Introduction

The Affordable Care Act (ACA) is a comprehensive healthcare reform law that was first enacted under President Barack Obama in 2010. The implementation of the ACA (Public Law No. 111-148) represented the largest set of tax law changes in decades. The ACA (and as amended by the Health Care and Education Reconciliation Act of 2010) comprises the most significant set of regulatory changes in U.S. healthcare since the enactment of Medicare and Medicaid in 1965, with far-reaching implications for both individuals and employers.

The impact of ACA on employers

The Employer Shared Responsibility Payment (ESRP) provisions are a component of the ACA directed at employers. Also known as the Employer Mandate, the ESRP took effect, starting in 2015. Key elements that impact the ESRP are as follows:

- The ESRP, otherwise known as the Employer Mandate, requires Applicable Large Employers (ALEs), employers with 50 or more full-time employees and full-time equivalent employees (FTE), to offer Minimum Essential Coverage (MEC) to at least 95% of their full-time workforce and their dependents whereby such coverage meets Minimum Value (MV) and is affordable to the employee. To prove compliance with the Employer Mandate, the offers of coverage must be reported through the submission of annual 1094-C and 1095-C form filings.

- Establishment of the Premium Tax Credit (PTC) and government-run health exchanges to provide individuals within a prescribed income range the opportunity to obtain affordable health coverage. Individual taxpayers can obtain PTCs from the government to subsidize, or lower the cost of health insurance plans purchased on government-run healthcare exchanges. However, in some instances, the issuance of PTCs can trigger tax penalties for employers, but more on that later.

- Expansion of Medicaid and Medicare allows Americans with income levels up to 138% of the federal poverty line (FPL) to enroll in Medicaid if the expansion was implemented in their state. As of August 2022, 39 states including Washington D.C. have expanded Medicaid coverage. Through a citizen-started measure, South Dakota is considering adopting the measure as well.

- Individual shared responsibility, or the Individual Mandate, required every citizen to be enrolled in health coverage or be subject to a tax penalty. This penalty was zeroed out as of January 2019. However, some states, including California, Massachusetts, New Jersey, Rhode Island, Vermont, and the District of Columbia created their own state-level individual mandates to replace the federal Individual Mandate. These individual mandates interplay with the Employer Mandate by incentivizing employees to obtain health coverage, whether through the employer, a government-run health exchange, or otherwise. As a result of these newly implemented individual mandates, these states also require additional ACA reporting requirements for employers with operations in their jurisdictions.

Implications of the ACA’s Employer Mandate

In accordance with the Employer Mandate of the ACA, ALEs must offer MEC to at least 95% (70% for 2015 only) of their full-time workforce and their dependents whereby such coverage meets MV and is affordable to the employee or be subject to penalties.

Determining whether an organization qualifies as an ALE can be challenging. It can be particularly complicated for organizations that have affiliations with other organizations. To know whether or not your organization is an ALE, an aggregated employer analysis must be performed.

To perform an aggregated employer analysis and subsequently determine ALE status, the following information must be reviewed:

- All legal entities that could potentially be related through ownership or working relationship

- The business structure and date each entity was formed

- Ownership information for each entity

- The working inter-relationship, if any, among entities, such as whether one provides services, such as management, for another

ACA compliance can be especially complex when there are multiple related entities, each of which consists of less than 50 full-time and full-time-equivalent employees. These entities may individually presume that each is not an ALE, but once the employer aggregation rules are correctly applied, they combine to form an ALE.

Significant consequences of this error to an employer include the failure to recognize its status as an ALE and the concomitant obligation to offer coverage as required under the ACA and the obligation to file and furnish ACA returns, either or both of which may result in significant IRS penalties. Another significant consequence of incorrectly performing an Aggregated Employer Group Analysis involves errors in allocating the ACA allowed reduction of full-time employees.

The IRS will not penalize the ALE Aggregated Group (or a single-entity ALE) for the first 30 full-time employees (this has been in effect since 2016 onward; transition relief in 2015 allowed for 80 full-time employees). However, the allocation of employees is ratably conducted among the members of an ALE Aggregated Group. Accordingly, it is essential to properly identify all ALE members.

In determining ALE status, another important consideration is the existence of seasonal workers. If an employer’s workforce exceeds 50 full-time employees, including full-time-equivalent employees (employees who perform at least 120 hours of work in a month), for 120 days or fewer during the preceding calendar year, and all of the employees in excess of 50 who were employed during that period of no more than 120 days were seasonal workers, the employer is not considered an ALE.

