Comprehensive tax credit solutions

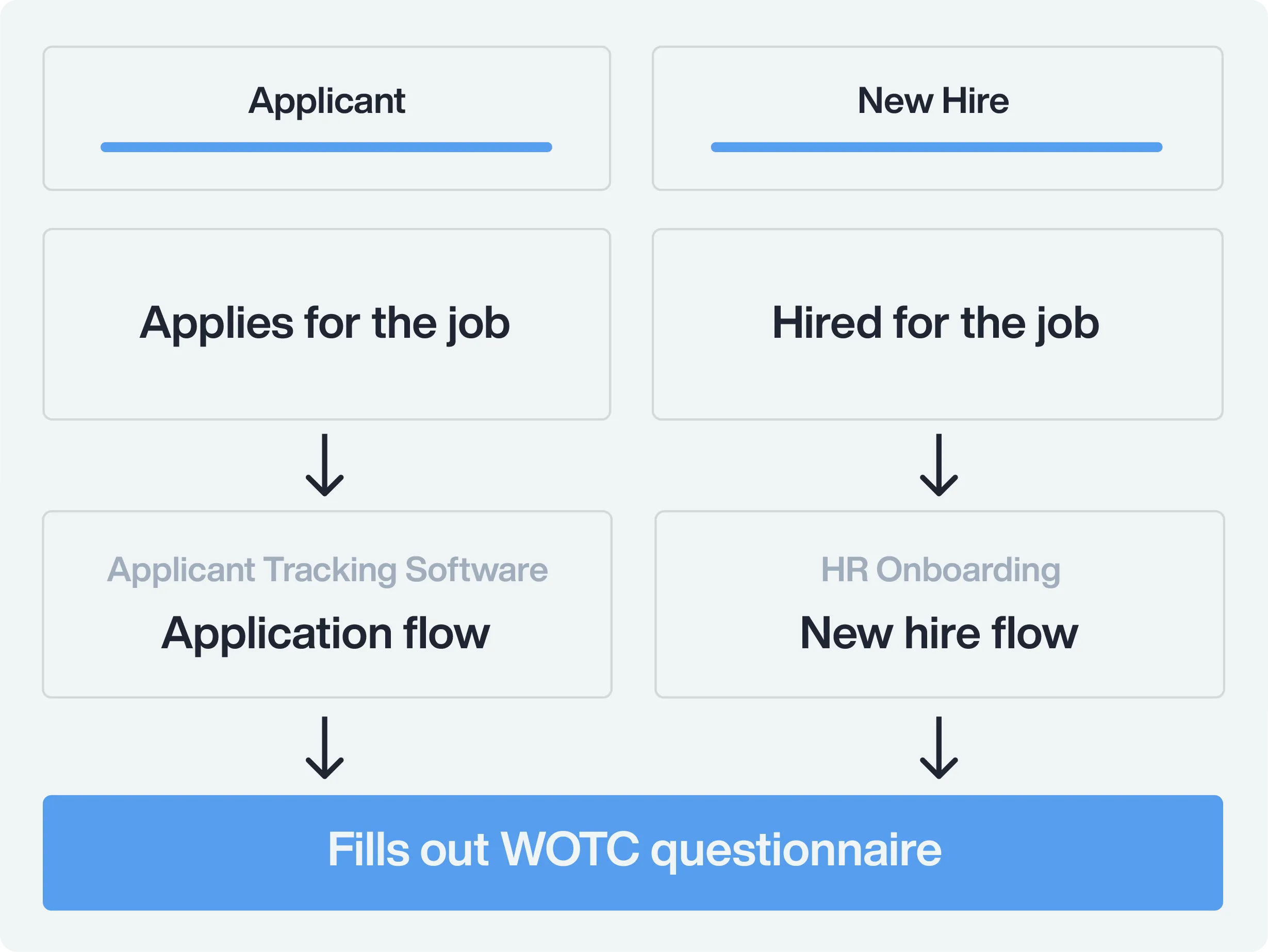

TaxAdvantage® helps organizations identify, secure, and maximize valuable tax credits with ease and accuracy. From initial identification to final claim submission, we ensure no credit is left behind. Our solution analyzes your HR data to uncover opportunities for the Work Opportunity Tax Credit (WOTC).

