Introduction

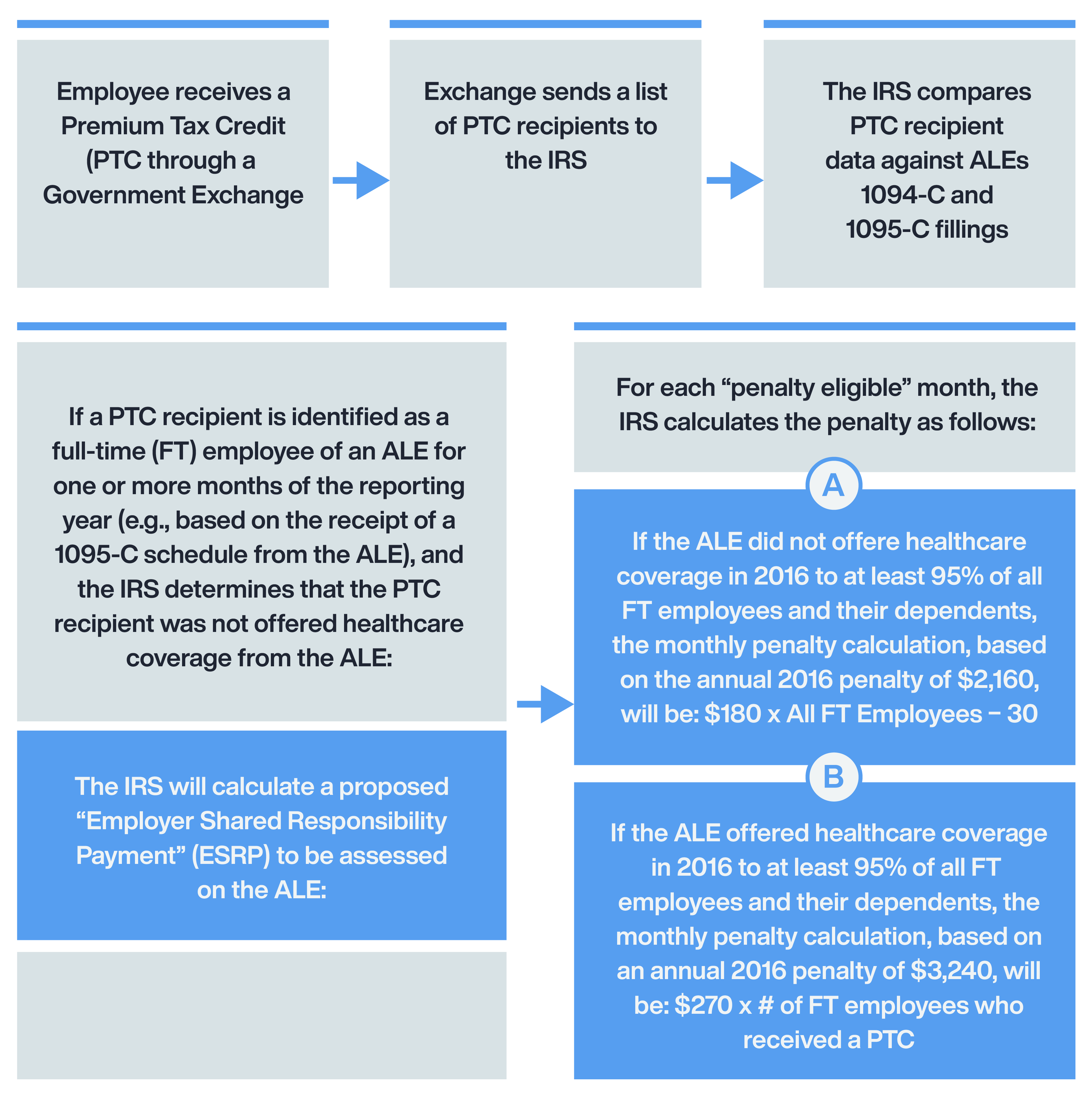

The IRS sends the Employer IRS Letter 226J proposing an Employer Shared Responsibility Payment

- Total proposed penalty for the calendar year, with calculations shown

- List of employees who received a Premium Tax Credit by month

An Applicable Large Employer (ALE) has 30 days to respond, but may request a short extension, not to exceed an additional 30 days.

