Introduction

As ACA reporting requirements change at both the federal and state level, it can be challenging to keep up. Trusaic’s Essential ACA Guide for Employers can help you understand this changing regulatory landscape and avoid costly penalties. Learn which employers must file, what coverage they must offer their employees, and the annual filing deadlines.

The Employer Mandate under the Affordable Care Act

At the time it was enacted in 2010, the implementation of the Patient Protection and Affordable Care Act (the “ACA”), (Public Law No. 111-148), represented the largest set of tax law changes in more than 20 years and affected millions of taxpayers.

The ACA’s Employer Mandate first went into effect on Jan. 1, 2015. In 2016, the Congressional Budget Office projected there would be $228 billion in penalties from employers that failed to offer coverage, or offered inadequate coverage, to their full-time employees.

Years later this is but a drop in the bucket. Enforcement of the Employer Mandate by the IRS began in November 2017, with Letter 226J tax penalty notices being issued to employers who failed to comply with the ACA requirement to provide 2015 tax reporting information. Enforcement has since expanded to 2016, 2017, 2018, 2019, 2020, 2021, and 2022 tax years, with subsequent tax years to come.

However, under the Employer Reporting Improvement Act, the statute of limitations has been set at six years where there previously was none. Thus, as of 2025, the IRS will only be able to enforce non-compliance as far back as the 2017 tax year.

Implementing ACA best practices requires a working understanding of the risks and costs of ACA. To that end, we’ve developed this overview of the ACA Employer Mandate regulations relating to tax penalties, reporting, and disclosure obligations.

Who does the ACA’s Employer Mandate affect?

Applicable Large Employers (ALEs) with at least 50 Full-time or Full-time Equivalent Employees must comply with the ACA’s Employer Mandate. These are employers that employed an average of at least 50 full-time or full-time equivalent employees on business days during the preceding calendar year (see 26 U.S.C. §4980H(c)(2)(A)). Notably, employers must look back to the preceding tax year to determine whether they are deemed ALEs for the current year.

Certain exceptions may apply if the workforce (a) exceeds 50 full-time or full-time equivalent employees for 120 days or fewer per calendar year, and (b) the employees that cause the workforce to exceed 50 are “seasonal workers.” To determine whether an employer is an ALE, both full-time and full-time equivalent employees are counted. A full-time employee averages at least 30 hours of service per week. To calculate full-time equivalent employees, monthly service hours for all non-full-time employees are totaled, then divided by 120.

When full-time and full-time equivalent subtotals are added together and total more than 50, the employer is deemed an ALE. For a particular calendar year, an employer’s ALE status is determined based on the number of its full-time plus full-time equivalent employees in the preceding year. For example, an employer’s ALE status in 2025 is determined based on the employer’s 2024 employee-count data.

An important consideration in determining ALE status is that the ALE includes all persons who are treated as being employed by one employer under subsection (b), (c), (m), or (o) of section 414 of the Internal Revenue Code of 1986 (“IRC”) (see IRC Section 414(b), (c), (m), and (o)). This means employees of related companies — e.g., within the same controlled group of corporations, trades, or businesses under common control or within the same affiliated service group — will be treated as employees of a single employer.

Accordingly, if two or more companies are related and have a combined total of 50 full-time or full-time equivalent employees, they will be treated as one ALE, with each component company an ALE member.

All predecessors and successors of an employer must also be included as part of the ALE (see 26 C.F.R. Section (“IRC Rule”) 54.4980H-1(a)(16)). However, the terms “predecessor” and “successor” are not defined by the IRS Final Regulations, and, instead, are left as reserved (see IRC Rule 54.4980H-1(a) (36); see also Fed. Reg. Vo.79, No. 29 (Feb. 12, 2014) (“Final Regulations”), at 8548).

The Treasury Department and the IRS continue to consider the development of rules for identifying a predecessor employer (or the corresponding successor employer), and until further guidance is issued, taxpayers may rely upon a reasonable, good faith interpretation of the statutory provision on the predecessor (and successor) employers for purposes of the ALE determination.

“For this purpose, use of the rules developed in the employment tax context for determining when wages paid by a predecessor employer may be considered as having been paid by the successor employer (see § 31.3121(a)(1)-1(b)) is deemed reasonable” (see Final Regulations, at 8548).