Schedule Demo

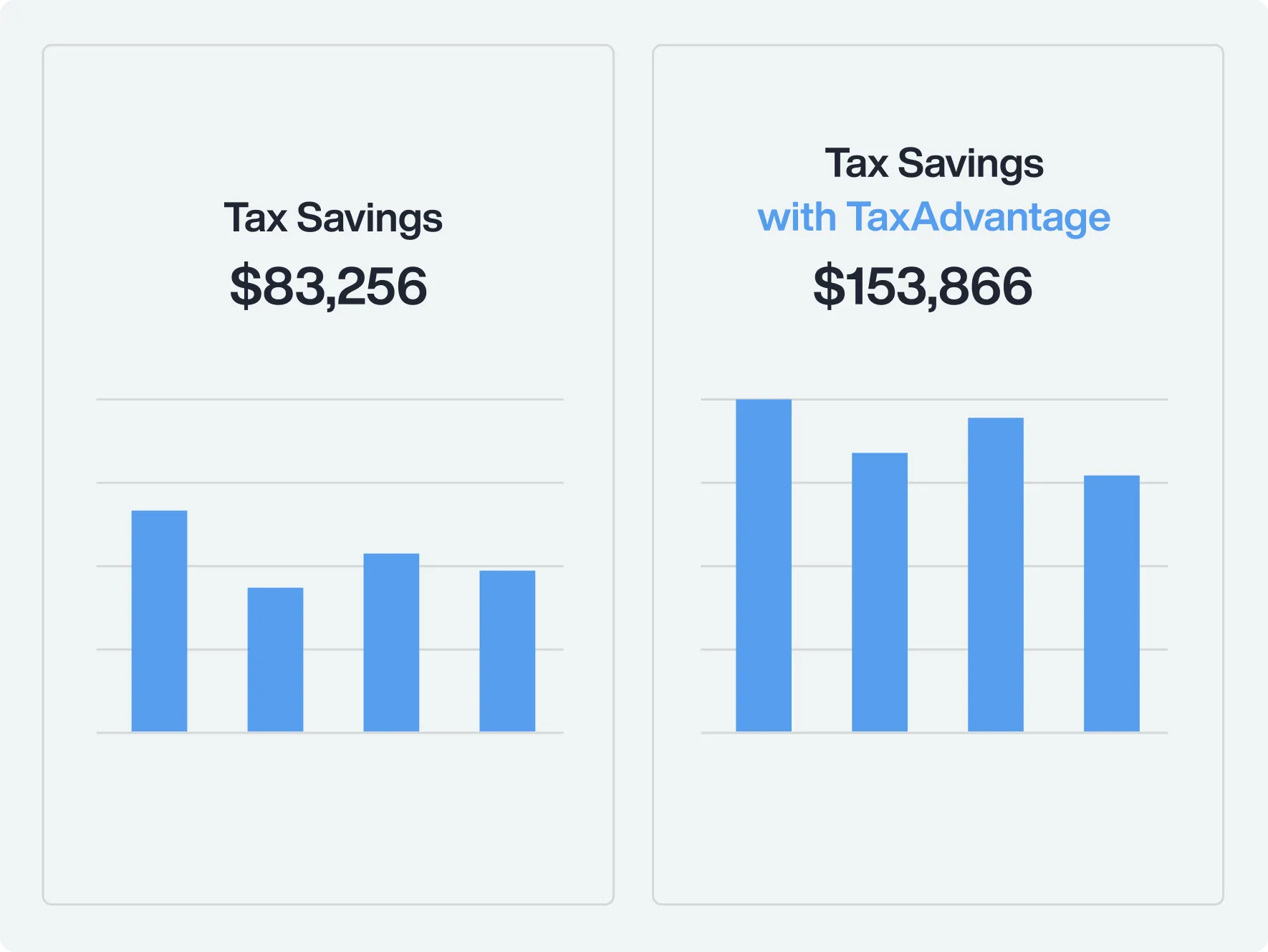

Proven track record in tax credit recovery

With over $350 million in tax credits uncovered, Trusaic delivers results that significantly reduce tax liabilities and enhance financial health.

