Introduction

While the EU Pay Transparency Directive may seem far off, the reality is there’s one compensation cycle before it takes effect – now is the time to act. Delaying could cost your organization both reputationally and financially.

If you are looking for a trusted partner to help you comply, a decision will need to be made quickly. More than 50,000 companies are affected by the EU Pay Transparency Directive – and there are very few pay equity solutions that will support compliance. Organizations that delay too long will be without a vendor and responsible for their own compliance.

Trusaic is actively working with our clients to prepare them for the EU Pay Transparency Directive’s implementation leveraging our RAPTR™ solution to upload data and calculate the seven key pay gap metrics that will be required under the Directive.

However, in order to understand and correct any wage gaps between worker categories in advance of the EU Directive rollout, an initial analysis is recommended. In this guide we provide an overview of our recommended approach and how we help you comply.

For country-by-country pay transparency regulations and broader EU context, visit our EU Pay Transparency Hub.

Our recommended action steps

Step 1: Establish a task force or identify key stakeholders

Identify all of the individuals responsible for accessing and/or collecting payroll and compensation data across the EU Member States where your organization is active. These may include HR departments and personnel at the local level, as well as worker representative groups or unions that will be involved.

Step 2: Conduct a data inventory and audit

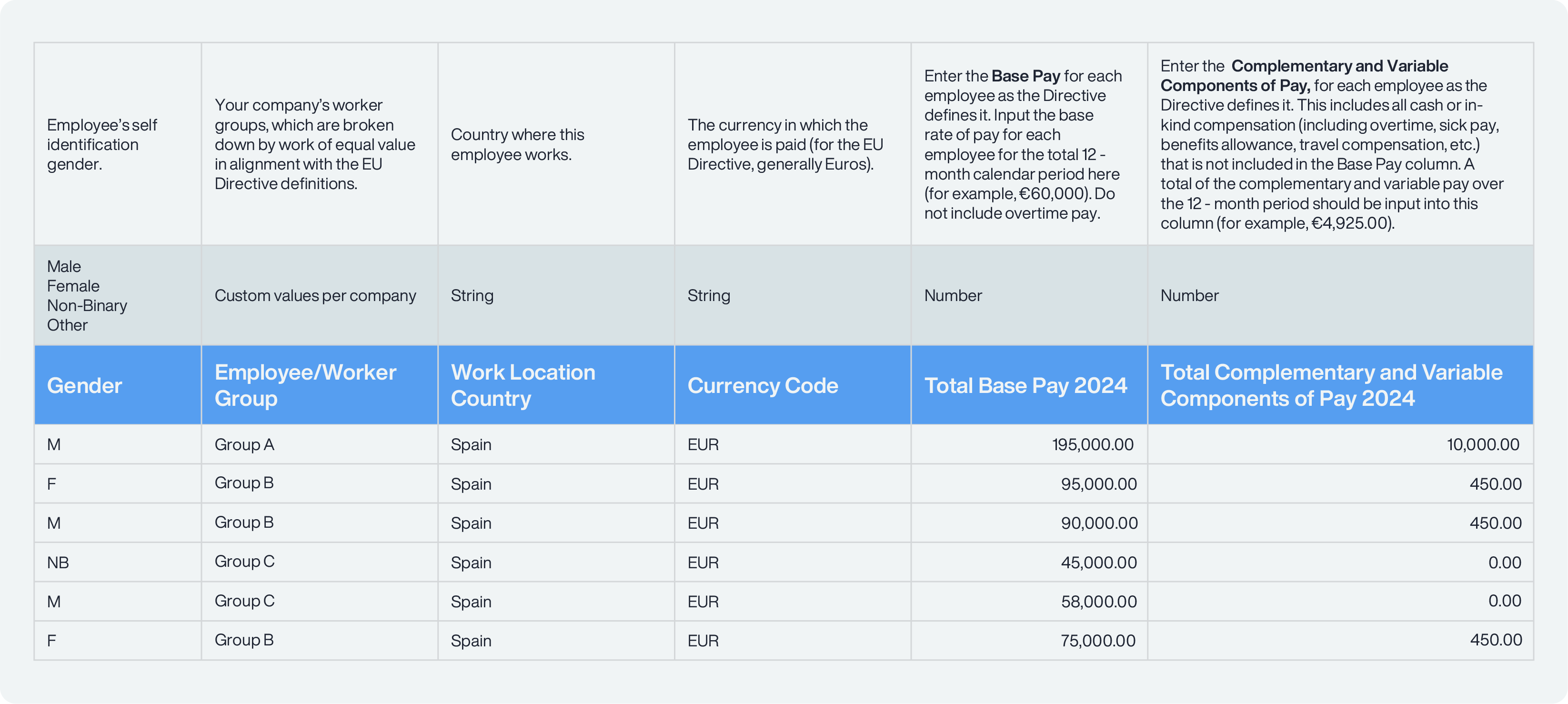

Determine where Base Pay, Complementary, and Variable Components of Pay data are stored in each country. Ensure all pay components – including bonuses, allowances, pensions, and statutory compensation – are recorded for a 12-month reference period, as required by the EU Directive.