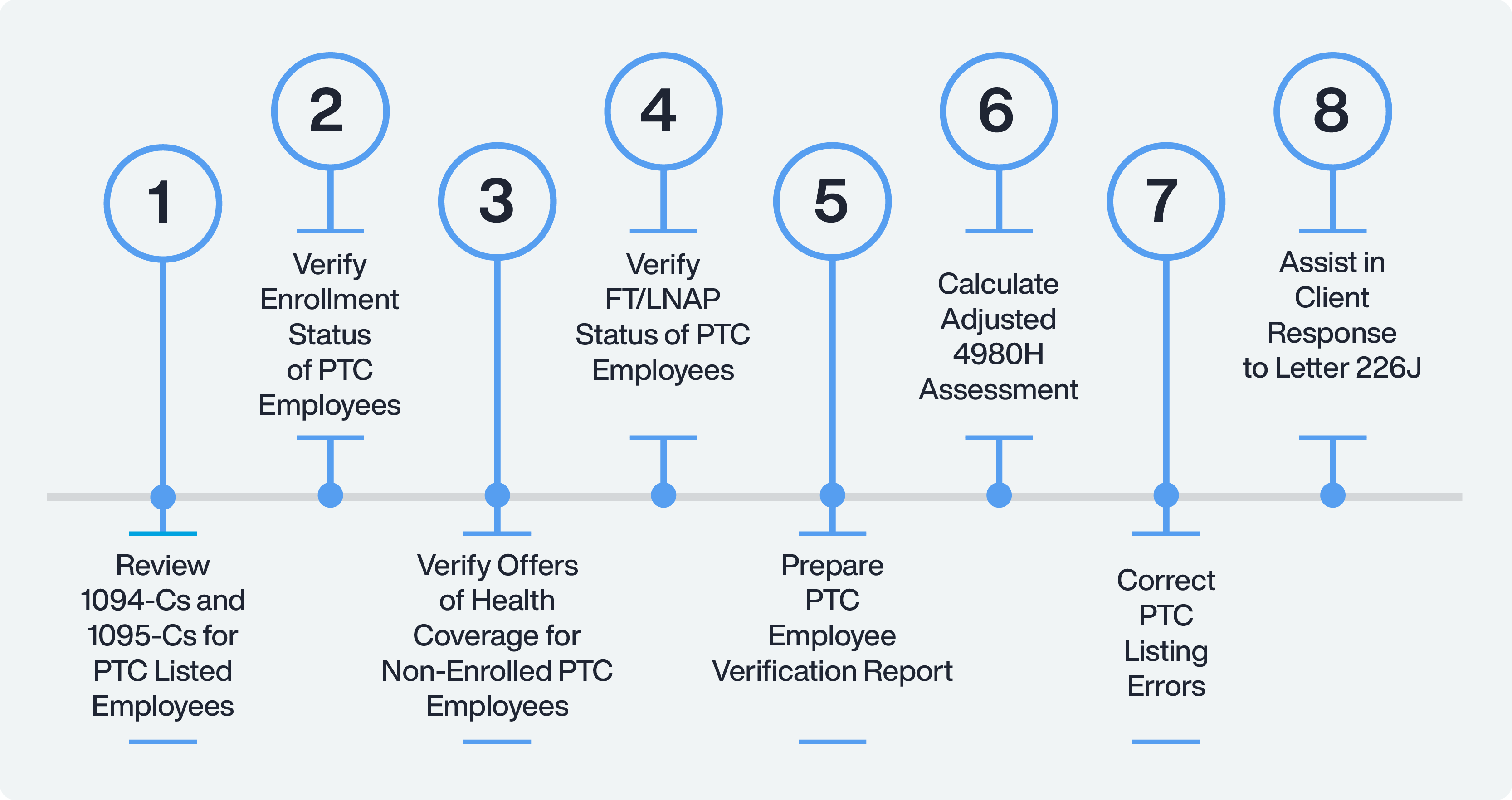

IRS Letter 226J penalty defense

The Phase 1 goal is penalty elimination.

Phase 2 goal: penalty reduction

If Phase 1 of the Penalty Defense Analysis is unable to reduce the number of properly PTC listed employees to zero, then the ALE may choose to perform a comprehensive redetermination of the tax year data.

A proficient vendor may be able to dramatically reduce the penalty exposure for a given tax year by performing an accurate redetermination of the ACA data underlying the ACA filings for a particular tax year.