An IRC Rule in the employment wages context reflects that in a corporate acquisition, the acquirer may be deemed a predecessor (see IRS Publication 15 (2017) noting under “successor employer” that “[w]hen corporate acquisitions meet certain requirements, wages paid by the predecessor are treated as if paid by the successor for purposes of applying the social security wage base and for applying the Additional Medicare Tax withholding threshold…”).

Determining full-time status of employees

The IRS has provided guidance for employers to determine whether an employee is averaging at least 30 hours per week, and therefore considered full-time.

These methods include the Monthly Measurement Method and the Look-Back Measurement Method (see Final Regulations). The Monthly Measurement Method can be applied to standard salaried employee workforces. The Look-Back Measurement Method, with its measurement and stability periods methodology, may be more effective for the complexities of variable-hour employee workforces.

Under the Look-Back Measurement Method, the employer would determine each employee’s full-time status by looking back at a defined period of not less than three, but not more than 12, consecutive calendar months (the measurement period), to determine whether the employee averaged at least 30 hours of service per week or at least 130 hours of service per calendar month during the measurement period.

All employees, including part-time, seasonal, and variable hour, must be analyzed to determine whether an employer is an ALE and whether the Employer must offer coverage to each employee.

For an employee who was determined full-time during the measurement period, they would also be treated as full-time during a subsequent “stability period” — a period of at least six consecutive calendar months immediately following the measurement period and no shorter than the measurement period. If the employee was not determined to be full-time during the measurement period, the employer may treat the employee as not full-time during a stability period that followed the measurement period.

Note: The stability period cannot exceed the measurement period. For example, if the employer chose a measurement period of eight months to determine its full-time employees, the stability period would immediately follow the measurement period and would also be eight months long.

What kind of coverage must be provided?

Employers Must Offer “Minimum Essential Coverage (MEC)” that has “Minimum Value (MV)” and is “affordable.”

To avoid penalties, the Employer Mandate requires an ALE to offer “MEC” to “all”4 full-time employees and their dependents and that such offer of coverage satisfies “MV” and “affordability” for the employee for each month.

MEC is specifically defined to include Government Sponsored Programs, Eligible Employer-Sponsored Programs, Plans in the Individual Market, and Grandfathered Health Plans that were in effect on the date of the ACA’s enactment (2010) (see 26 U.S.C. §5000A(a) and (f); 26 U.S.C. §36B). Government Sponsored Programs include the Medicare program under Part A of Title 18 of the Social Security Act, the Medicaid program under Title 19 of the Social Security Act, the CHIP program under Title 21 of the Social Security Act, medical coverage under chapter 55 of Title 1-, including TRICARE, veteran’s health care under chapter 17 of Title 38, and a health plan under Section 2504(e) of Title 22 (relating to Peace Corps volunteers).

Failure to satisfy MEC subjects the ALE to penalties under 26 U.S.C. §4980H(a).

A. Minimum Value

The ALE offering MEC must also satisfy MV standards to avoid penalties under 26 U.S.C. §4980H(b). MV means that the “plan’s share of the total allowed costs of benefits provided under the plan” is at least “60% of such costs.”

B. Affordable

Because employers are unlikely to know the household income of their employees, the IRS provides three safe harbors that an employer can use to determine affordability for purposes of the employer shared responsibility provisions. These safe harbors do not affect whether an employee’s coverage is affordable for determining the employee’s eligibility for the Premium Tax Credit.

Under these safe harbors, employers are allowed to use Form W-2 wages, an employee’s rate of pay, or the federal poverty line, instead of household income in making the affordability determination. For more information, access our Safe Harbor Playbook to Calculating ACA Affordability.

Which employees are subject to tax penalties?

Under the ACA, all citizens or lawful residents, subject to certain exemptions, were required to have MEC. The ACA’s Individual Mandate required an applicable individual to have MEC for himself or herself and dependents (see IRC Section 5000A(a)). Failure to do so would subject the individual to a tax penalty assessed for every month of the reporting year without MEC.

Individual Mandate and state employer tax penalty chronology

- The federal tax penalty was applied beginning in 2014 at the rate of $95 per adult and $47.50 per child with a family maximum of $285, or 1% of income above the filing threshold – whichever was greater.

- For 2015, the tax penalty increased to $325 per adult and $162.50 per child with a family maximum of $975, or 2% of income above the filing threshold – whichever was greater.

- For 2016, 2017, and 2018, the tax penalty increased to $695 per adult and $347.50 per child with a family maximum of $2,085, or 2.5% of income above the filing threshold – whichever was greater.