Step 3: Establish worker groups according to the equal value principle

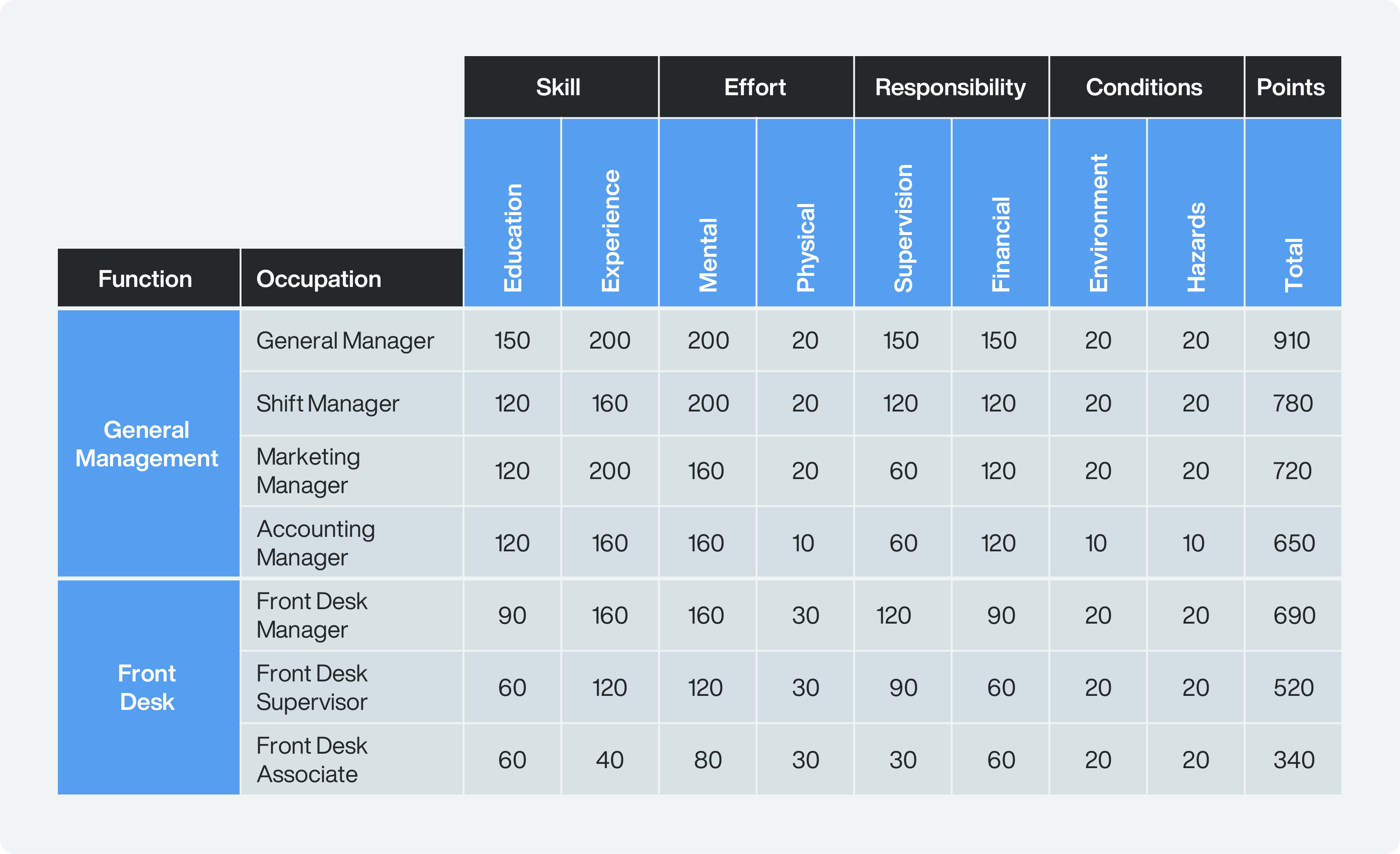

Use objective tools and criteria (skills, effort, responsibility, working conditions) to define worker categories per the “Equal Pay for Work of Equal Value” principle. Worker groups should be structured based on non-discriminatory, gender-neutral criteria. Based on this assessment, employers may create worker groups. Relevant definitions under the EU Directive include:

- Category of workers: a group of workers performing the same work; or work of equal value grouped in a non-arbitrary manner based on non-discriminatory and objective gender-neutral criteria.

- Work of equal value: work that is determined to be of equal value in accordance with non-discriminatory, objective, gender-neutral criteria, such as skills, effort, responsibility, and working conditions.

Example of one possible method to conduct a job evaluation (using a point-factor system) from the ILO resource above.

Step 4: Collect worker data for a 12-month reference period

Select a reference period (e.g., January 1 – December 31, 2024) and gather workforce data on all active employees from the last day of that period.