Note that a “seasonal worker” is different from a “seasonal employee.” A “seasonal worker” is one who performs labor or services on a seasonal basis as defined in certain Department of Labor Regulations; this category includes agricultural laborers and retail workers employed exclusively during holiday seasons.

For ALEs, ignoring the ACA is not an option. Given the complexities of conducting an aggregated employer group analysis, as well as preparing and submitting detailed, accurate, and on-time annual information returns to the IRS, many companies opt to work with ACA compliance specialists who can reduce the risk of costly IRS penalties, ensure full compliance with the ACA, and offer protection in the event of an audit.

The present and future of the ACA

In his first term, President Trump previously identified the repeal and replacement of the ACA as a priority in 2016. While successful in eliminating the Individual Mandate (one of the significant provisions in the ACA) beginning January 2019, other key provisions of the ACA remain intact, including the Employer Mandate.

In efforts to address the loss of the Individual Mandate at the federal level, a number of states, including Massachusetts, Maryland, New Jersey, California, Rhode Island, and Vermont, have passed state-specific ACA compliance legislation to create their own individual mandates or other related healthcare initiatives. Arguably the most significant indicator that the ACA’s Employer Mandate is here to stay is IRS enforcement activity. The IRS is currently issuing penalties, through the Letter 226J, some in the millions of dollars, to ALEs for not complying with the ACA. The statute of limitations for penalties was recently set at six years.

The U.S. Treasury Inspector General for Tax Administration (TIGTA) has reported that $4.5 billion dollars in penalties were issued for the year 2015. The TIGTA report also noted that the IRS had spent over $2.8 million to improve its process for identifying, calculating, and processing non-compliant ALEs. The IRS has since updated its tools for identifying ACA non-compliance and has issued significant penalties enforcing compliance with the ACA and began sending letters for the 2022 tax year.

The IRS disclosed its use of an automated ACA compliance validation system (ACV) tool that identifies ACA non-compliance based on annual ACA filings, suggesting that more ALEs will receive an IRS Letter 226J with each new year. In addition to Letter 226J penalty assessments being issued, the IRS is also issuing ACA penalties to ALEs that failed to timely file correct and complete Forms 1094-C and 1095-C with the IRS or timely furnish correct and complete Forms 1095-C to employees under IRC Sections 6721 and 6722.

These notices have focused on the failure to distribute Forms 1095-C to employees and to file Forms 1094-C and 1095-C with the IRS by the required deadlines. These comprise additional penalties beyond the penalties issued for not offering the required healthcare coverage under IRC Section 4980H. The IRS has determined penalty assessments for certain employers that failed to timely file/furnish the ACA information returns by using the number of W-2s employers filed with the IRS as a proxy for the number of Forms 1095-C. Using this proxy, which yields a larger estimate than the number of full-time employees, IRS penalties through Letter 5005-A and Form 886-A are potentially overestimated. Employers should be on the lookout for IRS warning notices as well.

Some organizations may see a Letter 5699 prior to the reception of an IRC Section 6721/6722 penalty assessment. Letter 5699 is sent to employers the IRS believes are ALEs and that they should be filing ACA information returns annually with the tax agency, but has no record of their filings. In Letter 5699, the IRS asks employers to confirm the name the ALE used when filing its ACA information, provide the Employer Identification Number (EIN) submitted and the date the filing was made.

How to comply with the ACA

For ALEs, compliance with the Employer Mandate of the ACA is essential. The underlying principle of the Employer Mandate is as follows: An employer with 50 or more full-time employees and full-time equivalent employees, or an ALE, is required to offer Minimum Essential Coverage (MEC) to at least 95% of their full-time workforce (and their dependents) whereby such coverage meets Minimum Value (MV) and is affordable to the employee or be subject to IRC Section 4980H penalties.

The three key elements of the Employer Mandate are:

Minimum Essential Coverage

The term “Minimum Essential Coverage” is defined by examples to include certain government-sponsored programs, such as Medicare and Medicaid, eligible employer-sponsored plans, and healthcare plans in the individual market. A notable distinction between employer-sponsored plans and “qualified plans” in the individual market through a government-run exchange is the requirement of “essential health benefits.” Essential health benefits include doctor visits, emergency services, hospitalization, maternity and newborn care, mental health, prescription drugs, rehabilitation services, and devices, lab services, preventative and well-being services, and pediatrics. Unlike qualified plans in the individual market, employer-sponsored plans do not require essential health benefits. Only qualified plans in the individual market through a government-run exchange allow for Premium Tax Credits (PTCs). PTCs are refundable tax credits designed to help individuals and their families with low or moderate income afford health insurance purchased through a state or federal health exchange, in the event that such individuals were not offered employer-sponsored coverage meeting the requirements of MEC, MV, and affordability.