- Effective Jan. 1, 2019, the ACA Individual Mandate penalty was reduced to $0 (see Tax Cuts and Jobs Act, P.L. No. 115-97, Section 11081(a)). However, in response to the zeroing of the ACA Individual Mandate, a number of states/jurisdictions imposed their own Individual Mandates, including California, New Jersey, Rhode Island, Vermont, and Washington D.C. Most of these states follow a similar penalty structure as the former Federal Individual Mandate.

- It remains unclear how the patchwork of Individual Mandates will impact employer compliance (especially with multi-state operations) other than creating more complexity.

What role do the exchanges play?

Exchanges offer health coverage to all and subsidies to eligible individuals

Individuals who are eligible for a tax subsidy to offset the cost of health coverage are those with an annual household income of at least 100% and no more than 400% of the Federal Poverty Line (FPL). (see Section 36B(c)). However, President Joe Biden’s American Rescue Plan expanded the eligibility for subsidies for 2021 and 2022, which were continued through 2025 under Biden’s Inflation Reduction Act.

Now, individuals with income beyond 400% of the FPL may be able to receive subsidies through at least 2025. This enhanced version of PTC’s have yet to be extended beyond 2025. It’s yet to be determined if President Donald Trump will extend this version of PTCs, which has implications for ACA compliance at large. Employers should stay tuned to these developments.

Note: PTCs would still be available regardless in 2026 and beyond, but at a smaller dollar amount.

As it relates to PTCs, however, using the U.S. Department of Health and Human Services (HHS) 2025 figures for an individual with no dependents, 100% of the FPL is $15,060 and 400% of the FPL is $60,240.

The 100% FPL for an individual with a non-working spouse and two children is $31,200, and 400% is $124,800. These ranges capture all full-time employees that are paid at the federal minimum wage. Indeed, if that same individual with no dependents earned $10.25 per hour, 30 hours per week, 48 weeks per year (to exclude four weeks of unpaid holidays, sick or vacation days), they would earn $14,760 annually, and readily qualify for a subsidy.

Under the ACA, a single streamlined process is made available to allow for the application of both the exchanges and certain federal assistance programs, including Medicaid and the state’s Children’s Health Insurance Program (see ACA §1413 (codified in 42 U.S.C. §18083)).

These subsidies are often issued in the form of a PTC and are the current trigger for the IRS issuing ACA non-compliance penalty letters. Due to the filing requirements imposed on ALEs and health insurance carriers, the IRS is able to readily verify which individuals obtained a PTC, but more on that below.

What are employees required to do?

Obtain health coverage

Employees who do not have access to MEC or such MEC does not meet affordability and/or MV requirements, may be eligible to receive subsidies to offset the cost of coverage through an exchange (see ACA §1411 (codified as 42 U.S.C. §18081)).

With respect to premium assistance subsidies in the form of PTCs, PTCs are determined by the lesser of: (a) the monthly premiums to cover a taxpayer and his or her dependents under a qualified health plan enrolled in the exchange; or (b) the excess (if any) of the adjusted monthly premium for the applicable second-lowest-cost silver plan with respect to the taxpayer over any amount equal to one-half of the product of the Applicable Percentage and the taxpayer’s household income (see IRC Section 36B(b)).