- Audit readiness: maintain thorough documentation to support claims

- Compliance expertise: stay ahead of changing regulations

- End-to-end management: from analysis to submission, we handle it all

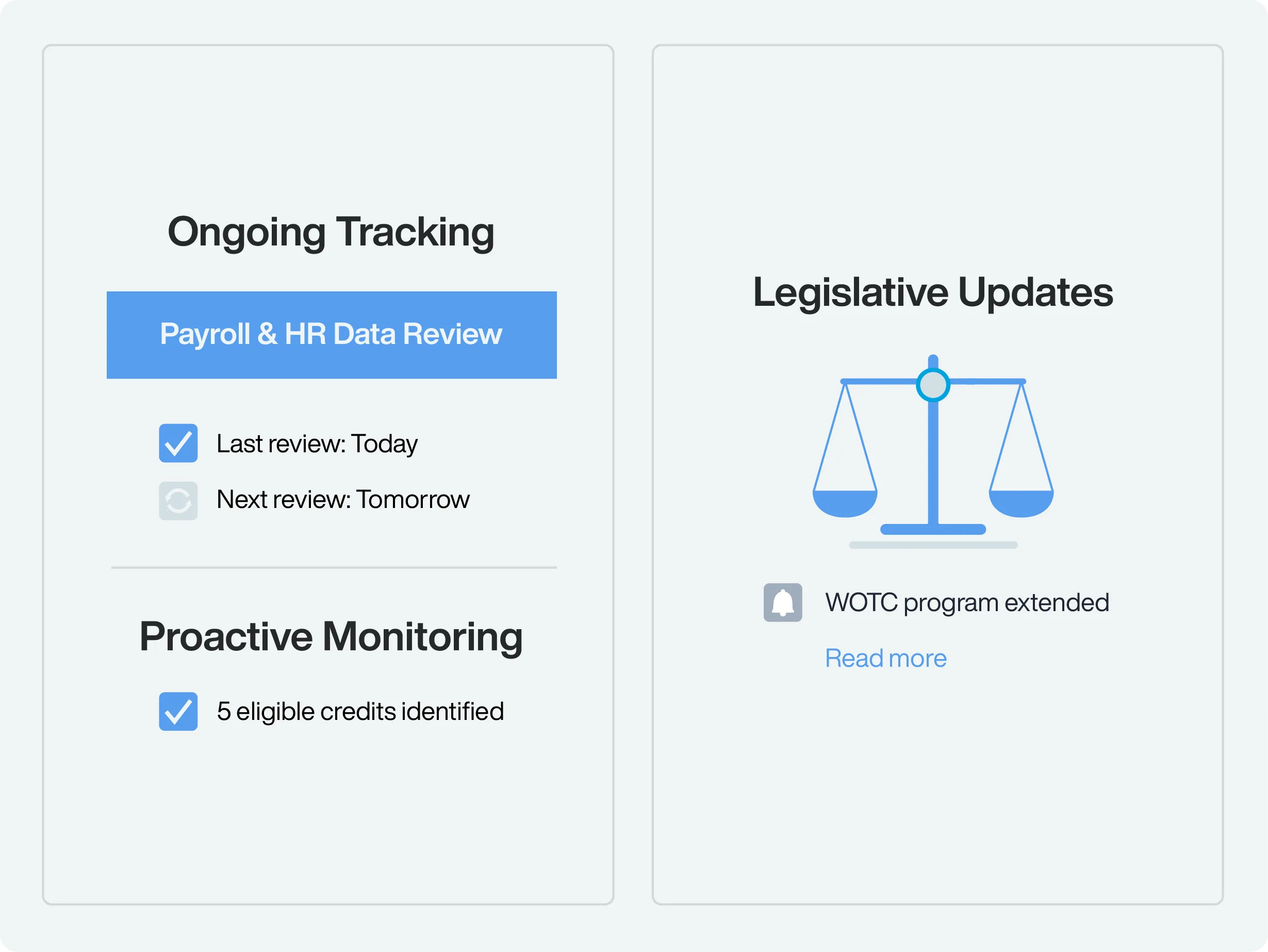

Stay ahead with proactive monitoring

TaxAdvantage doesn’t stop at securing credits — we help you avoid missed opportunities in the future with continuous monitoring and compliance assurance.

- Ongoing tracking: monthly reviews of payroll and HR data

- Legislative updates: ensure compliance with evolving laws

Key Features

Comprehensive analysis

Identify every possible tax credit

to maximize your tax savings

for doing the right thing.

Proven results

Significantly reduce tax liabilities,

helping your company improve its

bottom line and increase profitability.

Automated claims

Expedite tax credit applications

with software and guidance from our

tax experts to save money faster.

Capabilities

FAQs

-

What is the Work Opportunity Tax Credit (WOTC)?

WOTC is a federal tax credit that incentivizes businesses to hire individuals from specific target groups, such as veterans and individuals receiving government assistance.

-

What results can I expect?

Trusaic has helped clients uncover over $350 million in tax credits, with many achieving significant reductions in tax liabilities.

-

How does TaxAdvantage ensure compliance?

We provide proactive monitoring, regular audits, and expert support to align your processes with current regulations.

-

What kinds of businesses are eligible for the WOTC?

Any business can earn tax credits by hiring individuals who fit one of the program’s target groups, such as veterans, disabled persons, and persons receiving government assistance.