Minimum Value

The IRS determines that a health plan provides MV if it covers at least 60% of the total allowed cost of benefits that are expected to be incurred under the plan. Typically, the Summary of Benefits and Coverage will confirm whether or not a plan meets MV requirements.

Affordability

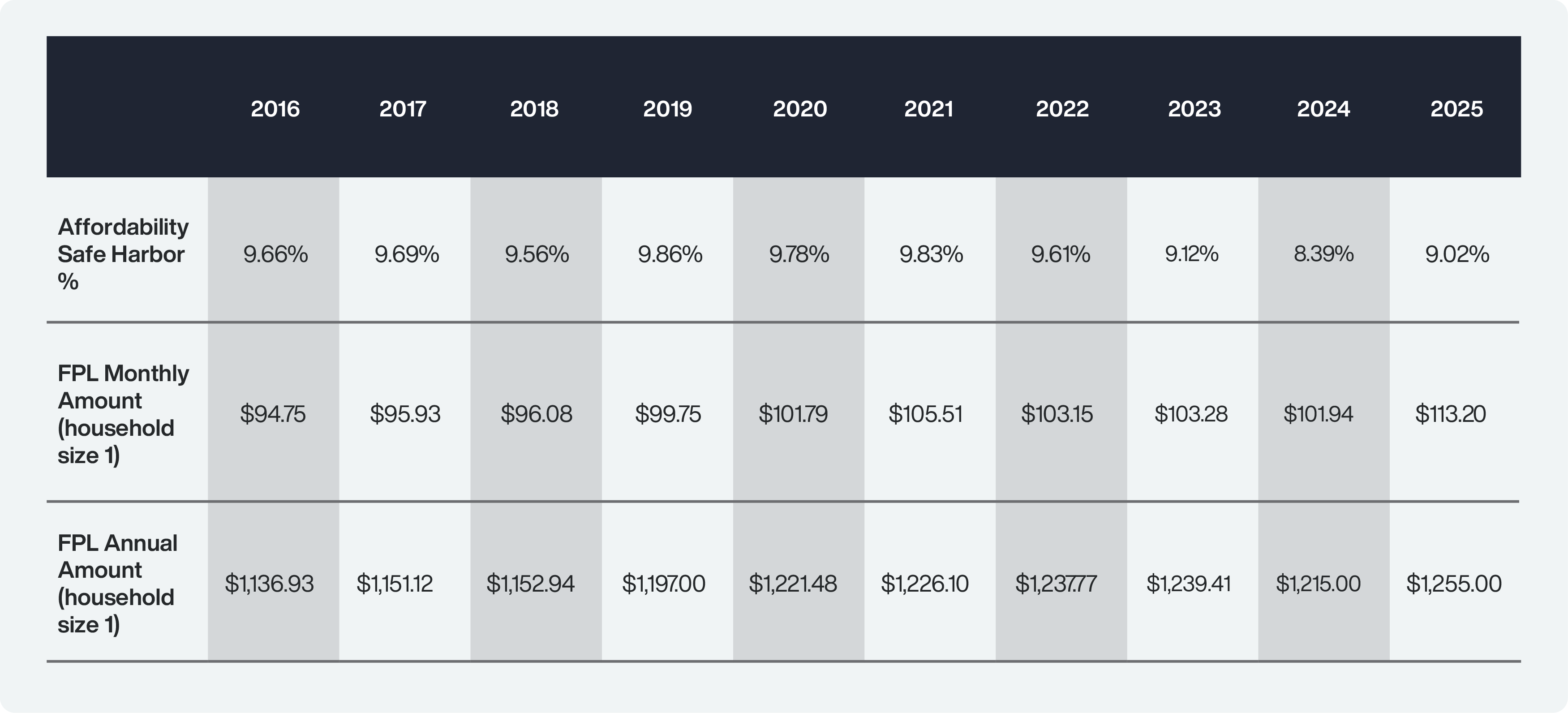

Affordability is calculated based on a cap of 9.5% of an individual’s annual household income. This 9.5% cap is adjusted annually. For the 2024 tax year, the affordability percentage is 8.39%. For previous years’ ACA affordability thresholds, please refer to the chart below:

To help employers determine ACA affordability, the IRS provides three safe harbors. They are outlined in the section below.