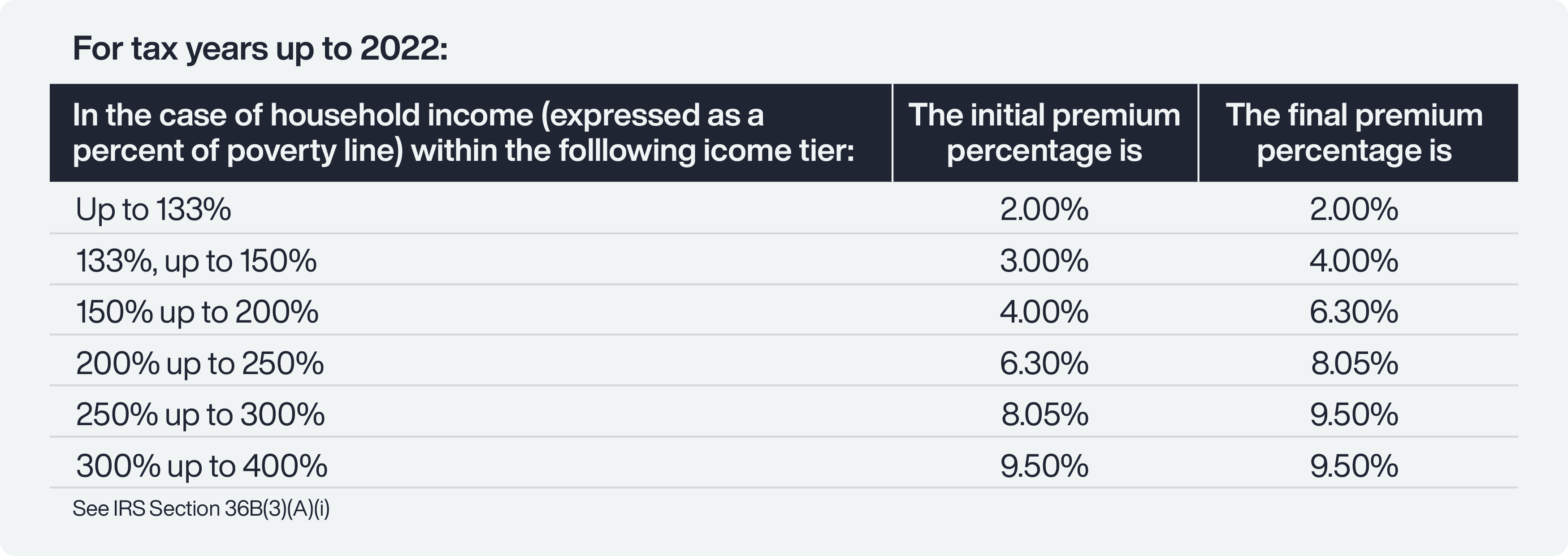

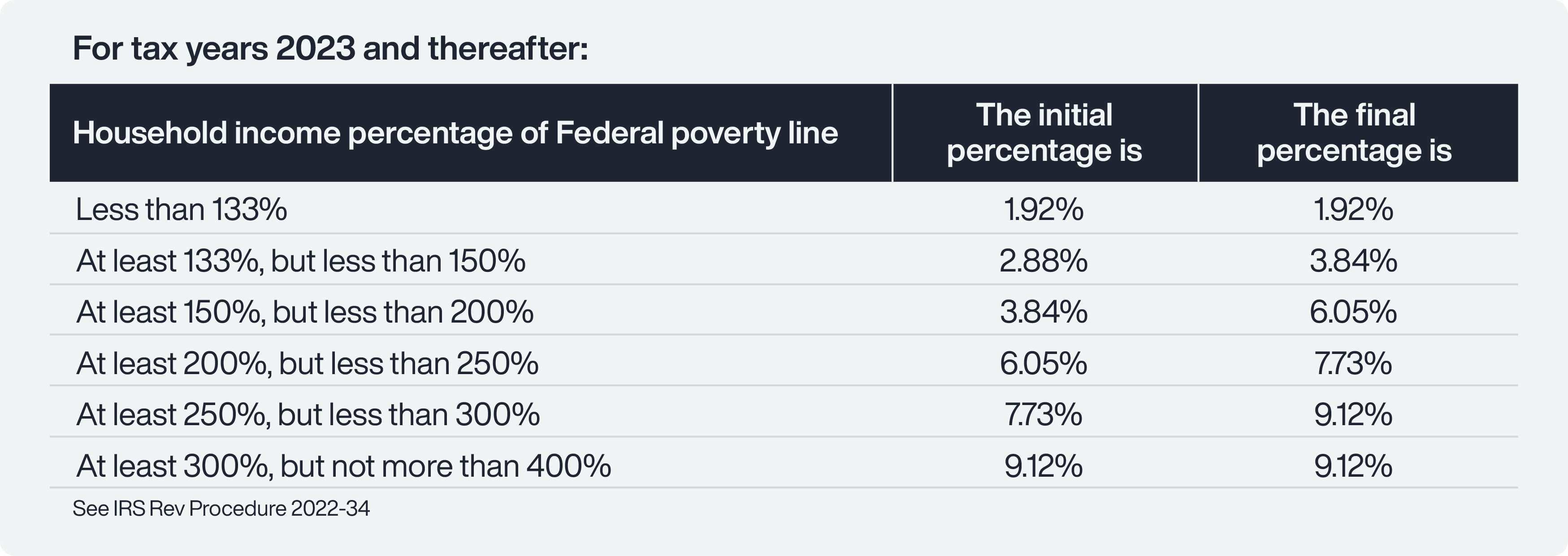

The applicable percentages are determined based on household income within each income tier as set forth in the chart below. To determine whether an employee qualifies for PTCs, the employee’s household income will need to be calculated.

