Massachusetts is poised to follow California and Illinois and become the third state to require pay data reporting. It would also be the eleventh to require pay transparency in job listings. On October 4, Massachusetts House of Representatives voted 148-8 in favor of the legislation.

Pay transparency and wage equity requirements

October 4,3, If successful in the Massachusetts Senate, HB4109 would require employers, or its agent, with 25 or more employees to:

- Disclose the salary or wage range for a position in all job postings.

- Provide the salary range to employees who are offered promotions or transfers.

- Provide the pay range to employees for their current role, if requested.

Definitions

“Pay range” is defined as the “annual salary range or hourly wage range that the covered employer reasonably and in good faith expects to pay for such position at that time.”

“Posting” means “any advertisement or job posting intended to recruit job applicants for a particular and specific employment position, including, but not limited to, recruitment done directly by a covered employer or indirectly through a third party.”

Pay data reporting: Significantly, the bill also requires covered employers with 100 or more employees to supply wage and demographic information to the Executive Office of Labor and Workforce Development. That data would then be aggregated and published, with the goal of identifying gender and racial pay disparities by sector.

HB4109 is widely referred to as the Frances Perkins Workplace Equity Act. The first female US Secretary of Labor, Boston native Perkins was also the first woman to serve in a presidential cabinet.

Achieving equal pay in Massachusetts

Massachusetts became the first state to introduce an equal pay law in 1945. While it was updated in 2018 to ensure equal pay for comparable work, the gender pay gap remains.

Current data suggests Massachusetts has one of the smallest wage gaps nationally, but that is not the whole picture. Figures from the National Women’s Law Center, show that women in Massachusetts earn 81% of men’s earnings. For women of color the gap is greater.

Pay disparities across the state also vary. Research from the Boston Women’s Workforce Council finds a 30¢ wage gap for women in the Greater Boston area. Latina women earn just 55¢, and Black women 51¢, for every dollar earned by white men. The average racial wage gap is 24¢.

Although discrimination based on sex, race, gender-identity, sexual orientation, and ethnicity is illegal, it persists. Lack of equal opportunities for career advancement, and poor access to affordable, quality childcare are also barriers to equal pay.

HB4109 aims to eliminate pay discrimination, close wage gaps, create more equitable workplaces, and ensure equal pay for equal work.

Does Massachusetts legislation imply the return of EEO-1 Component 2?

Wage equity requirements may indicate a future return to EEO-1 Component 2.

“Covered employer” is defined within the bill as:

“an employer: (i) with not less than 100 full-time employees in the commonwealth at any time during the prior calendar year; and (ii) subject to the federal filing requirements of a wage data report.”

Since the demise of EEO-1 Component 2, wage data reporting has been removed, but this could hint at its return. Speculation over the reintroduction of Component 2 has been rife for some time.

For now, HB4109 heads to the Senate, where it’s reported over half of its members cosponsored earlier versions of the bill.