FPL Safe Harbor

This FPL Safe Harbor is determined using the Federal Poverty Level (FPL), which is adjusted on an annual basis. For the 2025 ACA reporting year, the mainland 2024 FPL of $15,060 for a household size of one is used. To meet this safe harbor for 2025, the employer would need to demonstrate that each ACA full-time employee was offered self-only coverage that did not exceed the product of the FPL multiplied by 9.02% and then divided by 12 ($15,060 x 9.02% / 12 = $113.20). If the employee contribution for self-only coverage meets or is below this amount, then the FPL Safe Harbor is met.

W-2 Safe Harbor

The W-2 Safe Harbor may be used to establish affordability if the employer’s lowest cost self-only coverage does not exceed 9.5% (as annually adjusted) of that employee’s Form W-2 wages. The W-2 Safe Harbor can be the trickiest safe harbor because it cannot be determined until the end of the reporting year. The reason for this is that the amount in the W-2 Box 1 is required for the affordability calculation. As an example, to claim the W-2 Safe Harbor for 2025, the following formula is generally used: W-2 Box 1 Wages multiplied by 9.02% with an adjustment for partial year coverage, if the employee in question did not have coverage for all 12 months. For more information on the W-2 safe harbor, see IRC Rule 54.4980H-5(e)(2)(ii)(A) and 54.4980H-5(e)(2)(ii)(B).

Rate of Pay Safe Harbor

The Rate of Pay Safe Harbor is based on an employee’s hourly rate or monthly salaried rate depending on employment status. This safe harbor may be used to establish affordability if the employer’s lowest cost self-only coverage that provides minimum value does not exceed 9.5% (as annually adjusted) of (a) for hourly employees, an amount equal to 130 hours multiplied by the lower of the employee’s hourly rate of pay as of the first day of the coverage period (generally the first day of the plan year) or the employee’s lowest hourly rate of pay during the calendar month or (b) for salaried employees, the employee’s monthly salary, as of the first day of the coverage period (instead of 130 multiplied by the hourly rate of pay).

- Hourly Workers:To determine the affordability threshold for an hourly worker, take the employee’s lowest hourly rate for the month and multiply by 130 (the minimum total of hours on a monthly basis to be treated as a full-time employee under the ACA). Take that product, and multiply by 9.02% (for 2025). This will identify the maximum monthly premium that the employee may be required to pay to satisfy affordability per ACA regulations. As an example: Chris works 130 hours at a $15 hourly rate in March 2025. Multiply $15 by 130. Take the result of $1,950 and multiply it by 9.02%. $175.89 is the maximum amount for March that Chris’s employer can require Chris to pay to cover himself if the employer wants to satisfy affordability for that month with respect to that employee.

- Salaried Workers: To determine the affordability threshold for a salaried employee, multiply the monthly salary by 9.02%. As an example: Joanna is a full-time employee who receives a monthly salary of $10,000. Multiply $10,000 by 9.02%. The $902 is the maximum monthly amount that Joanna’s employer can require Joanna to pay to cover herself if the employer wants to satisfy affordability for that month with respect to that employee.

How to assess full-time employees under the ACA

One of the most challenging aspects of achieving ACA compliance is accurately determining an ALE’s full-time employee count. There is a common misconception that “full-time” means 40 hours per week.

With regard to the ACA, full-time means averaging at least 30 hours of service per week or 130 hours of service per month. The Employer Mandate dictates that full-time employees as defined by ACA guidelines are those for whom an offer of MEC meets MV and affordability to avoid IRC Section 4980H penalties. As noted above, the full-time employee count is also a significant factor in determining whether an employer meets the threshold to qualify as an ALE.

The distinction between full-time and full-time-equivalent employees is as follows:

- Full-time employees In accordance with ACA guidelines, a full-time employee is a worker who, on average, works at least 30 hours per week, or at least 130 hours in a calendar month. The IRS allows employers one of two measurement methods for determining full-time employee status.

