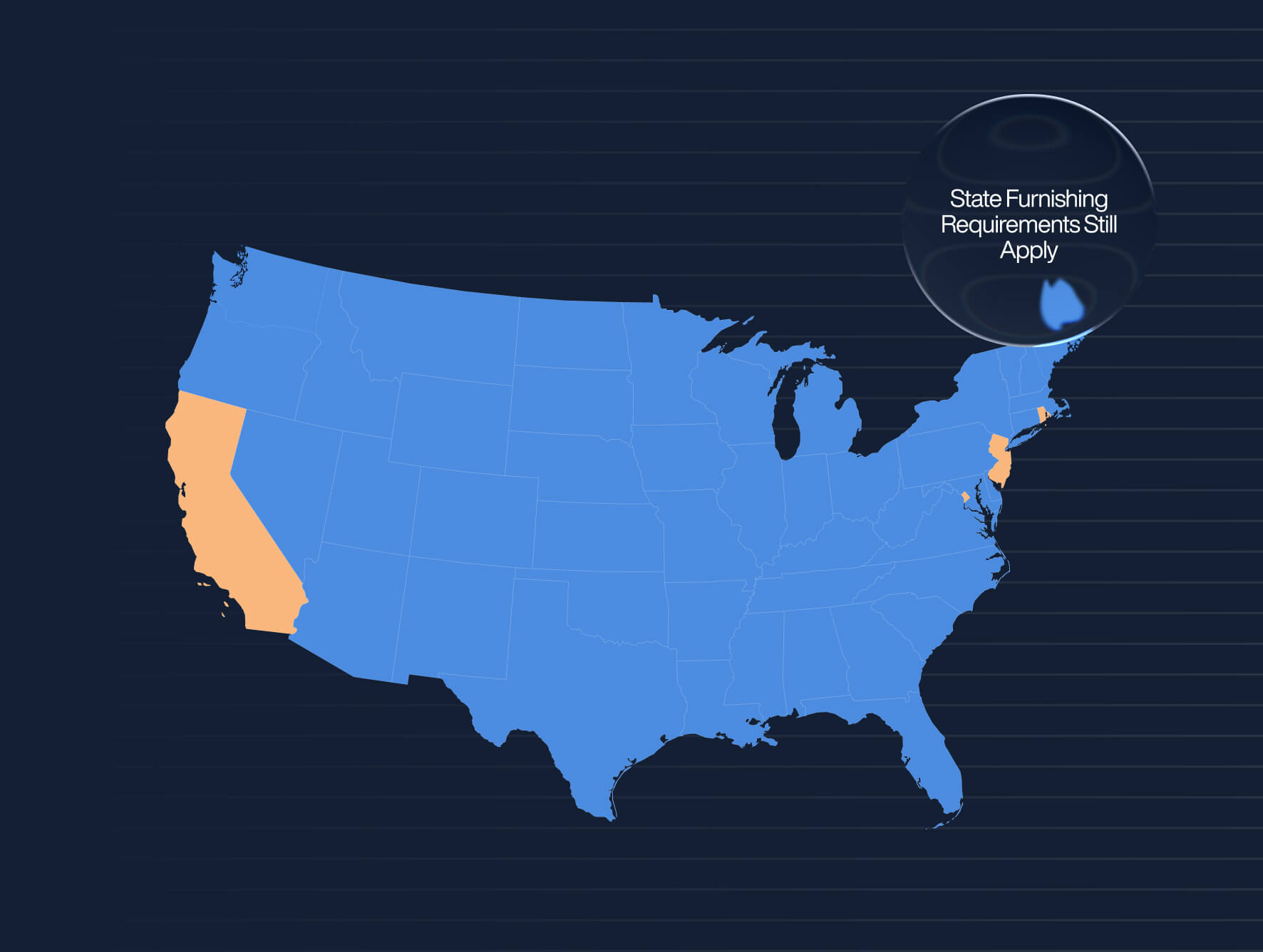

For employers with California employees, the new year brings an upcoming compliance priority. The Jan. 31, 2026 furnishing deadline for California residents is a critical date that operates independently of federal rules.

While the IRS has introduced flexibility for federal furnishing, California maintains stricter standards. This means employers cannot apply a one-size-fits-all strategy to their workforce this season.

Here is what you need to know to meet California’s 1095-C furnishing requirements.

The California Deadline: Jan. 31, 2026

For any employee who was a California resident in the 2025 tax year, employers must meet state-specific furnishing requirements. The California Franchise Tax Board (FTB) maintains its own timeline distinct from the IRS.

- Deadline: You must furnish Form 1095-C (or 1095-B) to California employees by Jan. 31, 2026. Note, FTB does not impose a penalty to applicable entities for failure to provide information statements to individuals by January 31.

- No Automatic Extension: Unlike the IRS, which often grants automatic 30-day extensions for furnishing, California’s deadline is firm.

- No On-Demand Option: The new federal rule allowing employers to post a notice instead of mailing forms does not apply here. You must actively provide the form.

The Active Delivery Requirement

California requires you to furnish the statement to the individual, which the FTB interprets as active delivery. Unlike the new federal rules, the state does not explicitly allow employers to rely on a passive website notice.

- Paper Mail: To ensure compliance, the standard approach is to mail a paper copy of Form 1095-C.

- Electronic Delivery: You may furnish the form electronically if you have established consent procedures that align with standard tax reporting protocols.

Who Is Considered a California Employee?

Properly identifying your California workforce is the first step in compliance. The mandate applies to any employee who resided in California during the tax year.

This definition often captures employees that HR teams might overlook:

- Part-Year Residents: Employees who lived in California before moving away (or vice versa).

- Remote Workers: Employees who technically report to a headquarters in another state (like Texas or New York) but physically work from a home office in California.

For ACA reporting purposes, physical residency dictates the rule. If your data does not accurately track changes in state of residence, you risk missing the furnishing deadline for these specific employees.

Federal Rules: A Different Standard

While the California deadline is imminent, the IRS rules for the rest of your workforce offer more flexibility for the 2025 tax year.

- Later Deadline: The IRS deadline to furnish forms to employees is March 2, 2026 (permanently extended by 30 days).

- On-Demand Option: For federal purposes, employers can post a “clear and conspicuous” notice on their website informing employees that forms are available upon request, rather than mailing them automatically.

- Filing Deadline: The deadline to transmit your 1094-C/1095-C data electronically to the IRS is March 31, 2026.

Operationalizing the Split

Because of these diverging rules, manual tracking can double your administrative workload. You essentially need two distinct distribution workflows running in parallel:

- California Workflow: Must be identified and mailed or electronically delivered by Jan. 31, 2026. Note, FTB does not impose a penalty to applicable entities for failure to provide information statements to individuals by January 31.

- Federal Workflow: Aligns with the March 2, 2026 deadline, allowing employers to satisfy furnishing obligations via a posted website notice rather than automatic distribution.

Mixing these lists can lead to inefficiencies – either mailing everyone early (unnecessary cost) or mailing everyone late (compliance failure).

How Trusaic Simplifies the 1095-C Process

You don’t need to segment your workforce or worry about conflicting state requirements manually. Trusaic’s ACA Complete® solution manages this complexity automatically:

- State Identification: We identify all employees subject to the California mandate based on residency data.

- Federal Efficiency: We handle your federal electronic filing and can manage on-demand or standard furnishing for the rest of your workforce.

- State Filing: We handle the subsequent transmission of data to the California FTB by their March 31 filing deadline.

ACA compliance is a patchwork of state and federal rules. Ensure your organization is prepared for the January deadline without the manual burden. Contact Trusaic to streamline your California furnishing strategy