Streamline your ACA compliance efforts

Clean data is the key to flawless compliance

You already have software to manage every aspect of the employee journey. But all the software in the world won't help you if your data is flawed.

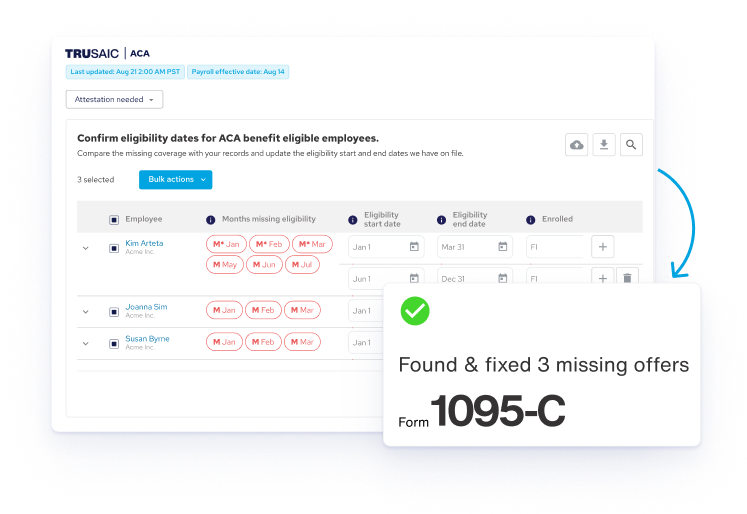

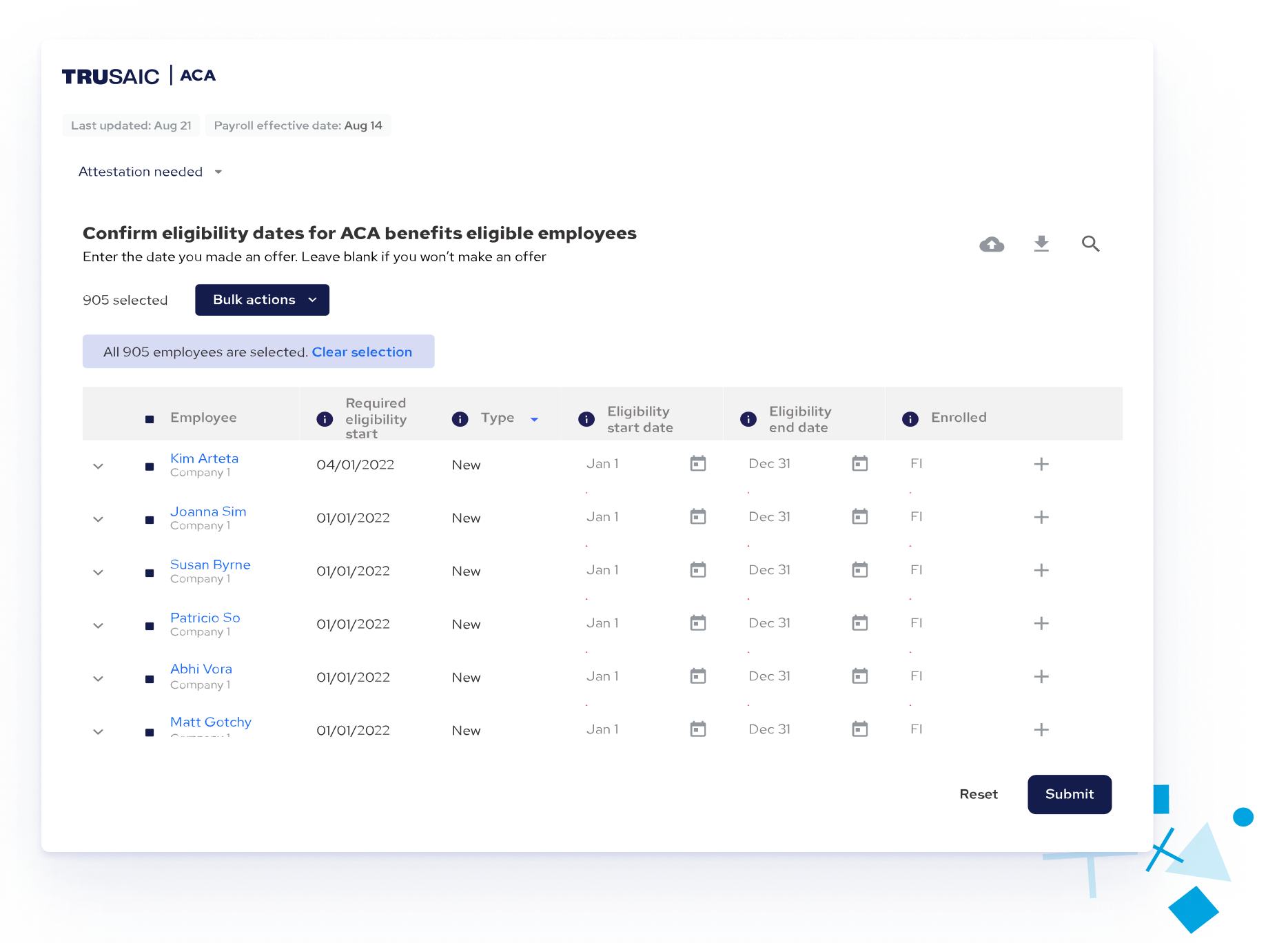

Our technology solves the people and process failures that drive penalties, many of which are created by disparate, inaccurate or incomplete data. From multiple data sources, we consolidate, clean, and transform your data into accurate, actionable intelligence. Clean data, combined with our legal and regulatory expertise, provides the basis for all of our ACA solutions.