The US is falling behind in equal pay

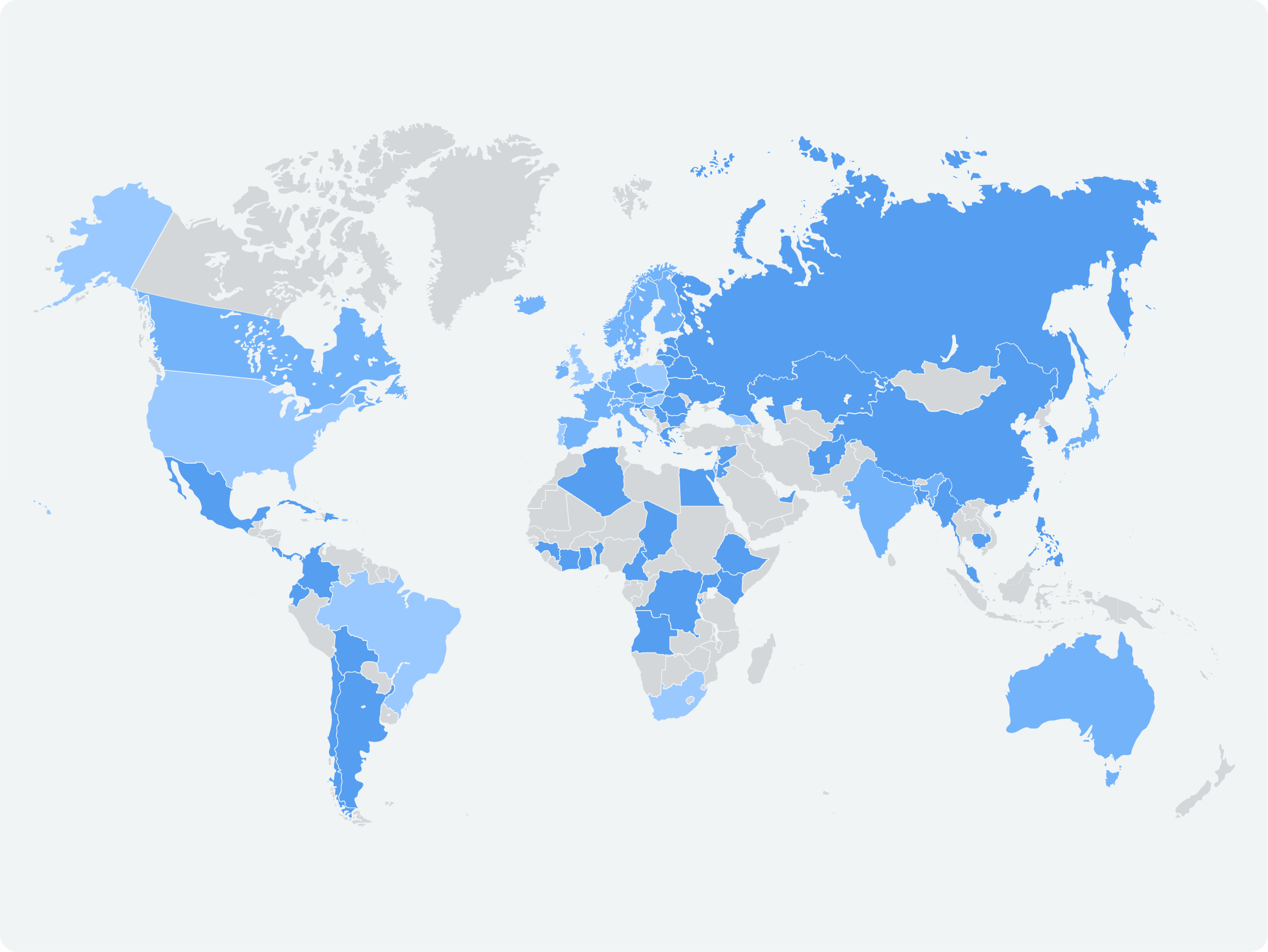

While Massachusetts pay transparency legislation seems highly probable, national progress towards equal pay is still slow.

The US is in the grip of a gender pay gap and ranks a lowly 25th out of 33 nations for women in the workforce. Even hopeful predictions expect women to wait another 50 years for equal pay. Latina women fare far worse; they are not likely to see equal pay until 2206.

Action is being taken at federal level to address the wage gap. HR 1599, the national “Salary Transparency Act,” would require all employers nationwide to disclose pay ranges in job listings, and provide wage ranges to job applicants and existing employees. If passed, the bill would apply to all organizations, regardless of size and number of employees.

HR 1599 has been referred to the House Committee on Education and the Workforce. But employers don’t need to wait to adopt pay transparency.

Implement a policy of pay equity

Pay transparency is becoming the norm, and organizations must navigate its challenges while adapting to evolving legislation. Start with the following steps:

Move towards pay equity: Pay transparency offers tangible benefits for employers, from boosting employee engagement and retention to attracting more talent to job listings. Over 25% of US workers are now covered by pay transparency legislation and that figure could soon rise to 50%. Pay transparency laws are pending in states including Pennsylvania, and New Jersey, while South Carolina has introduced a pay equity bill.

Create equitable job listings: Provide salary ranges that are explainable to job applicants and employees. All employers should be able to demonstrate consistent and fair salary ranges.

Prepare for opportunity equity: Both Illinois and Colorado have introduced legislation relating to 2024’s emerging trend. Opportunity equity gives all workers equal access to opportunities for employment, development, and career advancement.

Prevent pay inequity before it happens: Trusaic PayParity carries out a pay equity audit across your workforce at the intersection of gender, race/ethnicity, age, disability, and more in a single statistical regression analysis. We also identify the root causes of pay disparities including systemic issues such as unconscious bias.

Pay equity isn’t only about compliance. It’s the right thing to do.

Don’t wait for pay equity legislation. Start your journey to equal pay today. Speak to one of our experts.