdiction-specific requirements?

Trusaic’s platform adapts to local pay transparency laws worldwide, ensuring reports meet unique regulatory standards across states, provinces, and countries.

-

Does Trusaic help with narratives for pay transparency reports?

Yes. Trusaic provides built-in tools to help you craft contextual narratives that explain pay gaps and demonstrate your commitment to pay equity.

-

How does Trusaic help us reduce the risk of regulatory enforcement?

Trusaic ensures you meet all reporting deadlines and submit accurate, defensible reports. By addressing pay inequities in advance, you reduce the risk of regulatory action.

-

Why is pay equity analysis important before submitting pay transparency reports?

Pay transparency reporting is based on payroll data and shows unadjusted pay gaps. Pay equity analysis uses HRIS and compensation data to identify and correct unexplained pay inequities. Conducting a pay equity analysis first ensures your pay transparency reports won’t reveal illegitimate pay gaps, reducing regulatory risk.