Generally, to qualify, the household income must fall between 100% and 400% of the FPL (see IRC Section 36B(c)). Note, under the American Rescue Plan and Inflation Reduction Act, qualification was expanded to households beyond 400% for 2021 through 2025 years.

Based on the applicable affordability baseline, 9.5% for 2022 and prior years, and 8.5% for 2023, and presumably for at least 2024 and 2025, the actual affordability is determined based on adjustment from the baseline.

Based on the applicable affordability baseline, 9.5% for 2022 and prior years, and 8.5% for 2023, and presumably for at least 2024 and 2025, the actual affordability is determined based on adjustment from the baseline.

Additionally, to be subject to an IRC Section 4980H penalty, the ALE must either (a) have failed to offer MEC to the employee and his or her dependents; or (b) offered coverage but the self-only coverage was not affordable and/or did not meet the MV. Enacted in March of 2021, the American Rescue Plan allowed individuals who earn up to 150% of the FPL to obtain coverage for $0 monthly premiums from ACA health exchanges.

In addition, individuals who earn 400% of the FPL and beyond can obtain coverage through the exchange for no more than 8.5% of their household income. Thanks to the Inflation Reduction Act, these ACA enhancements have been extended through December 2025. Once an application is submitted to the exchange, the exchange may initially assess or determine eligibility and enrollment for certain federal assistance, including Medicaid. Such determination includes verification of certain information by the Secretary of Homeland Security, Secretary of the Treasury, and Commissioner of Social Security.

The exchange will determine eligibility for advance payments of PTCs as well as cost-sharing reductions. As part of that determination, the exchange will verify household income and family size through tax return information from the Treasury.

Upon verification of eligibility, the exchange is required to provide notice to the employee and employer. As part of the notice to the employer, the exchange must provide the following:

- Identification of the employee

- Indication that the employee has been determined to be eligible for advanced payments of the PTC

- Indication that the employer may be liable for payment under Section 4980H if the employer is an ALE; and

- Notice of the employer’s right to appeal

What are the ACA Employer Mandate non-compliance penalties?

A. Employers who do not offer Minimum Essential Coverage

ALEs must provide the opportunity for full-time employees to enroll in MEC under an Eligible Employer-Sponsored Plan. If at least one full-time employee in any given month has been certified as having been enrolled in that same month in a health plan through an exchange, and for which the employee was allowed or paid a PTC or cost-sharing reduction, that ALE will be obligated to make an “assessable payment equal to the applicable payment amount times the number of individuals employed by the employer as full-time employees during such month” (see IRC Section 4980H).

With respect to any month in 2025, the applicable payment amount is 1/12 of $2,900, adjusted annually. The employer who does not provide health insurance for a given month is assessed at a rate of 1/12 of $2,900 (adjusted annually) for each full-time employee each month. Note that the number of full-time employees “shall be reduced by 30 solely for purposes of calculating” the assessable payment.

In other words, the first 30 full-time employees are excluded from the $2,900 per employee penalty.

B. Employers whose coverage does not meet Minimum Value and/or Affordability Requirements

Employers that offer MEC with self-only coverage that does not meet Affordability and/or MV requirements are subject to a tax penalty. The penalty corresponds only to those employees who receive an applicable PTC or cost-sharing allowance. On a monthly basis, if one or more full-time employees had been certified as having enrolled in a qualified health plan through the exchange for which the employee has received or been allowed an applicable PTC or cost-sharing allowance, the employer will be assessed payment for all such certified employees. For any month in 2025, the aggregate tax penalty is computed by the product of 1/12 of $4,30 and the number of certified employees. However, there is an overall penalty limitation calculated by Section 4980H(a) penalty times the total number of full-time employees minus 30 (see IRC Section 4980H(b)(2)).

To avoid penalties for failing to offer eligible MEC, an employer must make the lowest cost option available to all full-time employees. A conservative low-cost option is likely to be based on the 9.5% affordability ceiling (adjusted annually) for premium costs, corresponding to the lowest-earning full-time employee with no dependents. Of course, having a low-cost option does not preclude the employer from providing other more costly plans. The key is making the low-cost option available. In view of the MEC requirements, insurers are likely to always have that option available.