Step 5: Conduct gender pay gap analysis

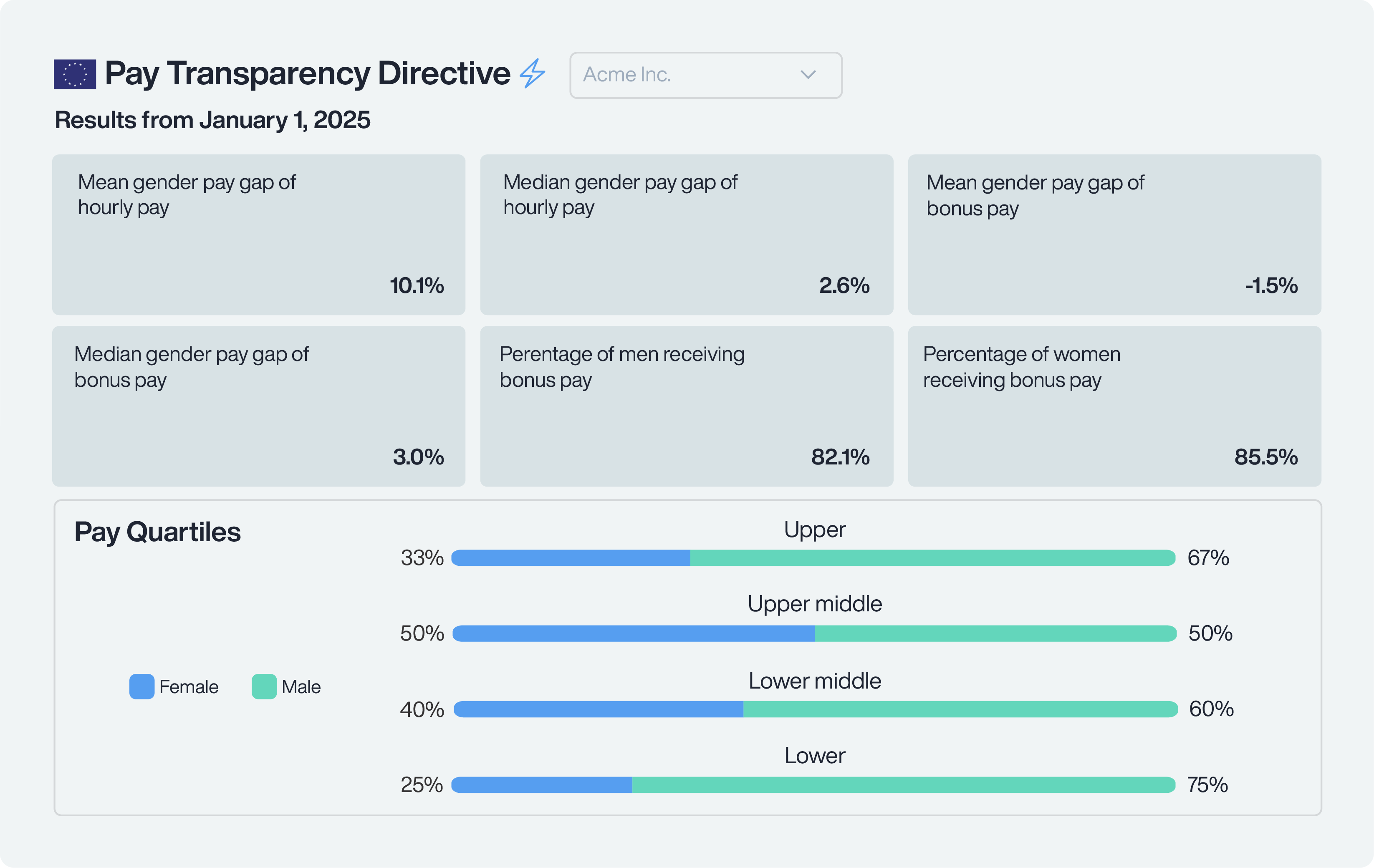

Trusaic will calculate the seven key metrics that are required under the EU Directive, using the supplied data workbook.

Step 6: Review gender pay gap analysis

Understand which employee groups have raw gender pay gaps ≥5% in the initial analysis.

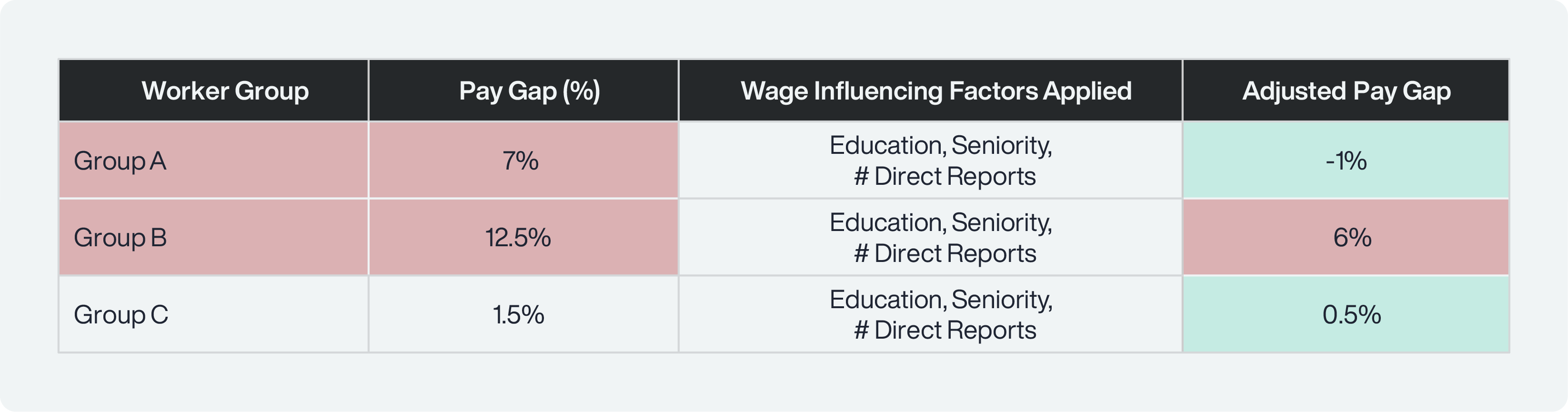

Step 7: Apply WIFs to payroll data

Use Trusaic’s PayParity® software to apply WIFs through multiple regression analysis. This will determine if factors such as education, seniority, or direct reports explain pay gaps. If gaps persist beyond 5%, proceed to further analysis (Step 8).

Step 8: Conduct additional analysis and remediation if necessary

Perform further analysis in PayParity using compensation data rather than payroll data. Assess individual compensation elements separately. If gaps above 5% remain after accounting for WIFs, plan for remediation before the EU Pay Transparency Directive takes effect.