ACA Complete

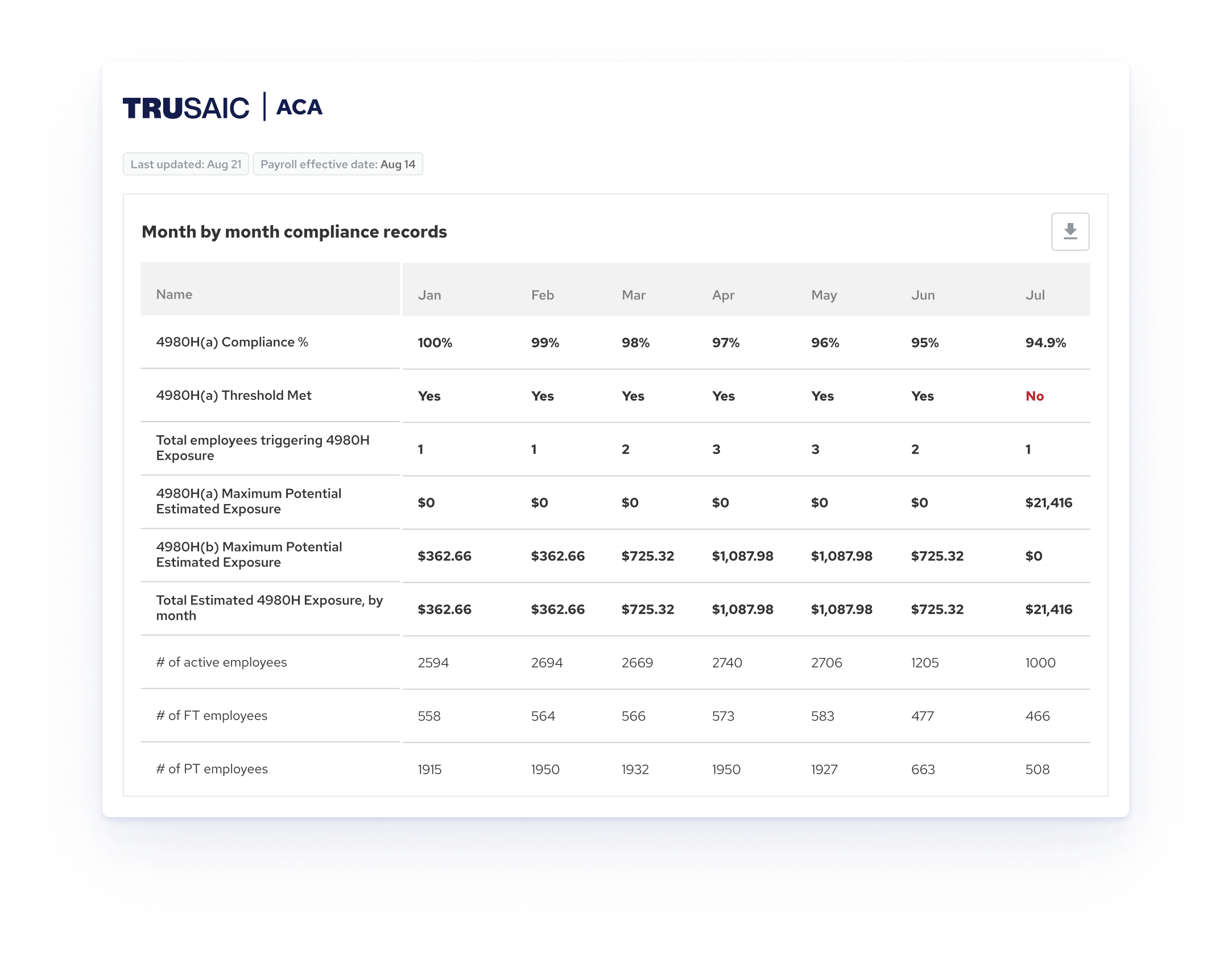

Our ACA Complete® solution delivers everything you need to track, prepare, furnish, file and defend your ACA compliance. We take care of ongoing monthly monitoring so you know exactly when offers of coverage are required and handle both state and federal filings. While our technology handles your data, an expert dedicated ACA specialist manages the entire compliance process for you.

We minimize your IRS penalty risk and guide you in the event of an IRS or state audit. And with our fast implementation and seamless integrations, you can get started quickly to start minimizing your risk today.

Benefits of monthly monitoring and audit defense

ACA compliance is never done, and neither are we.

Our monthly compliance reports ensure you always meet regulatory requirements and never have to worry about penalties. In addition, we can perform a retroactive audit to correct any previous issues and help you avoid them going forward.

If an IRS audit does occur, our experts assist you every step of the way in responding to the IRS and preparing for an IRS audit.

Received a letter from the IRS?

IRS Audit Services:

Reduce or eliminate your IRS penalty assessments.

IRS Audit Services:

Reduce or eliminate your IRS penalty assessments.

We respond to the following IRS letters:

Failure to file notices and follow up letters

5699, 5698

5005-A

972-CG, 1948C

CP215

CP504B

Incorrect filing notices

ACA solutions to suit your needs:

Annual reporting

Annual reporting + monthly monitoring + audit defense

Annual reporting

ACA Essential®

Forms preparation and filing with expert support

1094-C/1095-C IRS and state1 filing

1095-C PDFs

1095-C print and mail1

Penalty Risk Assessment

1094-C/1095-C preparation

1095-C review and approval

Expert support for annual filing

Annual reporting + monthly monitoring + audit defense

ACA Complete®

Compliance tracking, filing, and a dedicated ACA

specialist for risk mitigation

1094-C/1095-C IRS and state1 filing

1095-C PDFs

1095-C print and mail1

Penalty Risk Assessment

1094-C/1095-C preparation