- Full-time-equivalent employees The ACA designates full-time-equivalent employees as a combination of employees, each of whom individually is not a full-time employee, but who, in combination, work the equivalent of a full-time employee. For example, two employees who each work an average of 15 hours per week are equivalent to one full-time employee. The full-time-equivalent employee determination only applies to whether an employer is an ALE.

How to implement the correct IRS measurement method for the ACA

The two methods sanctioned by the IRS for determining full-time employee status are the Look-Back Measurement Method and the Monthly Measurement Method. Employers are required to implement one of these methods to ensure accurate full-time determination.

The Look Back Measurement Method

The Look Back Measurement Method typically works best for workforces that include a substantial number of part-time, seasonal, or other variable-hour employees. For these workforces, it can be difficult to identify in advance which employees are considered to be full-time under the ACA. The Look-Back Measurement Method allows employers to monitor and track their employees’ hours of service to determine if they are full-time before extending an offer of coverage. The Look-Back Measurement Method consists of three different periods:

The measurement period

During this period, which can be as short as three months to as long as 12 months, each employee’s hours are tracked and averaged. Many employers prefer to use a 12-month Measurement Period, allowing for a more normalized calculation of an employee’s average hours of service.

The administrative period

Following the Measurement Period, there is an optional Administrative Period of no longer than 90 days. The IRS has specifically rejected an extension of this 90-day period to three full calendar months. The Administrative Period must begin immediately following the end of a Measurement Period and end immediately prior to the start of the associated Stability Period. The Administrative Period is typically used as a duration of time to collect and prepare all the paperwork necessary to ensure that an offer can be made at the start of the Stability Period. The length of the Administrative Period may vary depending on the type of Measurement Period that was completed.

For example, with regard to new hires completing their initial Measurement Period, employers may opt for a 30-day waiting period as opposed to a standard 60-day Administrative Period for ongoing employees.

The stability period

After the optional Administrative Period has been completed, the Stability Period begins. The onset of the Stability Period should align with the beginning of an employee’s offer coverage effective date. This period determines the employee’s full-time or non-full-time status based on the results of the preceding Measurement Period. During the Stability Period, regardless of the hours they are currently working, employees are identified as either full-time or not full-time. While not subject to the same requirements pertaining to full-time employees, an employer is free to offer coverage to non-full-time employees as well. For most employers, it makes the most sense to align the Stability Period with the health plan year.

The Monthly Measurement Method

The Monthly Measurement Method is more straightforward than the Look-Back Measurement Method. This method is designed for employers who have primarily full-time workforces. Employee status is based on whether or not a given employee performed a minimum of 130 hours of service a month or 30 hours a week. Under the Monthly Measurement Method, an employee’s status can fluctuate between full-time and non-full-time status, as there are no stability or measurement periods. Each month, employee hours are averaged to determine status. For organizations with a significant number of variable-hour employees, the Monthly Measurement Method is typically not preferred.

Changes in employment status

Additional rules apply when an employee switches from a full-time position to a non full-time position, and vice versa.

Penalties for not complying with the ACA

For ALEs, the stakes for ACA compliance are high. The Congressional Budget Office has estimated that the IRS will collect $228 billion in ACA penalties over the period between 2017-2026.

Employers that fail to comply with the ACA can be penalized millions of dollars under IRC Section 4980H. Section 4980H penalties have two components. The “A” penalty, under IRC Section 4980H(a), for an ALE that fails to offer MEC to 95% of full-time employees (and their dependents), is calculated at an annualized rate of $2,900 for the 2025 tax year multiplied by the total number of full-time employees (minus up to 30).

The “B” penalty, under Section 4980H(b), is calculated at a rate of $4,350 for the 2025 tax year multiplied by the number of full-time employees who obtain a tax subsidy because the ALE did not offer MEC or, if such coverage was offered, that coverage failed to meet the requirements of MV and affordability for the employee. These penalties are currently being issued to employers through IRS Letter 226J.

In addition to penalties under IRC Section 4980H, further penalties can be assessed to employers who fail to achieve ACA compliance. Under IRC Sections 6721 and 6722, penalties may be assessed for failing to accurately and completely file returns to the IRS and/or failing to accurately and completely furnish statements to the applicable employees.

Depending on the lateness of the filing, penalties can range from $60 to $330 per return (whereby each applicable employee counts as one return) for the 2024 tax year and can add up to more than $6 million for combined filing and employee statement distribution failures. Moreover, penalties are doubled for a willful failure, in which an employer bears the burden to demonstrate reasonable diligence despite failure to comply.