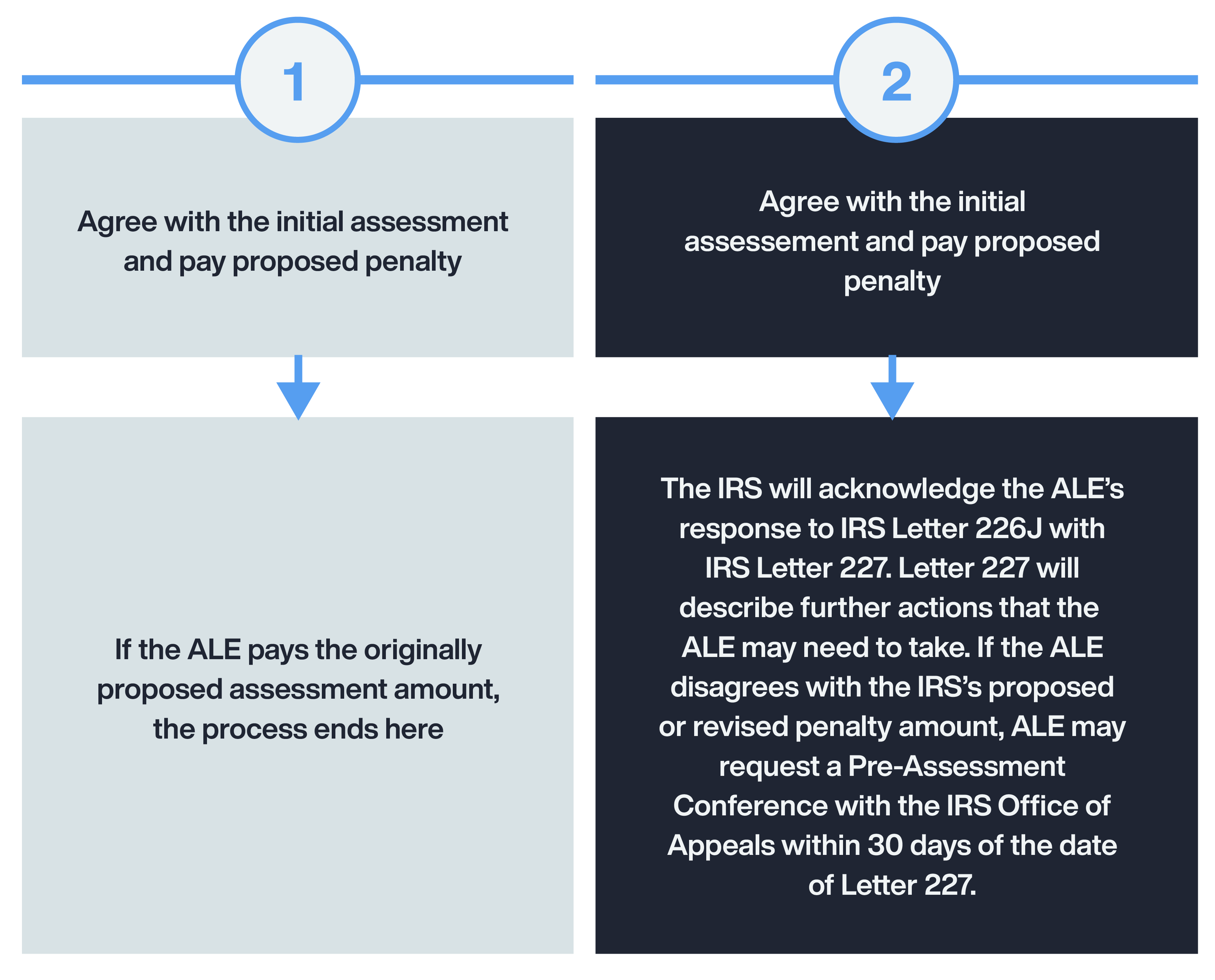

ALE responds to IRS Letter 226J using form 14764 “ESRP Response”

Employer will either:

Note: If the ALE does not respond to either Letter 226J or Letter 227, the IRS will assess the amount of the proposed Employer Shared Responsibility Payment and issue a notice and demand for payment, Notice CP 220J.

There are 5 different IRS 227 letters

Letter 227K

This is an excellent letter to receive. It means your case has been resolved to your organization s satisfaction. Essentially, Letter 227K acknowledges that the information in the Letter 226J response was accepted and the IRS inquiry has closed. Your organization does not owe an ESRP.

Letter 227L

While not as thrilling as receiving Letter 227K, receiving this version of Letter 227 is positive. It is sent when the IRS agrees with the information your organization provided in response to Letter 226J making the case for a reduced ESRP. The organization still needs to make a payment, but for an amount the organization accepts as responsible for payment and smaller than the originally proposed amount.

Letter 227M

It s not so great to receive a version of Letter 227M. That s the version in which the IRS disagrees with your organization s Letter 226J response and simply reiterates its original proposed penalty.

Letter 227J

This acknowledges the receipt of the signed response to Letter 226J Form 14764 in which an organization agrees to pay the ESRP as assessed. After you receive this letter, the case will be closed. No response is required other than to complete payment of the penalty.

Letter 227N

This acknowledges the decision reached in Appeals and shows the ESRP based on the Appeals review. After issuance of this letter, the case will be closed. No response.