1095-C review and approval

Dedicated ACA specialist

Health plan compliance review

ACA process consulting review

IRS controlled group analysis

Establish IRS measurements and periods

HR data configuration, monthly data consolidation and data quality analysis

Monthly metrics, compliance tracking and documentation management

IRS affordability and health insurance overspend monitoring

Exchange notice appeals

Comprehensive IRS audit defense1

Add state filing

ACA compliance doesn't stop at the federal level. Many jurisdictions, including California, New Jersey, Rhode Island, and Washington D.C. have mandated state ACA reporting.

Add state filing to:

- Minimize risk and ensure state level compliance

- Preparation and filing of forms 1095-B and 1095-C

- Comply with state agency rules including California Franchise Tax Board, New Jersey's Division of Revenue and Enterprise Services (DORES), Rhode Island's Department of Revenue Division of Taxation, Washington D.C.'s Office of Tax and Revenue (OTR)

State filing ACA services are available in three ways:

- Stand-alone

- As an add-on to ACA Essential

- Bundled with ACA Complete

Add state filing

ACA compliance doesn't stop at the federal level. Many jurisdictions, including California, New Jersey, Rhode Island, and Washington D.C. have mandated state ACA reporting.

Add state filing to:

- Minimize risk and ensure state level compliance

- Preparation and filing of forms 1095-B and 1095-C

- Comply with state agency rules including California Franchise Tax Board, New Jersey's Division of Revenue and Enterprise Services (DORES), Rhode Island's Department of Revenue Division of Taxation, Washington D.C.'s Office of Tax and Revenue (OTR)

State filing ACA services are available in three ways:

- Stand-alone

- As an add-on to ACA Essential

- Bundled with ACA Complete

How confident are you in your ACA Compliance?

Get Your ACA Vitals

Gain complete visibility across your ACA compliance, filing, and reporting efforts for free.

Get Your ACA Vitals

Gain complete visibility across your ACA compliance, filing, and reporting efforts for free.

