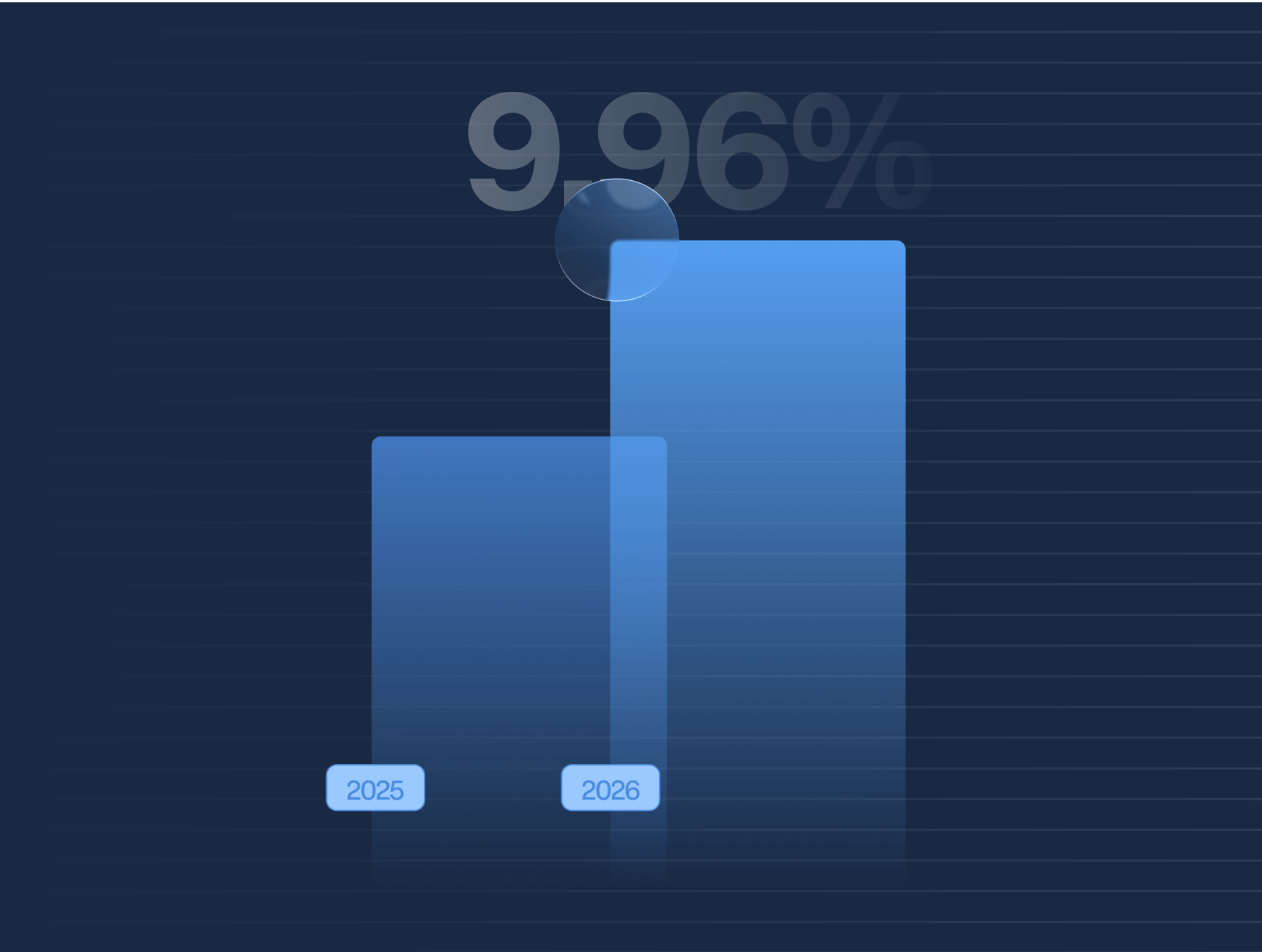

The IRS is raising the ACA affordability threshold to 9.96% for the 2026 tax year— the highest level on record.

As a result, employers will have more flexibility in making their employee premiums meet the affordable safe harbor for next year as required under the Affordable Care Act.

Here’s what you need to know about the updated percentage and how it could impact your ACA compliance strategy.

Understanding the New IRS Affordability Threshold

Under the ACA’s Employer Mandate, applicable large employers (ALEs) must offer minimum essential coverage that meets minimum value standards and is considered affordable. The IRS defines “affordable” using a percentage of the employee’s household income, which is updated annually.

For the 2026 tax year, the affordability percentage rises to 9.96%, up from 9.02% in 2025 and 8.39% in 2024.

This percentage is used in two key areas:

- To determine whether an individual qualifies for a premium tax credit when purchasing coverage on the ACA Marketplace.

- To evaluate whether an employer’s offer of coverage meets the affordability standard required under Section 4980H(b) of the Internal Revenue Code.

What the Increase Means for Employers

This nearly one-point increase gives employers additional flexibility. In theory, they can require employees to contribute more toward their health insurance premiums while still satisfying the ACA’s affordability requirement. But higher contributions may not align with employee expectations or financial capabilities, especially in lower-wage or high-turnover workforces.

The IRS affordability percentage plays a key role in ACA Safe Harbor calculations, which employers use to avoid penalties. These include:

- Federal Poverty Line (FPL) Safe Harbor

- Rate of Pay Safe Harbor

- W-2 Safe Harbor

Each method uses the updated percentage to determine if employee premium contributions exceed affordability limits.

Avoiding Compliance Pitfalls

While the updated percentage may create more breathing room for employers, failing to maintain true affordability can trigger IRS penalties. If a full-time employee receives a premium tax credit for coverage purchased on the Marketplace because the employer’s offer was unaffordable, the employer may be liable for Section 4980H(b) penalties — currently $4,350 annually per affected employee for the 2025 tax year (subject to future increases).

To mitigate risk, employers should:

- Review their contribution structures in light of the new threshold.

- Evaluate which Safe Harbor method offers the best fit for their organization.

- Recalculate affordability based on 2026 guidelines.

- Perform a Penalty Risk Assessment to identify potential liabilities early.

How Trusaic Can Help

Navigating shifting IRS thresholds and ACA reporting requirements can be complex. Trusaic’s ACA Compliance Solutions make it easy by:

- Automating affordability calculations across all Safe Harbors

- Monitoring IRS updates and adapting your strategy in real time

- Flagging affordability risks before they lead to penalties

- Streamlining federal and state filing through certified integrations with HCM platforms

With the affordability percentage now at its highest ever, employers must reassess their benefits strategies carefully. While the updated threshold allows for increased employee contributions, it also increases the risk of penalties for noncompliance if affordability is miscalculated.

Looking ahead to the 2026 tax year? Let Trusaic help you stay compliant, minimize risk, and simplify ACA reporting.