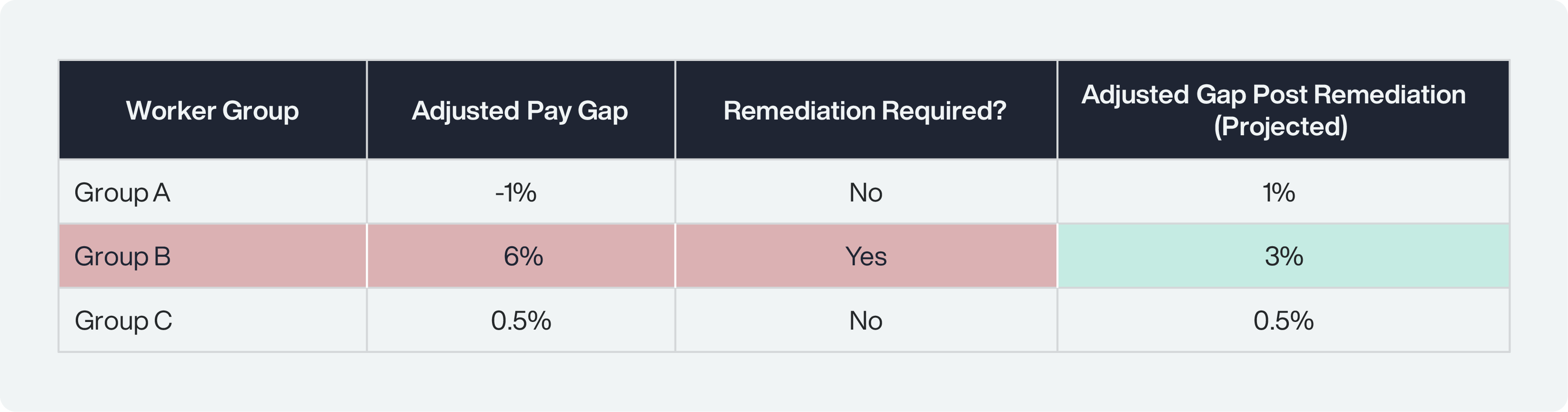

- As an example, see three worker groups below where WIFs have been applied to the raw pay gap to produce an adjusted pay gap.

- After adding controls for Education, Seniority, and Direct Reports, Groups A and C have pay gaps that are below 5%, but Group B is still greater than 5%.

For any adjusted pay gaps that are still greater than 5%, budget and plan to remediate gaps before the EU Pay Transparency Directive is implemented.

As an example, see three worker groups below. Group B could not be explained through gender-neutral factors and required the company to remediate pay gaps.

Step 9: Monitor EU Directive adoption across Member States

Trusaic is tracking and updating as member states enact legislation to adopt and roll out requirements under the EU Directive. Details on the reference period for payroll data, specific compensation elements to be included/not included, allowable Wage Influencing Factors (WIFs), and reporting specifications unique to each Member State will be communicated as they are available by Trusaic’s team.

Metrics for the EU Directive

The EU Pay Transparency Directive has identified seven key metrics that must be reported; individual countries may include additional requirements. These are the seven metrics to review for a preparedness analysis. Across the entire organization:

- Mean gender pay gap (Using gross pay, including base and complementary or variable components)

- Median gender pay gap (Using gross pay, including base and complementary or variable components)

- Mean gender pay gap for complementary or variable components

- Median gender pay gap for complementary or variable components

- Proportion of female and male workers receiving complementary or variable components of pay

- Proportion of female and male workers in each quartile pay band

Within each category of worker:

- Gender pay gap between workers by categories of workers, broken down by:

- Base pay

- Complementary or variable components of pay

Joint pay assessments

What is a joint pay assessment?