Although there was transition relief for employers available during 2015, virtually all of such transition relief no longer applied for plans starting in 2016 year (see Final Regulations).

C. Penalty assessment process

An ALE who has employees who properly obtained PTCs and/or reductions in cost-sharing through the exchange may be subject to penalties under Section 4980H. Under the ACA, upon notice of Section 1411 Certification, such employers are allowed a 90-day window to appeal the assessment.

The employer will have access to the data used to make the determination to the extent allowable by law, including whether the employee’s income is above or below the threshold for affordability, and have the opportunity to present information to the exchange. The IRS will contact employers to inform them of their potential liability and provide them an opportunity to respond before any tax liability is assessed.

The contact for a given calendar year will not occur until after employees’ individual tax returns are due for that year claiming PTCs and after the due date for ALEs to file the information returns identifying their full-time employees and describing any healthcare coverage that was offered. Once notified and given the opportunity to respond, the IRS will then send notice and demand for payment.

What are the IRS reporting requirements?

The ACA reporting obligations require monthly tracking of employee work hours and wages, covered dependents information, and premium-related information.

A. W-2 reporting

For tax years after 2011, the ACA has generally been requiring all employers with 250 or more W-2s to report the total costs for employee health benefits for employer-sponsored group health coverage (see ACA §9002 (codified as 26 U.S.C. §6051(a)(14)). The reporting began in January 2013.

The principle behind this reporting obligation is to provide useful and comparable consumer information on the cost of healthcare coverage to employees. Specifically, the report requires identification of the aggregate cost of employer-sponsored health coverage for each employee and his or her dependents on the employee’s W-2 form, in box 12 with code “DD.”

The specific items that are required are listed on the IRS website. Notably, Flex Spending Accounts funded solely by salary reductions to the employee, Health Savings Arrangement (HSA) contributions, and Archer Medical Savings Account (Archer MSA) contributions are not to be reported.

B. Coverage reporting – Applicable Large Employers

The ACA imposes on ALEs certain reporting and disclosure requirements with respect to applicable employees (see ACA Section 1513 (codified as 26 U.S.C. §6056); see also IRS Final Reporting Regulations, Fed. Reg. Vol. 79, No. 46 (March 10, 2014). These reporting and disclosure requirements are due on an annual basis for the prior tax year, starting in 2015.

Pursuant to the IRS Final Reporting Regulations, the IRS has provided IRS Forms 1094-C and 1095-C and accompanying instructions on completing these forms (see IRS Final Instructions on IRS Forms 1094-C and 1095-C). Form 1094-C is the transmittal form, which requires monthly information about each ALE member, including whether certain qualifying-offer methods apply, whether MEC was offered to 95% of the full-time employees and their dependents, and the total employee count, total full-time employee count, and identification of all ALE members. ALE member information requires employer aggregation analysis under IRC Section 414(b), (c), (m), and (o).

Form 1095-C requires comprehensive information for each month of the reporting year about each full-time employee, including the nature of the coverage, offered to the employee, the lost cost monthly premium for self-only coverage, and applicable safe harbor codes.

Reporting on the nature of coverage includes whether the MEC was offered to the employee, spouse, and/or dependents, whether spousal coverage was conditional, enrollment status, employment status, the applicability of any affordability safe harbors (FPL, W-2 safe harbor, or rate of pay), application of limited non-assessment periods, and other indicator codes relating to the type of offer of coverage. Self-insured ALEs have additional information requirements pertaining to covered individuals.

What are the state reporting requirements?

Multiple states now require both Individual Mandates and corresponding employer health coverage reporting.

A. California

California implemented its own Individual Mandate, effective January 1, 2020, requiring state residents and dependents to obtain minimum essential coverage or pay a penalty (see SB 78, amending Cal. Gov. Code Section 100700).

The California Franchise Tax Board (FTB) has released detailed information pertaining to the state’s Individual Mandate. Individuals must report their healthcare coverage to the FTB when filing state tax returns. A California state resident who failed to obtain qualifying health coverage for the entire duration of the tax year will be subject to a penalty — the Individual Shared Responsibility Penalty (ISRP). The ISRP will be either: 1) a flat amount, based on the number of people in the tax household, or 2) a percentage of the household income, whichever is higher.

For 2022, California residents who did not have coverage for themselves and their dependents, and did not qualify for an exemption, must pay the higher of either 1) a base flat amount of $850 per adult or more and half that per child, adjusted annually or 2) pay 2.5% of the amount of gross income that exceeds the filing threshold requirements based on the tax filing status and the number of dependents.