The IRS has issued penalties under IRC Sections 6721 and 6722 to employers who failed to file any returns using Letter 5005-A/Form 886-A. For employers who filed late, the IRS issues penalties under IRC Sections 6721 and 6722 using Notice 972CG.

The benefits of an ACA Penalty Risk Assessment

For employers who seek to achieve ACA compliance, the benefits of an ACA Penalty Risk Assessment are extensive. Filing incorrectly or with incorrect information could result in millions of dollars of Employer Shared Responsibility Payments (ESRPs) under IRC Section 4980H, like those included in IRS Letter 226J, and/or other reporting penalties under IRC Sections 6721 and 6722.

Conducting an ACA Penalty Risk Assessment can ensure that such penalties are avoided, and that a number of critical ACA filing items are fulfilled:

- Submission of the correct company name(s) and associated EIN(s)

- Listing of all ALE members and correct allocation of the reduction of full-time employees among ALE members

- Accurate annual and monthly reporting for all indicators

- Correct and logical entry of code combinations

- Listing of all covered members for self-funded plans

- Claim of all appropriate safe harbors

In addition, an annual assessment of a company’s ACA information returns (Forms 1094-C/1905-C) will help support best practices in multiple areas of ACA compliance:

- Consolidating, aggregating, and validating various forms of workforce data, including HR, time and attendance, payroll, and health benefits data, for each month of the applicable reporting year

- Conducting a monthly audit of employment classifications, such as full-time, part-time, variable, and seasonal

- Determining workforce composition, at both the ALE aggregated employer Group level and the EIN level

- Calculating health coverage affordability for each applicable employee

- Confirming and sustaining 100% accuracy of workforce data

ACA compliance and reporting

For employers, best practices in ACA compliance and reporting involve not only annual but monthly tracking, and include the following key areas: (1) accurate documentation and record-keeping, (2) data quality management, and (3) regulatory expertise.

Documentation and record-keeping

Monthly ACA compliance relies heavily on supporting documentation to verify accurate reporting and to prepare employers in the event of an IRS audit. Documentation should include items such as a summary of benefits and coverage, rate contribution sheets, offers of coverage to employees, medical invoices, enrollment forms, waiver forms, and acknowledgment of offers to employees for the relevant reporting year.

Data quality management

Ensuring clean, accurate data across various platforms can prove challenging for many employers. Requisite data includes census information, time and attendance, employment type, wage and rate information, and contribution structures, all of which must be accurately tracked to achieve compliance with the ACA. For employers who also use non-electronic files, unstructured HR data is another factor to consider. Ultimately, the quality of analytical data outputs is only as good as the quality of the raw data inputs.

This creates an additional degree of risk for employers who utilize do-it-yourself software packages, which automatically complete IRS forms without verifying that the data being used is accurate and often apply defaults that expose employers to penalties unless affirmatively changed. Flaws in data quality management are also significant triggers of ACA penalties issued by the IRS.

Regulatory expertise

In a dynamic regulatory landscape, a thorough and meticulous understanding of the requirements of the ACA Employer Mandate is essential. If employers do not have in-house staff with a comprehensive understanding of ACA regulations, it can be valuable to enlist the help of third-party ACA specialists who understand how to interpret and take action in accordance with the requirements of the ACA.

Mastery of ACA regulatory concepts, such as IRS-approved measurement methods, affordability safe harbors, and limited non-assessment periods, can be vital to minimizing or eliminating the risk of IRS penalties.

Full-service ACA compliance solutions

For ALEs, particularly those with variable workforces, enlisting outside support specializing in ACA compliance can help ensure accurate, on-time reporting and reduce the risk of IRS penalties. Trusaic’s full-service, comprehensive ACA compliance solution, ACA Complete, provides the following:

- A strong command of the current regulatory landscape

- A detailed grasp of the nuances of Employer Mandate compliance

- Ability to perform advanced data wrangling and prepping across disparate platforms, including payroll, benefits administration, time and attendance, and HR, as well as unstructured workforce data

- A full-service approach to federal and state ACA filing

- Designated support in the event of an IRS audit, backed by a clean, fully successful audit record

The best way to determine the value of external ACA compliance support is to get your ACA Vitals score. This short self-assessment will help your organization understand the inherent ACA risk areas within your organization. Armed with this information, you can confidently determine if a full-service ACA compliance solution, like ACA Complete, is in your best interest.