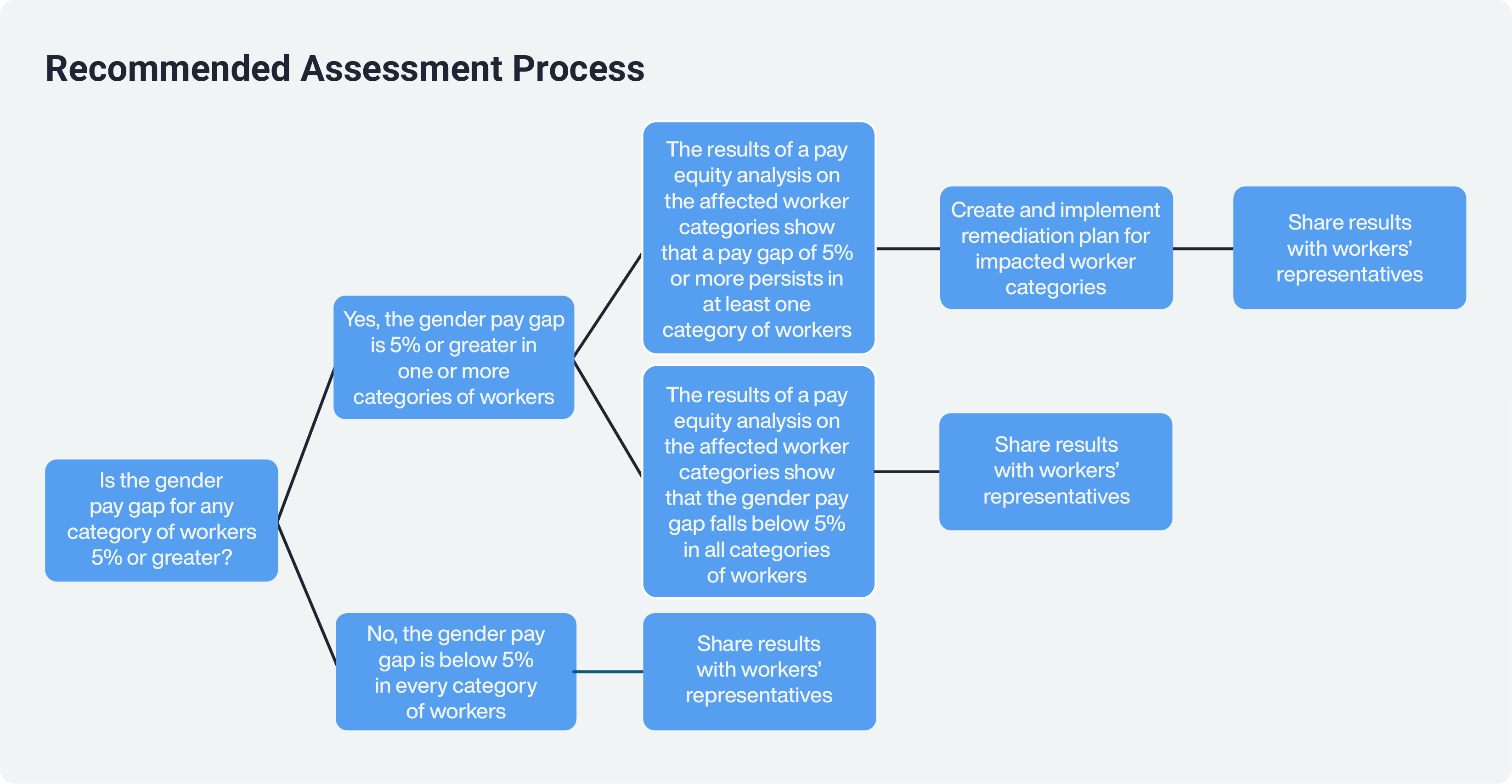

When certain conditions are met, employers may be faced with a second and stricter limb of the Pay Transparency Directive pay gap reporting obligation, called a joint pay assessment (JPA). The JPA is a detailed pay equity audit which is done in cooperation with workers’ representatives. The JPA includes seven criteria that examine the differences in pay discovered, reasons for the differences, and remedial measures.

Employers will need to conduct a joint pay assessment IF:

- Pay data reporting identifies a gender pay gap of at least 5% in any category (grouping) of workers;

- Employer cannot justify such gap on the basis of objective gender-neutral factors; and

- Employer has not remedied such unjustified difference in average pay level within six months of the date of submission of the Pay Data Report

Preventing a joint pay assessment

If there is a pay gap of 5% or larger in any employee groups, this would trigger a joint pay assessment (JPA) under the EU Pay Transparency Directive. To avoid a JPA, employers will either need to explain or correct large gaps. Gaps can be explained by using additional relevant Wage Influencing Factors to create new adjusted pay gaps, or using other context to justify their gaps using gender-neutral factors.

Triggering a JPA will prove time consuming and risky for employers. Calculating the raw pay gap metrics and applying gender-neutral factors in advance to explain any pay gaps detected can help prevent triggering a JPA; as well as making preemptive pay adjustments if an unjustified difference in pay is discovered.