Individuals interested in seeing their estimated penalty for the 2023 tax year should review the individual shared responsibility penalty estimator provided by the FTB. Correspondingly, all employers sponsoring health coverage for California resident employees need to comply with state-level reporting to track compliance with ISRP by California residents.

This reporting is in addition to the federal requirement to furnish Forms 1095-C to employees and file them with the IRS (along with Form 1094-C). Forms 1094-C and 1095-C are used to report the health insurance coverage of their employees to the state.

For the 2025 tax year, the furnishing deadline is Jan. 31, 2026, and filed with the California FTB by March 31, 2026. California also offers an extended filing deadline of May 31, 2026.

Employers are subject to a penalty of $50 per return for failure to comply with the additional employer reporting requirement.

B. New Jersey

Beginning Jan. 1, 2019, under the New Jersey Health Insurance Market Preservations Act, New Jersey began its own Individual Mandate, requiring its residents to obtain health coverage or be subject to an Individual Shared Responsibility Payment (SRP). The amount of this penalty is based on the statewide average annual premium for Bronze Health Plans in New Jersey and depends on household income and size.

For the 2023 year, the penalty starts at a minimum of $695 for a household size of 1, up to a maximum of $3,661. For a family with two adults and three dependents and a household income of (a) $200,000 or below, the minimum penalty is $2,351, and the maximum $4,869, (b) $200,001 and $400,000, the minimum penalty is $2,351 and the maximum penalty is $10,279, if $400,001 or more, the minimum penalty is $2,351 and the maximum penalty is $19,793. State residents interested in seeing their estimated penalty for the 2023 tax year should review the ISRP estimator provided by the Official Site of the State of New Jersey.

To verify health coverage reporting by individual taxpayers, the New Jersey Health Insurance Market Preservation Act (NJA3380) also requires state-level employer reporting. This reporting requirement is in addition to the federal requirement to furnish Forms 1095-C to employees and file them with the IRS (along with Form 1094-C).

Fully insured employers can avoid reporting only if they ensure compliance with reporting by their insurer. New Jersey has issued updated guidance regarding state-level ACA health insurance employer reporting. This reporting requirement is in addition to the federal requirement to furnish Forms 1095-C to employees and file with the IRS (along with Form 1094-C).

Fully insured employers can avoid reporting only if they ensure compliance with reporting by their insurer. Form 1095-C (parts I and III completed) or NJ-1095 can be used to report the health insurance coverage of their employees to the state.

For the 2025 tax year, the filing deadline is March 31, 2026, and the Forms distribution deadline is March 3, 2026.

Penalties for non-compliance have not been announced yet.

C. Rhode Island

Rhode Island’s individual penalty went into effect in January of 2020 (see R.I. Gen. Laws Section 44-30-101). Rhode Island residents must maintain minimum essential healthcare beginning Jan. 1, 2020, or a Shared Responsibility Payment Penalty (SRPP).

The SRPP is the greater of either a flat amount of $695 per adult and $347.50 per child based on the number of people in a household or 2.5% of the household gross income that exceeds certain filing threshold requirements. Correspondingly, all employers offering MEC to Rhode Island resident employees must submit state-level reporting to track compliance with SRPP by residents.

This reporting requirement is in addition to the federal requirement to furnish Forms 1095-C to employees and file them with the IRS (along with Form 1094-C). Fully insured employers can avoid reporting if their insurer complies. Employers and health sponsors providing MEC to an individual will be required to file a return with the Division of Taxation and provide a return to the individual.

For the 2025 tax year, the furnishing deadline is March 3, 2026. The filing deadline to RI’s Dept of Revenue, Division of Taxation is March 31, 2026.

Employers failing to report may be subject to a penalty, which is “reviewed on a case by case basis and addressed as its unique facts and circumstances warrant”.

D. Washington DC

Washington D.C. implemented its own Individual Mandate starting in 2019 (see Code of D.C. Section 47-5102). This is pursuant to the Individual Taxpayer Health Insurance Responsibility Requirement Amendment Act of 2018 (Ch. 51 to Title 47 of D.C. Official Code). It’s important to note that the D.C. mandate does not apply to individuals who commute to work in D.C., but do not reside there.