Data discrepancy

Mismatches in the information you provided in your 1094-C template compared with what we calculated based on the 1095-C template

Risk of over-reporting

Number of employees for whom a Form 1095-C is not required based on the code combinations you entered in your 1095-C template

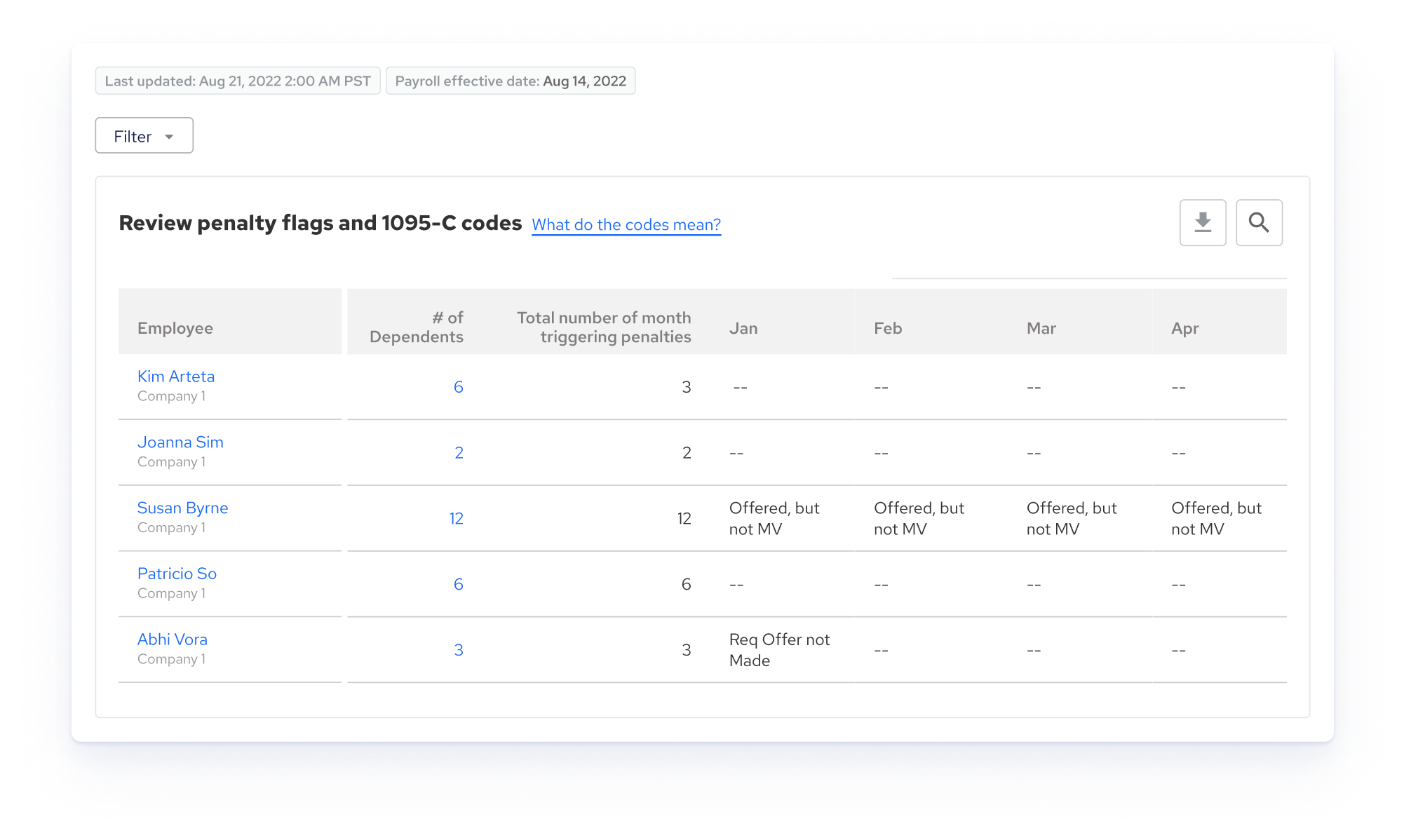

Coding errors

Number of employees triggering code combination errors based on the information you provided in your 1095-C template

Compliance errors

Number of employees with Section 4980H compliance issues. Common issues include no offer of coverage and affordability

Total penalty exposure

Total 4980H(a), 4980H(b), 6721, and 6722 penalty exposure estimated based on your templates

Frequently asked questions

Get complete ACA coverage now