An individual is considered a D.C. resident if his/her employer withholds wages and pays taxes to D.C. on their behalf or that individual has a mailing address in D.C. for any period during the applicable calendar year. Those applicable individuals who fail to obtain health insurance coverage may be subject to a penalty of $695 for each adult and $347.50 for each child (up to $2,085 per family), or 2.5% of family income that is over the federal tax filing threshold, whichever is greater.

It’s important to note that the D.C. mandate does not apply to individuals who commute to work in D.C., but do not reside there.

D.C. also requires every “applicable entity that provides minimum essential coverage to an individual during a calendar year” to submit an information return regarding such coverage to D.C.’s Office of Tax and Revenue (OTR).

Applicable entities who are subject to DC reporting, include all employers that provide employment-based health coverage and (a) are required to file Forms 1095-B or 1095-C to its employees or (b) covered at least 50 full-time employees, including at least one D.C. resident. Fully insured employers are subject to the D.C. reporting requirement.

This reporting requirement is in addition to the federal requirement to furnish Forms 1095-C to employees and file them with the IRS (along with Form 1094-C). However, the same IRS Forms can be submitted to D.C.’s Office of Tax and Revenue (OTR). All information returns are required to be filed electronically through MyTaxDC.org, as paper filings will not be accepted.

For the 2025 tax year, the furnishing deadline is March 3, 2026. However, Washington D.C. follows the federal standard, which means employers have the option to make Form 1095-C available upon request and maintain a public notice of that right through Oct. 15, 2026. The filing deadline is April 30, 2026.

A penalty for non-compliance has not been adopted.

E. Massachusetts

Before the enactment of the ACA, Massachusetts had its own Affordable Care Act in 2006 (see Massachusetts’ “Act Providing Access to Affordable, Quality, Accountable Health Care,” Ch. 58 (2006)).

Once the ACA went into effect, the Massachusetts law coordinated with the federal ACA law. Now, with the elimination of the federal Individual Mandate, the state mandate remains. Individuals who fail to obtain coverage will be subject to a penalty, which varies in amount depending on age, income, and family size.

The penalties, which will be imposed through the individual’s personal income tax return, do not exceed 50% of the minimum monthly insurance premium for which an individual would have qualified through the Massachusetts Health Connector. In 2023, for example, an individual earning over 300% of the Federal Poverty Level is subject to a penalty of $183 per month, or $2,196 per year.

Two parents with one child, without coverage for all of 2023 and earning above 300% of the Federal Poverty Line is subject to an annual penalty of $4,392. On the employer side, if the insurance carrier does not furnish, the employer must furnish Form MA 1099-HC, Individual Mandate Massachusetts Health Care Coverage to employees, and file with the Massachusetts Department of Revenue.

Form MA 1099-HC is similar to Form 1095-B. This reporting requirement applies to all covered individuals residing in Massachusetts to whom the employer-provided creditable coverage. However, most insurance carriers will issue this form on behalf of employers and send to the state a report listing all Form MA-1099-HCs. Form 1099-HC is due by Jan. 31 following the year of coverage.

Form 1099-HC should be electronically filed through MTC. A penalty of $50 per employee with an overall cap of $50,000 is assessed if an employer fails to submit Form 1099-HC. Additionally, employers with 6 or more employees are also required to annually submit the Health Insurance Responsibility Disclosure (HIRD) Form. This includes employers that are out of state and have at least six employees within the state.

The HIRD Form reports on employer-level information about employer-sponsored insurance offerings. The HIRD form is due no later than Dec. 15 of the filing year and must be completed electronically on MassTaxConnect (MTC) web portal, which is administered by the Dept of Revenue. There are no penalties relating to the HIRD form.

Note: Trusaic does not offer filing or furnishing services for Massachusetts.

Employee notice requirements

The ACA amends the Fair Labor Standards Act to impose certain notice obligations to employers. Under Section 1512, employers must give written notice of the following information about the ACA (see ACA Section 1512 (codified as Section 18B of FLSA, 29 U.S.C. §218B)):

- Informing employees of the existence of the exchange, including a description of the services provided by the exchange and the manner in which the employee may contact the exchange to request assistance

- If the employer’s plan’s share of the total allowed costs of benefits provided under the plan is less than 60% of such costs, that employee may be eligible for PTCs and a cost-sharing reduction if the employee purchases a qualified health plan through the exchange

- If the employee purchased a qualified health plan through the exchange, the employee will lose the employer’s contribution (if any) to the health benefits plan offered by the employer, and all or a portion of such contributions may be excludable from income for Federal income tax purposes

Need help with ACA Compliance?